For tens of millions of People, the open enrollment interval (OEP) to buy 2022 ACA-compliant protection will probably be in contrast to any of the earlier eight OEPs. The explanation? These shoppers will – for the primary time – have the ability to faucet into the Reasonably priced Care Act’s premium tax credit (extra generally known as medical insurance subsidies).

Due to the American Rescue Plan, shoppers who in earlier years may need discovered themselves outdoors the eligible degree for subsidies – or who might have discovered that subsidy quantities have been so low as to not be engaging – are actually amongst these eligible for premium tax credit. So in the event you haven’t shopped for medical insurance these days, you could be shocked to see how inexpensive your well being protection choices are this fall (beginning November 1), and what number of plan choices can be found in your space.

Hundreds of thousands have already tapped into the subsidies

Most individuals who at the moment have protection by the medical insurance exchanges have seen improved affordability this yr because of the American Rescue Plan (ARP). That features tens of millions of people that have been already enrolled in plans when the ARP was enacted final March, in addition to tens of millions of others who signed up throughout the particular enrollment interval that continued by mid-August in most states (and remains to be ongoing in some states).

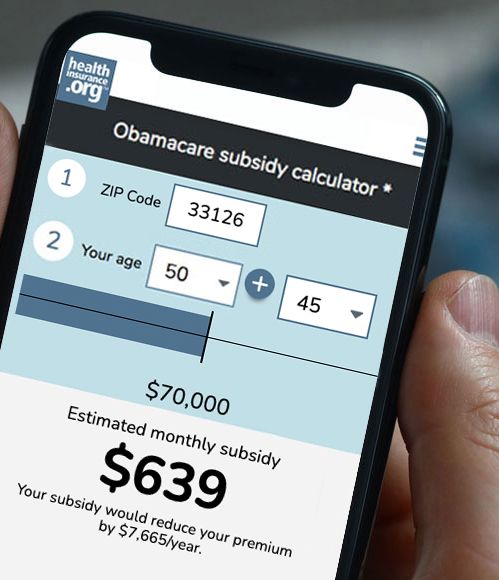

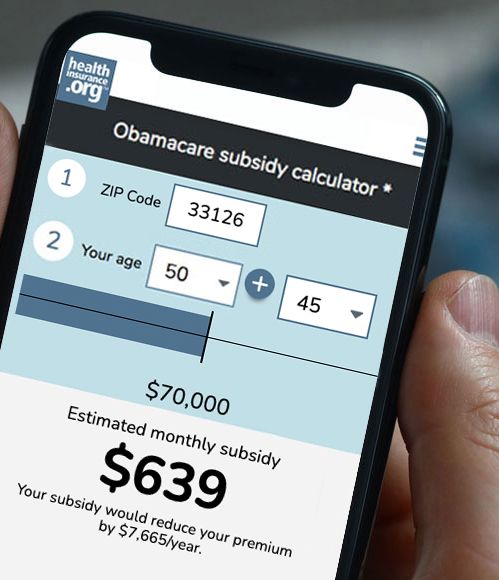

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical insurance premiums.

However there are nonetheless tens of millions of others who’re both uninsured or have obtained protection elsewhere. And there are additionally individuals who already had protection within the trade in 2021 however didn’t take the choice to change to a extra strong plan after the ARP was applied. Should you’re in both of those classes, you don’t need to miss the open enrollment interval within the fall of 2021.

The Construct Again Higher Act, which remains to be into consideration in Congress, would prolong the ARP’s subsidies and be sure that medical insurance stays inexpensive in 2023 and past. However even with none new legislative motion, many of the ARP’s subsidy enhancements will stay in place for 2022.

Which means there’ll proceed to be no higher revenue restrict for premium tax credit score (subsidy) eligibility, and the proportion of revenue that folks should pay for the benchmark plan will proceed to be decrease than it was in prior years. The general result’s that subsidies are bigger than they have been prior to now, and obtainable to extra individuals.

Who ought to make a degree to overview their subsidy eligibility?

So who must pay shut consideration this fall, throughout open enrollment? In actuality, anybody who doesn’t have entry to Medicare, Medicaid, or an employer-sponsored well being plan – as a result of even in the event you’re already enrolled and pleased with the plan you’ve, auto-renewal just isn’t in your greatest curiosity.

However there are a number of teams of people that really want to buy protection this fall. Let’s check out what every of those teams can anticipate, and why you shouldn’t let open enrollment cross you by in the event you’re in one in all these classes:

1. The uninsured – eligible for low-cost or NO-cost protection

The vast majority of uninsured People cite the price of protection as the explanation they don’t have medical insurance. But tens of millions of these people are eligible without cost or very low-cost well being protection however haven’t but enrolled. This has been the case in prior years as effectively, however premium-free or very low-cost well being plans are much more broadly obtainable on account of the ARP.

Should you’re uninsured since you don’t assume medical insurance is inexpensive, know that greater than a 3rd of the individuals who enrolled by way of HealthCare.gov throughout the COVID/ARP particular enrollment interval this yr bought plans for lower than $10/month.

Even in the event you’ve checked in earlier years and couldn’t afford the plans that have been obtainable, you’ll need to examine once more this fall, for the reason that subsidy guidelines have modified since final yr.

2. Customers enrolled in non-ACA-compliant plans

There are tens of millions of People who’ve bought well being protection that isn’t compliant with the ACA. Most of those plans are both much less strong than ACA-compliant plans, or use medical underwriting, or each. They embody:

Individuals buy or maintain these plans for a wide range of causes. However chief amongst them has lengthy been the truth that ACA-compliant protection was unaffordable – or was assumed to be unaffordable.

There are additionally individuals who desire a number of the advantages that a few of these plans provide (the fellowship of being a part of a well being care sharing ministry, as an example, or the abundantly obtainable main care with a DPC membership). However by and huge, the explanation individuals select protection that isn’t ACA-compliant, or that isn’t even insurance coverage in any respect, is as a result of ACA-compliant protection doesn’t match of their budgets.

This has lengthy included a couple of primary teams of individuals: Those that earned an excessive amount of to qualify for subsidies, these affected by the “household glitch,” and those that certified for less than minimal subsidy help and nonetheless felt that the protection obtainable within the trade wasn’t inexpensive.

(One other group of individuals unable to afford protection are those that earn lower than the poverty degree in 11 states which have refused to broaden Medicaid and thus have a protection hole. Some individuals within the protection hole buy non-ACA-compliant protection, however this inhabitants can be prone to not have any protection in any respect. Should you or a beloved one are within the protection hole, we encourage you to learn this text.)

The ARP has not mounted the household glitch or the protection hole, though there are legislative and administrative options into consideration for every of those.

However the ARP has addressed the opposite two points, and people provisions stay in place for 2022. The revenue cap for subsidy eligibility has been eradicated, which signifies that some candidates can qualify for subsidies with revenue far above 400% of the poverty degree. And for many who have been already eligible for subsidies, the subsidy quantities are bigger than they was once, making protection extra inexpensive.

So in case you are enrolled in any kind of self-purchased well being plan that isn’t compliant with the ACA, you owe it to your self to examine your on-exchange choices this fall, throughout the open enrollment interval. Understand that you are able to do that by the trade, by an enhanced direct enrollment entity, or with the help of a medical insurance dealer.

3. Patrons enrolled in off-exchange well being plans

There are additionally individuals who have “off-exchange” ACA-compliant plans that they’ve bought instantly from an insurance coverage firm, with out utilizing the trade. (Word that this isn’t the identical factor as enrolling in an on-exchange plans by an enhanced direct enrollment entity, lots of that are insurance coverage corporations).

There are a selection of causes individuals have chosen to enroll in off-exchange well being plans over the past a number of years. And for a few of these enrollees, 2022 could be the yr to change to an on-exchange plan.

Since 2018, some individuals have opted for off-exchange plans in the event that they weren’t eligible for premium subsidies and wished to enroll in a Silver-level plan. This was a really rational alternative, inspired by state insurance coverage commissioners and marketplaces alike. However in the event you’ve been shopping for off-exchange protection with a view to get a Silver plan with a cheaper price tag, the first level to bear in mind for 2022 is that you just would possibly discover that you just’re now eligible for premium subsidies.

Identical to the individuals described above, who’ve enrolled in varied non-ACA-compliant plans in an effort to acquire inexpensive protection, the elimination of the revenue restrict for subsidy eligibility is a sport changer for individuals who have been shopping for off-exchange protection to get a cheaper price on a Silver plan.

Some individuals have opted for off-exchange protection as a result of their most well-liked well being insurer wasn’t taking part within the trade of their space. This may need been a deciding issue for an applicant who was solely eligible for a really small subsidy — or no subsidy in any respect — and was prepared to pay full value for an off-exchange plan from the insurer of their alternative.

However 2022 is the fourth yr in a row with growing insurer participation within the exchanges, and a few big-name insurers are becoming a member of or rejoining the exchanges in fairly a couple of states. So in the event you haven’t checked your on-exchange choices shortly, this fall is unquestionably the time to take action. You could be shocked to see what number of choices you’ve, and once more, how inexpensive they’re.

4. Customers enrolled in on-exchange plans, however no revenue particulars on file and no current protection reconsiderations

Should you’re already enrolled in an on-exchange plan and also you had given the trade a projection of your revenue for 2021, you most likely noticed your subsidy quantity improve in some unspecified time in the future this yr.

But when the trade didn’t have an revenue on file for you, they wouldn’t have been capable of activate a subsidy in your behalf (on the HealthCare.gov platform, subsidy quantities have been routinely up to date in September for individuals who hadn’t up to date their accounts by that time, however provided that you had supplied a projected revenue to the trade whenever you enrolled in protection for 2021). And even when your subsidy quantity did get up to date, you may need remained on the plan you had picked final fall, regardless of the choice to choose a unique one after the ARP was enacted.

The excellent news is that you just’ll have the ability to declare your full premium tax credit score, for the whole thing of 2021, whenever you file your 2021 tax return (assuming you had on-exchange well being protection all year long). And throughout the open enrollment interval for 2022 protection, you may present revenue info to the trade so {that a} subsidy is paid in your behalf every month subsequent yr.

Reconsidering your plan alternative throughout open enrollment would possibly find yourself being helpful as effectively. Should you didn’t qualify for a subsidy prior to now, or in the event you solely certified for a modest subsidy, you may need picked a Bronze plan or perhaps a catastrophic plan, in an effort to maintain your month-to-month premiums inexpensive.

However with the ARP in place, you would possibly discover which you can afford a extra strong well being plan. And in case your revenue doesn’t exceed 250% of the poverty degree (and particularly if it doesn’t exceed 200% of the poverty degree), pay shut consideration to the obtainable Silver plans. The bigger subsidies might make it potential so that you can afford a Silver plan with built-in cost-sharing reductions that considerably cut back out-of-pocket prices.

One different level to bear in mind: If you’re receiving a premium subsidy this yr, bear in mind that it would change subsequent yr because of a brand new insurer getting into the market in your space and providing lower-priced plans. Right here’s extra about how this works, and what to contemplate as you’re looking for protection this fall.

The takeaway level right here? Even in the event you’ve been glad along with your plan, it’s best to examine your choices throughout open enrollment. This isn’t the yr to let your plan auto-renew. Make sure you’ve supplied the trade with an up to date revenue projection for 2022, and actively evaluate the plans which are obtainable to you. It’s potential {that a} plan with higher protection or a broader supplier community could be inexpensive to you for 2022, even when it was financially out of attain whenever you checked final fall.

Louise Norris is an particular person medical insurance dealer who has been writing about medical insurance and well being reform since 2006. She has written dozens of opinions and academic items in regards to the Reasonably priced Care Act for healthinsurance.org. Her state well being trade updates are repeatedly cited by media who cowl well being reform and by different medical insurance consultants.

For tens of millions of People, the open enrollment interval (OEP) to buy 2022 ACA-compliant protection will probably be in contrast to any of the earlier eight OEPs. The explanation? These shoppers will – for the primary time – have the ability to faucet into the Reasonably priced Care Act’s premium tax credit (extra generally known as medical insurance subsidies).

Due to the American Rescue Plan, shoppers who in earlier years may need discovered themselves outdoors the eligible degree for subsidies – or who might have discovered that subsidy quantities have been so low as to not be engaging – are actually amongst these eligible for premium tax credit. So in the event you haven’t shopped for medical insurance these days, you could be shocked to see how inexpensive your well being protection choices are this fall (beginning November 1), and what number of plan choices can be found in your space.

Hundreds of thousands have already tapped into the subsidies

Most individuals who at the moment have protection by the medical insurance exchanges have seen improved affordability this yr because of the American Rescue Plan (ARP). That features tens of millions of people that have been already enrolled in plans when the ARP was enacted final March, in addition to tens of millions of others who signed up throughout the particular enrollment interval that continued by mid-August in most states (and remains to be ongoing in some states).

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical insurance premiums.

However there are nonetheless tens of millions of others who’re both uninsured or have obtained protection elsewhere. And there are additionally individuals who already had protection within the trade in 2021 however didn’t take the choice to change to a extra strong plan after the ARP was applied. Should you’re in both of those classes, you don’t need to miss the open enrollment interval within the fall of 2021.

The Construct Again Higher Act, which remains to be into consideration in Congress, would prolong the ARP’s subsidies and be sure that medical insurance stays inexpensive in 2023 and past. However even with none new legislative motion, many of the ARP’s subsidy enhancements will stay in place for 2022.

Which means there’ll proceed to be no higher revenue restrict for premium tax credit score (subsidy) eligibility, and the proportion of revenue that folks should pay for the benchmark plan will proceed to be decrease than it was in prior years. The general result’s that subsidies are bigger than they have been prior to now, and obtainable to extra individuals.

Who ought to make a degree to overview their subsidy eligibility?

So who must pay shut consideration this fall, throughout open enrollment? In actuality, anybody who doesn’t have entry to Medicare, Medicaid, or an employer-sponsored well being plan – as a result of even in the event you’re already enrolled and pleased with the plan you’ve, auto-renewal just isn’t in your greatest curiosity.

However there are a number of teams of people that really want to buy protection this fall. Let’s check out what every of those teams can anticipate, and why you shouldn’t let open enrollment cross you by in the event you’re in one in all these classes:

1. The uninsured – eligible for low-cost or NO-cost protection

The vast majority of uninsured People cite the price of protection as the explanation they don’t have medical insurance. But tens of millions of these people are eligible without cost or very low-cost well being protection however haven’t but enrolled. This has been the case in prior years as effectively, however premium-free or very low-cost well being plans are much more broadly obtainable on account of the ARP.

Should you’re uninsured since you don’t assume medical insurance is inexpensive, know that greater than a 3rd of the individuals who enrolled by way of HealthCare.gov throughout the COVID/ARP particular enrollment interval this yr bought plans for lower than $10/month.

Even in the event you’ve checked in earlier years and couldn’t afford the plans that have been obtainable, you’ll need to examine once more this fall, for the reason that subsidy guidelines have modified since final yr.

2. Customers enrolled in non-ACA-compliant plans

There are tens of millions of People who’ve bought well being protection that isn’t compliant with the ACA. Most of those plans are both much less strong than ACA-compliant plans, or use medical underwriting, or each. They embody:

Individuals buy or maintain these plans for a wide range of causes. However chief amongst them has lengthy been the truth that ACA-compliant protection was unaffordable – or was assumed to be unaffordable.

There are additionally individuals who desire a number of the advantages that a few of these plans provide (the fellowship of being a part of a well being care sharing ministry, as an example, or the abundantly obtainable main care with a DPC membership). However by and huge, the explanation individuals select protection that isn’t ACA-compliant, or that isn’t even insurance coverage in any respect, is as a result of ACA-compliant protection doesn’t match of their budgets.

This has lengthy included a couple of primary teams of individuals: Those that earned an excessive amount of to qualify for subsidies, these affected by the “household glitch,” and those that certified for less than minimal subsidy help and nonetheless felt that the protection obtainable within the trade wasn’t inexpensive.

(One other group of individuals unable to afford protection are those that earn lower than the poverty degree in 11 states which have refused to broaden Medicaid and thus have a protection hole. Some individuals within the protection hole buy non-ACA-compliant protection, however this inhabitants can be prone to not have any protection in any respect. Should you or a beloved one are within the protection hole, we encourage you to learn this text.)

The ARP has not mounted the household glitch or the protection hole, though there are legislative and administrative options into consideration for every of those.

However the ARP has addressed the opposite two points, and people provisions stay in place for 2022. The revenue cap for subsidy eligibility has been eradicated, which signifies that some candidates can qualify for subsidies with revenue far above 400% of the poverty degree. And for many who have been already eligible for subsidies, the subsidy quantities are bigger than they was once, making protection extra inexpensive.

So in case you are enrolled in any kind of self-purchased well being plan that isn’t compliant with the ACA, you owe it to your self to examine your on-exchange choices this fall, throughout the open enrollment interval. Understand that you are able to do that by the trade, by an enhanced direct enrollment entity, or with the help of a medical insurance dealer.

3. Patrons enrolled in off-exchange well being plans

There are additionally individuals who have “off-exchange” ACA-compliant plans that they’ve bought instantly from an insurance coverage firm, with out utilizing the trade. (Word that this isn’t the identical factor as enrolling in an on-exchange plans by an enhanced direct enrollment entity, lots of that are insurance coverage corporations).

There are a selection of causes individuals have chosen to enroll in off-exchange well being plans over the past a number of years. And for a few of these enrollees, 2022 could be the yr to change to an on-exchange plan.

Since 2018, some individuals have opted for off-exchange plans in the event that they weren’t eligible for premium subsidies and wished to enroll in a Silver-level plan. This was a really rational alternative, inspired by state insurance coverage commissioners and marketplaces alike. However in the event you’ve been shopping for off-exchange protection with a view to get a Silver plan with a cheaper price tag, the first level to bear in mind for 2022 is that you just would possibly discover that you just’re now eligible for premium subsidies.

Identical to the individuals described above, who’ve enrolled in varied non-ACA-compliant plans in an effort to acquire inexpensive protection, the elimination of the revenue restrict for subsidy eligibility is a sport changer for individuals who have been shopping for off-exchange protection to get a cheaper price on a Silver plan.

Some individuals have opted for off-exchange protection as a result of their most well-liked well being insurer wasn’t taking part within the trade of their space. This may need been a deciding issue for an applicant who was solely eligible for a really small subsidy — or no subsidy in any respect — and was prepared to pay full value for an off-exchange plan from the insurer of their alternative.

However 2022 is the fourth yr in a row with growing insurer participation within the exchanges, and a few big-name insurers are becoming a member of or rejoining the exchanges in fairly a couple of states. So in the event you haven’t checked your on-exchange choices shortly, this fall is unquestionably the time to take action. You could be shocked to see what number of choices you’ve, and once more, how inexpensive they’re.

4. Customers enrolled in on-exchange plans, however no revenue particulars on file and no current protection reconsiderations

Should you’re already enrolled in an on-exchange plan and also you had given the trade a projection of your revenue for 2021, you most likely noticed your subsidy quantity improve in some unspecified time in the future this yr.

But when the trade didn’t have an revenue on file for you, they wouldn’t have been capable of activate a subsidy in your behalf (on the HealthCare.gov platform, subsidy quantities have been routinely up to date in September for individuals who hadn’t up to date their accounts by that time, however provided that you had supplied a projected revenue to the trade whenever you enrolled in protection for 2021). And even when your subsidy quantity did get up to date, you may need remained on the plan you had picked final fall, regardless of the choice to choose a unique one after the ARP was enacted.

The excellent news is that you just’ll have the ability to declare your full premium tax credit score, for the whole thing of 2021, whenever you file your 2021 tax return (assuming you had on-exchange well being protection all year long). And throughout the open enrollment interval for 2022 protection, you may present revenue info to the trade so {that a} subsidy is paid in your behalf every month subsequent yr.

Reconsidering your plan alternative throughout open enrollment would possibly find yourself being helpful as effectively. Should you didn’t qualify for a subsidy prior to now, or in the event you solely certified for a modest subsidy, you may need picked a Bronze plan or perhaps a catastrophic plan, in an effort to maintain your month-to-month premiums inexpensive.

However with the ARP in place, you would possibly discover which you can afford a extra strong well being plan. And in case your revenue doesn’t exceed 250% of the poverty degree (and particularly if it doesn’t exceed 200% of the poverty degree), pay shut consideration to the obtainable Silver plans. The bigger subsidies might make it potential so that you can afford a Silver plan with built-in cost-sharing reductions that considerably cut back out-of-pocket prices.

One different level to bear in mind: If you’re receiving a premium subsidy this yr, bear in mind that it would change subsequent yr because of a brand new insurer getting into the market in your space and providing lower-priced plans. Right here’s extra about how this works, and what to contemplate as you’re looking for protection this fall.

The takeaway level right here? Even in the event you’ve been glad along with your plan, it’s best to examine your choices throughout open enrollment. This isn’t the yr to let your plan auto-renew. Make sure you’ve supplied the trade with an up to date revenue projection for 2022, and actively evaluate the plans which are obtainable to you. It’s potential {that a} plan with higher protection or a broader supplier community could be inexpensive to you for 2022, even when it was financially out of attain whenever you checked final fall.

Louise Norris is an particular person medical insurance dealer who has been writing about medical insurance and well being reform since 2006. She has written dozens of opinions and academic items in regards to the Reasonably priced Care Act for healthinsurance.org. Her state well being trade updates are repeatedly cited by media who cowl well being reform and by different medical insurance consultants.