A serious premise of the Inexpensive Care Act (ACA) was that People who want to purchase their very own well being protection within the particular person market ought to be capable of receive protection – no matter their medical historical past – and that the month-to-month premiums needs to be inexpensive.

The foundations to facilitate these objectives have been in place for a number of years now. And though they’ve labored fairly effectively for some People, there have been others for whom ACA-compliant well being protection was nonetheless unaffordable.

However the American Rescue Plan, enacted earlier this yr, has boosted the ACA’s subsidies, making actually inexpensive protection way more accessible than it was once.

The numbers communicate for themselves: Trade enrollment has probably reached a document excessive of almost 13 million folks in 2021, after greater than 2.5 million folks enrolled throughout the COVID/American Rescue Plan enrollment window, which ended this month in most states.

How a lot are shoppers saving on medical health insurance premiums?

And the quantity that individuals are paying for his or her protection and care is kind of a bit decrease than it was earlier than the APR’s subsidy enhancements. We are able to see this throughout the states that use the federally run change (HealthCare.gov), in addition to the states that run their very own exchanges:

- Among the many individuals who enrolled throughout the latest particular enrollment interval within the 36 states that use HealthCare.gov, common after-subsidy premiums had been 27% decrease than the quantities folks had been paying pre-ARP.

- Amongst HealthCare.gov enrollees who signed up throughout the particular enrollment interval or who up to date their enrollments to assert the improved subsidies, 35% at the moment are paying lower than $10/month for his or her protection.

- Common deductibles for brand new HealthCare.gov enrollees had been 90% decrease than pre-ARP deductibles, probably pushed largely by the quantity of people that had been in a position to enroll in free or low-cost Silver plans with built-in cost-sharing reductions. (This consists of folks receiving unemployment compensation in 2021, in addition to individuals who aren’t eligible for Medicaid and whose family earnings is between 100% and 150% of the federal poverty degree.)

- The state-run change in Washington reported that 78% of their enrollees at the moment are receiving premium subsidies, versus 61% earlier than the ARP was carried out. And shoppers with earnings above 400% of the poverty degree, who weren’t eligible for subsidies pre-ARP, at the moment are paying a median of $200 much less in premiums every month. Washington’s change additionally famous that 15% of their enrollees at the moment are paying $1/month or much less for his or her protection, versus solely 5% whose premiums had been that low pre-ARP.

- The state-run change in California reported that customers with family incomes between 400% and 600% of the poverty degree are saving a median of just about $800/month on their premiums. (That’s a person with earnings as much as about $76,000, or a family of 4 with an earnings as much as about $157,000.)

- The state-run change in Nevada reported that individuals who enrolled or up to date their account because the ARP was carried out are paying a median of $154/month in after-subsidy premiums, whereas the after after-subsidy premium on the finish of final winter’s open enrollment interval (pre-ARP) was $232/month.

- Maryland’s state-run change reported a 12% enhance within the variety of enrollees receiving subsidies; greater than 80% of Maryland’s present change enrollees are subsidy-eligible.

These examples spotlight the improved affordability that the ARP has dropped at the medical health insurance marketplaces. Individuals who had been already eligible for subsidies at the moment are eligible for bigger subsidies. And lots of the individuals who had been beforehand ineligible for subsidies — however doubtlessly going through very unaffordable medical health insurance premiums — are benefiting from the ARP’s elimination of the earnings cap for subsidy eligibility.

How lengthy will the ARP’s subsidy enhance final?

Though the ARP’s subsidies for folks receiving unemployment compensation in 2021 are solely accessible till the top of this yr, the remainder of the ARP’s premium subsidy enhancements will proceed to be accessible all through 2022 — and maybe longer, if Congress extends them.

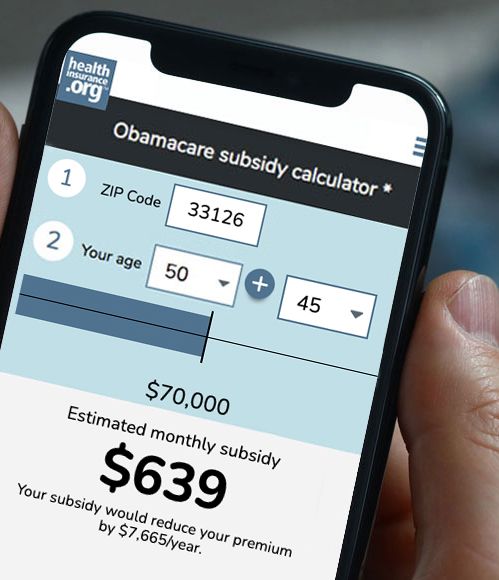

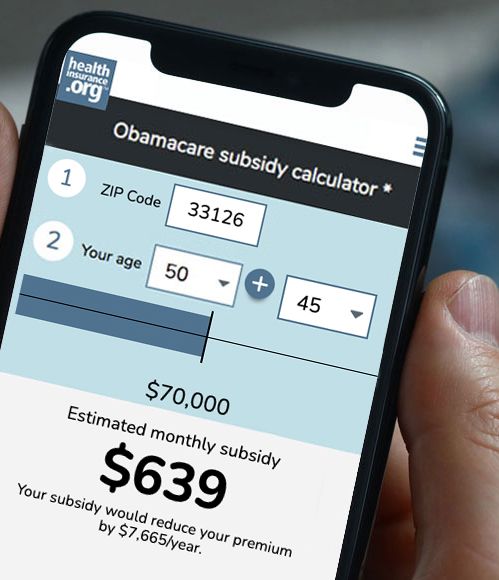

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical health insurance premiums.

Because of this the affordability positive factors we’ve seen this yr shall be accessible throughout the upcoming open enrollment interval, when individuals are evaluating their plan choices for 2022.

Sturdy ACA-compliant protection will proceed to be a extra sensible possibility for extra folks, lowering the necessity for different protection choices corresponding to short-term plans, fastened indemnity plans, and well being care sharing ministry plans.

Even catastrophic plans – that are ACA-compliant however not appropriate with premium subsidies – are more likely to see decreased enrollment over the following yr, since extra individuals are eligible for enhanced subsidies that make metal-level plans extra inexpensive.

Can everybody discover inexpensive medical health insurance now?

Sadly, not but. There are nonetheless affordability challenges going through some People who must receive their very own well being protection. That features greater than two million folks caught within the “protection hole” in 11 states which have refused to increase eligibility for Medicaid, in addition to about 5 million folks affected by the ACA’s “household glitch.”

There are methods for avoiding the protection hole if you happen to’re in a state that hasn’t expanded Medicaid, and Congressional lawmakers are additionally contemplating the potential of a federally-run well being program to cowl folks within the protection hole.

Households affected by the household glitch have entry to an employer-sponsored plan that’s inexpensive for the worker however not for the entire household – and but the household can be ineligible for subsidies within the market/change. (It’s doable that the Biden administration may deal with this problem administratively in future rulemaking.)

Have ARP’s subsidy boosts been profitable?

Apart from these two obstacles, the ARP has succeeded in making inexpensive well being protection a extra sensible possibility for many People who must receive their very own well being protection. We are able to see success within the record-high change enrollment, the elevated share of enrollees who’re subsidy-eligible, and the discount in after-subsidy premiums that individuals are paying.

When you’re at present uninsured or coated by a non-ACA-compliant plan (together with a grandfathered or grandmothered plan), it’s in your finest curiosity to take a second to see what your choices are within the ACA-compliant market. Open enrollment for 2022 protection begins in simply two months, however you may additionally discover you can nonetheless enroll in a plan for the remainder of 2021 if you happen to stay in a state the place a COVID/American Rescue Plan enrollment window is ongoing, or if you happen to’ve skilled a qualifying occasion lately (examples embody lack of employer-sponsored insurance coverage, marriage, or the beginning or adoption of a kid).

Even if you happen to shopped simply final winter, throughout open enrollment for 2021 plans, you is perhaps shocked on the distinction between the premiums you’ll have paid then and now. The ARP wasn’t but in impact over the last open enrollment interval, so if you happen to weren’t eligible for a subsidy final time you seemed, or if the plans nonetheless appeared too costly even with a subsidy, you’ll need to examine once more this fall.

The subsidies for 2022 will proceed to be bigger and extra broadly accessible than they’ve been up to now, and also you owe it to your self to see what’s accessible in your space.

Louise Norris is an particular person medical health insurance dealer who has been writing about medical health insurance and well being reform since 2006. She has written dozens of opinions and academic items concerning the Inexpensive Care Act for healthinsurance.org. Her state well being change updates are frequently cited by media who cowl well being reform and by different medical health insurance consultants.

A serious premise of the Inexpensive Care Act (ACA) was that People who want to purchase their very own well being protection within the particular person market ought to be capable of receive protection – no matter their medical historical past – and that the month-to-month premiums needs to be inexpensive.

The foundations to facilitate these objectives have been in place for a number of years now. And though they’ve labored fairly effectively for some People, there have been others for whom ACA-compliant well being protection was nonetheless unaffordable.

However the American Rescue Plan, enacted earlier this yr, has boosted the ACA’s subsidies, making actually inexpensive protection way more accessible than it was once.

The numbers communicate for themselves: Trade enrollment has probably reached a document excessive of almost 13 million folks in 2021, after greater than 2.5 million folks enrolled throughout the COVID/American Rescue Plan enrollment window, which ended this month in most states.

How a lot are shoppers saving on medical health insurance premiums?

And the quantity that individuals are paying for his or her protection and care is kind of a bit decrease than it was earlier than the APR’s subsidy enhancements. We are able to see this throughout the states that use the federally run change (HealthCare.gov), in addition to the states that run their very own exchanges:

- Among the many individuals who enrolled throughout the latest particular enrollment interval within the 36 states that use HealthCare.gov, common after-subsidy premiums had been 27% decrease than the quantities folks had been paying pre-ARP.

- Amongst HealthCare.gov enrollees who signed up throughout the particular enrollment interval or who up to date their enrollments to assert the improved subsidies, 35% at the moment are paying lower than $10/month for his or her protection.

- Common deductibles for brand new HealthCare.gov enrollees had been 90% decrease than pre-ARP deductibles, probably pushed largely by the quantity of people that had been in a position to enroll in free or low-cost Silver plans with built-in cost-sharing reductions. (This consists of folks receiving unemployment compensation in 2021, in addition to individuals who aren’t eligible for Medicaid and whose family earnings is between 100% and 150% of the federal poverty degree.)

- The state-run change in Washington reported that 78% of their enrollees at the moment are receiving premium subsidies, versus 61% earlier than the ARP was carried out. And shoppers with earnings above 400% of the poverty degree, who weren’t eligible for subsidies pre-ARP, at the moment are paying a median of $200 much less in premiums every month. Washington’s change additionally famous that 15% of their enrollees at the moment are paying $1/month or much less for his or her protection, versus solely 5% whose premiums had been that low pre-ARP.

- The state-run change in California reported that customers with family incomes between 400% and 600% of the poverty degree are saving a median of just about $800/month on their premiums. (That’s a person with earnings as much as about $76,000, or a family of 4 with an earnings as much as about $157,000.)

- The state-run change in Nevada reported that individuals who enrolled or up to date their account because the ARP was carried out are paying a median of $154/month in after-subsidy premiums, whereas the after after-subsidy premium on the finish of final winter’s open enrollment interval (pre-ARP) was $232/month.

- Maryland’s state-run change reported a 12% enhance within the variety of enrollees receiving subsidies; greater than 80% of Maryland’s present change enrollees are subsidy-eligible.

These examples spotlight the improved affordability that the ARP has dropped at the medical health insurance marketplaces. Individuals who had been already eligible for subsidies at the moment are eligible for bigger subsidies. And lots of the individuals who had been beforehand ineligible for subsidies — however doubtlessly going through very unaffordable medical health insurance premiums — are benefiting from the ARP’s elimination of the earnings cap for subsidy eligibility.

How lengthy will the ARP’s subsidy enhance final?

Though the ARP’s subsidies for folks receiving unemployment compensation in 2021 are solely accessible till the top of this yr, the remainder of the ARP’s premium subsidy enhancements will proceed to be accessible all through 2022 — and maybe longer, if Congress extends them.

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical health insurance premiums.

Because of this the affordability positive factors we’ve seen this yr shall be accessible throughout the upcoming open enrollment interval, when individuals are evaluating their plan choices for 2022.

Sturdy ACA-compliant protection will proceed to be a extra sensible possibility for extra folks, lowering the necessity for different protection choices corresponding to short-term plans, fastened indemnity plans, and well being care sharing ministry plans.

Even catastrophic plans – that are ACA-compliant however not appropriate with premium subsidies – are more likely to see decreased enrollment over the following yr, since extra individuals are eligible for enhanced subsidies that make metal-level plans extra inexpensive.

Can everybody discover inexpensive medical health insurance now?

Sadly, not but. There are nonetheless affordability challenges going through some People who must receive their very own well being protection. That features greater than two million folks caught within the “protection hole” in 11 states which have refused to increase eligibility for Medicaid, in addition to about 5 million folks affected by the ACA’s “household glitch.”

There are methods for avoiding the protection hole if you happen to’re in a state that hasn’t expanded Medicaid, and Congressional lawmakers are additionally contemplating the potential of a federally-run well being program to cowl folks within the protection hole.

Households affected by the household glitch have entry to an employer-sponsored plan that’s inexpensive for the worker however not for the entire household – and but the household can be ineligible for subsidies within the market/change. (It’s doable that the Biden administration may deal with this problem administratively in future rulemaking.)

Have ARP’s subsidy boosts been profitable?

Apart from these two obstacles, the ARP has succeeded in making inexpensive well being protection a extra sensible possibility for many People who must receive their very own well being protection. We are able to see success within the record-high change enrollment, the elevated share of enrollees who’re subsidy-eligible, and the discount in after-subsidy premiums that individuals are paying.

When you’re at present uninsured or coated by a non-ACA-compliant plan (together with a grandfathered or grandmothered plan), it’s in your finest curiosity to take a second to see what your choices are within the ACA-compliant market. Open enrollment for 2022 protection begins in simply two months, however you may additionally discover you can nonetheless enroll in a plan for the remainder of 2021 if you happen to stay in a state the place a COVID/American Rescue Plan enrollment window is ongoing, or if you happen to’ve skilled a qualifying occasion lately (examples embody lack of employer-sponsored insurance coverage, marriage, or the beginning or adoption of a kid).

Even if you happen to shopped simply final winter, throughout open enrollment for 2021 plans, you is perhaps shocked on the distinction between the premiums you’ll have paid then and now. The ARP wasn’t but in impact over the last open enrollment interval, so if you happen to weren’t eligible for a subsidy final time you seemed, or if the plans nonetheless appeared too costly even with a subsidy, you’ll need to examine once more this fall.

The subsidies for 2022 will proceed to be bigger and extra broadly accessible than they’ve been up to now, and also you owe it to your self to see what’s accessible in your space.

Louise Norris is an particular person medical health insurance dealer who has been writing about medical health insurance and well being reform since 2006. She has written dozens of opinions and academic items concerning the Inexpensive Care Act for healthinsurance.org. Her state well being change updates are frequently cited by media who cowl well being reform and by different medical health insurance consultants.