This submit was written in collaboration with Prudential. Whereas we’re financially compensated by them, we nonetheless try to take care of our editorial integrity and evaluation merchandise with the identical goal lens. We’re dedicated to offering one of the best data so as so that you can make private monetary selections with confidence. You may view our Editorial Tips right here.

That is the first article in Put Your Cash The place Your Coronary heart Is, a sequence of 5 articles written in collaboration with Prudential that tackles the subject of Environmental, Social and Governance (ESG) and takes a more in-depth have a look at accountable insurance coverage and funding.

You ensure to recycle as a lot as you’ll be able to, devour much less vitality by switching off all of your standby home equipment… you’ve began rising your personal produce (thanks, NParks for the seeds!) and also you’re even saving up for an electrical automotive.

Nonetheless, regardless of your finest efforts to guide a sustainable and socially accountable life-style, have you considered how your investments might be not directly funding the local weather disaster?

Yup, the corporate you’re investing in won’t be environmentally acutely aware or could have unsustainable practices similar to irresponsibly draining the earth of its valuable sources or being biased in relation to hiring.

As a shopper, you will have the ability to place your cash the place your coronary heart is. Let’s have a look at how monetary establishments are contributing to sustainable growth by incorporating ESG — brief for Environmental, Social and Governance — elements into not simply their funding selections, but in addition the enterprise operations itself.

One among these corporations is Prudential.

Listed below are 4 methods Prudential has chosen to get on board with ESG:

1. Investments are made with ESG elements in thoughts

On the subject of their funding portfolios and choices, Prudential presents ESG-focused fund choices. That is to create a extra sustainable economic system by accountable funding.

These ESG-focused fund choices embrace the PRULink International Local weather Change Fairness Fund, which focuses on corporations that profit from appearing on local weather change. Launched in September 2021, the PRULink International Local weather Change Fairness Fund feeds into the GMO Local weather Change Funding Fund, which is the underlying fund.

The funding goal is to hunt to generate excessive complete return by investing primarily in equities of corporations that GMO believes are positioned to learn, immediately or not directly, from efforts to curb or mitigate the long run results of world local weather change, to handle the environmental challenges introduced by international local weather change, or to enhance the effectivity of useful resource consumption.

You’ll be investing in corporations which are thought of to be concerned in industries relating to wash vitality, batteries and storage, electrical grid, vitality effectivity, recycling and air pollution management, agriculture, water, and companies that service such industries.

Equally, there’s additionally the PRULink International Affect ESG Fairness Fund, which feeds into the Wellington International Affect Fund. The main target is on life necessities, human empowerment and environmental sustainability, in addition to producing constructive social affect in underserved communities.

2. Transferring away from investments which are deemed to be contributing to environmental decline

On 7 Could 2021, Prudential pledged to attain net-zero carbon emissions by 2050. One of many insurer’s first actions was to divest from all corporations that derive greater than 30% of their income from coal by the tip of 2022.

This can be a transfer in the suitable path, provided that the combustion of coal generates a larger carbon footprint than that of different fossil fuels.

Prudential shouldn’t be stopping there. The accountable insurer goes the additional mile to minimise fossil gas air pollution by planning a buy-out and shut-down of coal-fired energy crops in Asia throughout the subsequent 15 years.

3. Taking steps to cut back its operational carbon footprint

It’s simpler mentioned than achieved, however Prudential ensures it walks the discuss. The insurer has additionally turned its ESG lens internally and manages the environmental affect of its operations.

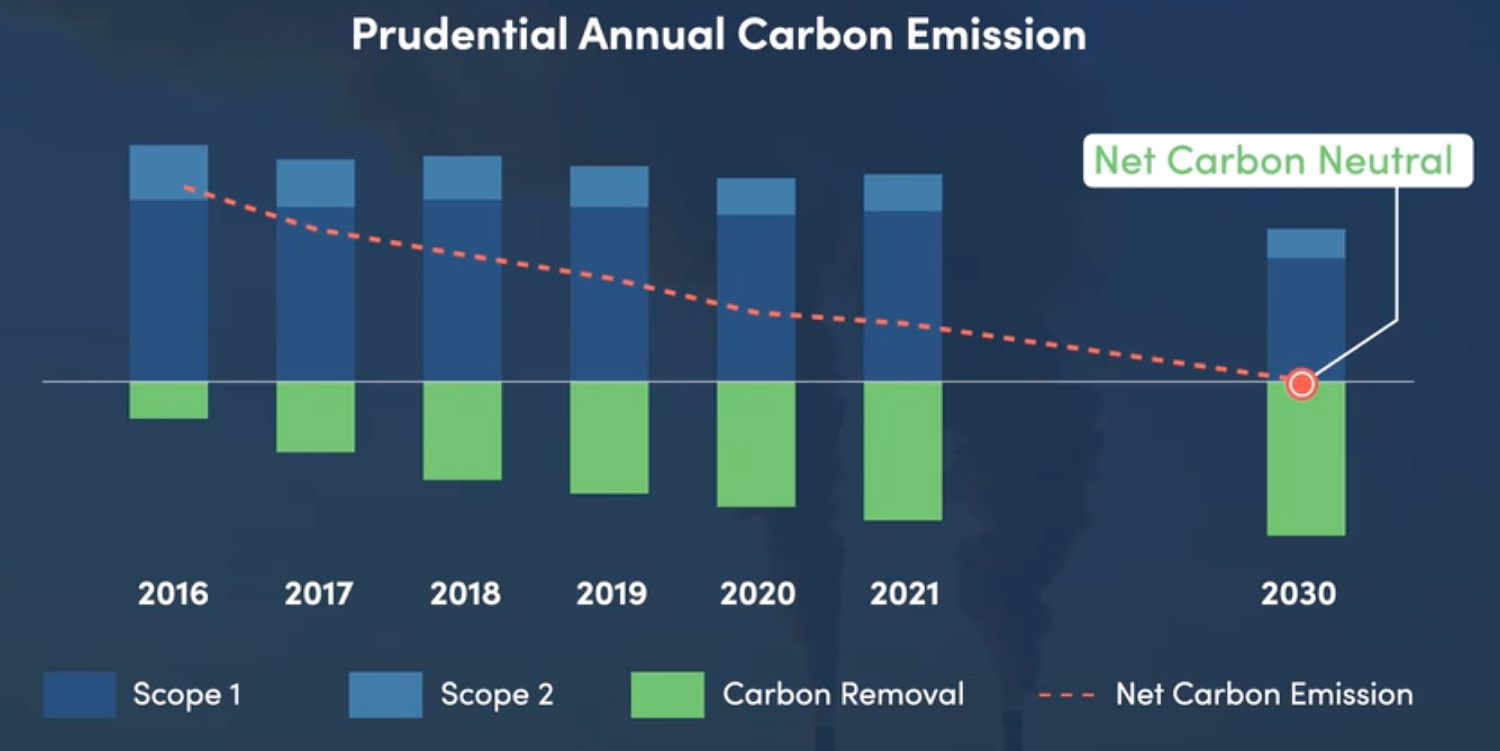

The aim: To develop into internet carbon impartial throughout the emissions immediately produced in its day by day operations and electrical energy utilization. Prudential has additionally established progressive targets for water and waste and has improved the effectivity in the way it makes use of these sources.

4. Constructing social capital by embracing better variety, inclusion, and belonging in our office

Social capital refers back to the social relationships and networks that not solely affect the efficient operate of the society, but in addition correlate and complement the economic system of that society.

One of many methods Prudential is constructing social capital is embracing better variety and inclusion. To attain this, the insurer actively promotes gender equality and age-inclusivity throughout all working ranges to help a multi-generational workforce and a various expertise pipeline throughout the organisation.

To advertise fairness, Prudential has in place a holistic method to make sure equitable compensation by common critiques of its workers.

The proof is certainly within the pudding. By having clear ESG measures for gender variety and equality throughout Prudential’s enterprise construction, the corporate managed to succeed in a feminine participation charge of fifty% for senior managers and above, and a gender pay hole of only one.3%.

All clued in on the fundamentals of ESG and accountable investing? Keep in mind, you will have the ability to make a constructive affect on the world and put your cash the place your coronary heart is.

Discover out extra about Prudential’s ESG initiatives.

This text is in your data solely and doesn’t have regard to the particular funding targets, monetary scenario and explicit wants of any individuals. Please search recommendation from a certified Monetary Advisor for a monetary evaluation earlier than buying a coverage appropriate to fulfill your wants.

This commercial has not been reviewed by the Financial Authority of Singapore.