Because the COVID-19 Vaccination Program begins rolling, eligible residents in Hong Kong could select to be inoculated with Sinovac’s CoronaVac or BioNTech’s Pfizer. Furthermore, the federal government will arrange an indemnity fund to compensate folks adversely affected by the vaccinations. Having mentioned that, you may nonetheless be apprehensive that this fund won’t supply satisfactory monetary assist. This brings us to the query: Will insurance coverage insurance policies at the moment obtainable available in the market cowl the potential dangers of getting the COVID-19 vaccinations? At present at INO, our specialists will reveal the reply.

Coronavirus vaccine unwanted side effects

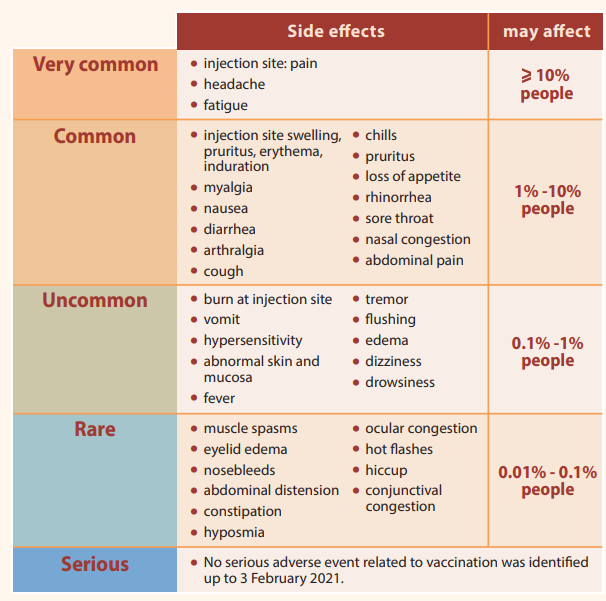

These footage are screen-capped from the official authorities factsheets on the 2 vaccines supplied within the COVID-19 Vaccination Program: Sinovac and BioNTech.

Sinovac:

BioNTech:

The Hong Kong authorities’s COVID-19 vaccine indemnity fund

Based on official information, the federal government will allocate HKD $1 billion to offer monetary aid for irregular reactions after vaccination. You need to file a declare inside two years after the injection.

On that observe, the Legislative Council doc exhibits that if somebody dies or is injured after being vaccinated, the compensation quantity is as follows:

Loss of life after vaccination

|

Age of the deceased

|

Insured quantity

|

|

At or beneath 40 years previous

|

HKD $2.5 million

|

|

At or above 40 years previous

|

HKD $2 million

|

Harm after vaccination

|

Age of affected person

|

Insured quantity

|

|

At or beneath 40 years previous

|

HKD $3 million

|

|

At or above 40 years previous

|

HKD $2.5 million

|

By means of civil litigation, you’ll be able to nonetheless file for declare from the vaccine producer after receiving the federal government’s indemnity fund. Nevertheless, take observe that this fund shall be offset from the ultimate compensation awarded by the courtroom.

In comparison with different areas, our vaccine indemnity fund right here is sort of strong. For instance, for those who die after inoculation in Macao, the insured quantity is merely HKD $1 million. Its authorities will even present well being companies to those that endure from the vaccine’s unwanted side effects. The Singapore authorities, then again, will present SGD $10,000 (HKD $58,000) value of economic assist to those that want to remain at an Intensive Care Unit (ICU) because of the injection. Instances of great accidents or dying shall be compensated SGD $225,000 (roughly HK$1.3 million). Within the UK, if the vaccine causes critical hurt, the utmost indemnity quantity is $120,000 kilos (roughly HKD $1.25 million).

Though Hong Kong’s indemnity protection shouldn’t be unhealthy, as soon as you’ve got misplaced your capacity to work due to the unwanted side effects, this compensation quantity shouldn’t be going to be sufficient. The federal government could not cowl whole medical bills. In case you want further protection, think about shopping for a separate insurance coverage plan.

To begin with, in accordance with the Hong Kong Federation of Insurers, sure particular person or group insurance coverage insurance policies will think about the next objects exterior of canopy: the price of preventive therapy and care, together with vaccination, and direct or oblique claims because of the inoculation.

The Voluntary Well being Insurance coverage (VHIS) has no associated exclusion clauses, so it is going to cowl the therapy of adversarial reactions resulting from vaccination. The Voluntary Well being Insurance coverage Workplace has additionally confirmed that the eligible bills for the therapy of adversarial reactions attributable to vaccination towards the coronavirus belong to the fundamental protection of all VHIS authorized merchandise. This consists of hospitalization, day surgical procedure and prescribed prescriptions in and outdoors of Hong Kong, in addition to prices concerned in diagnostic imaging exams.

Some particular person medical insurance plans supply protection for the COVID-19 vaccination, together with the adversarial reactions and unwanted side effects described by the WHO attributable to the vaccine inside 14 days after the jab. With that mentioned, the policyholder should present a vaccination certificates and a written proof from their Basic Doctor. Solely compensation for the adversarial reactions attributable to the vaccine might be authorized.

You’ll be able to declare about HKD $700 to HKD $1,000 per day for those who develop an adversarial response inside 14 days of injection. In case you die 30 days after the jab due to an adversarial response, you’ll be able to obtain a compensation of HKD $100,000 to HKD $200,000.

Nevertheless, whether or not it’s the VHIS or particular person medical insurance, it’s best to take further care to show that the vaccine has a direct affect in your physique, and never due to different bodily elements. That is particularly related to those that already endure from persistent circumstances. That is why the probabilities of efficiently acquiring compensation might not be very excessive.

Contact INO on your insurance coverage options

INO has over 20 years of expertise within the automotive insurance coverage dealer business. Other than automotive insurance coverage (third-party and complete), we additionally present dwelling insurance coverage, motorbike insurance coverage, VHIS, Hong Kong-Zhuhai-Macao Bridge (HZMB) insurance coverage, and plenty of extra. Contact our crew of skilled insurance coverage advisors for tailor-made recommendation and a free plan comparability!