This put up was written in collaboration with Singtel Sprint. Whereas we’re financially compensated by them, we nonetheless attempt to take care of our editorial integrity and evaluation merchandise with the identical goal lens. We’re dedicated to offering the most effective suggestions and recommendation so as so that you can make private monetary choices with confidence. You possibly can view our Editorial Pointers right here.

Most of us historically get our insurance policy from an agent, be it by a referral from a buddy or our current agent. We then set a date, meet up, undergo the plan after which signal the papers.

Even for those who select to look on-line for insurance coverage insurance policies, you could must fill in your contact particulars on the insurer’s web site then anticipate a callback from an agent earlier than you kickstart the above course of.

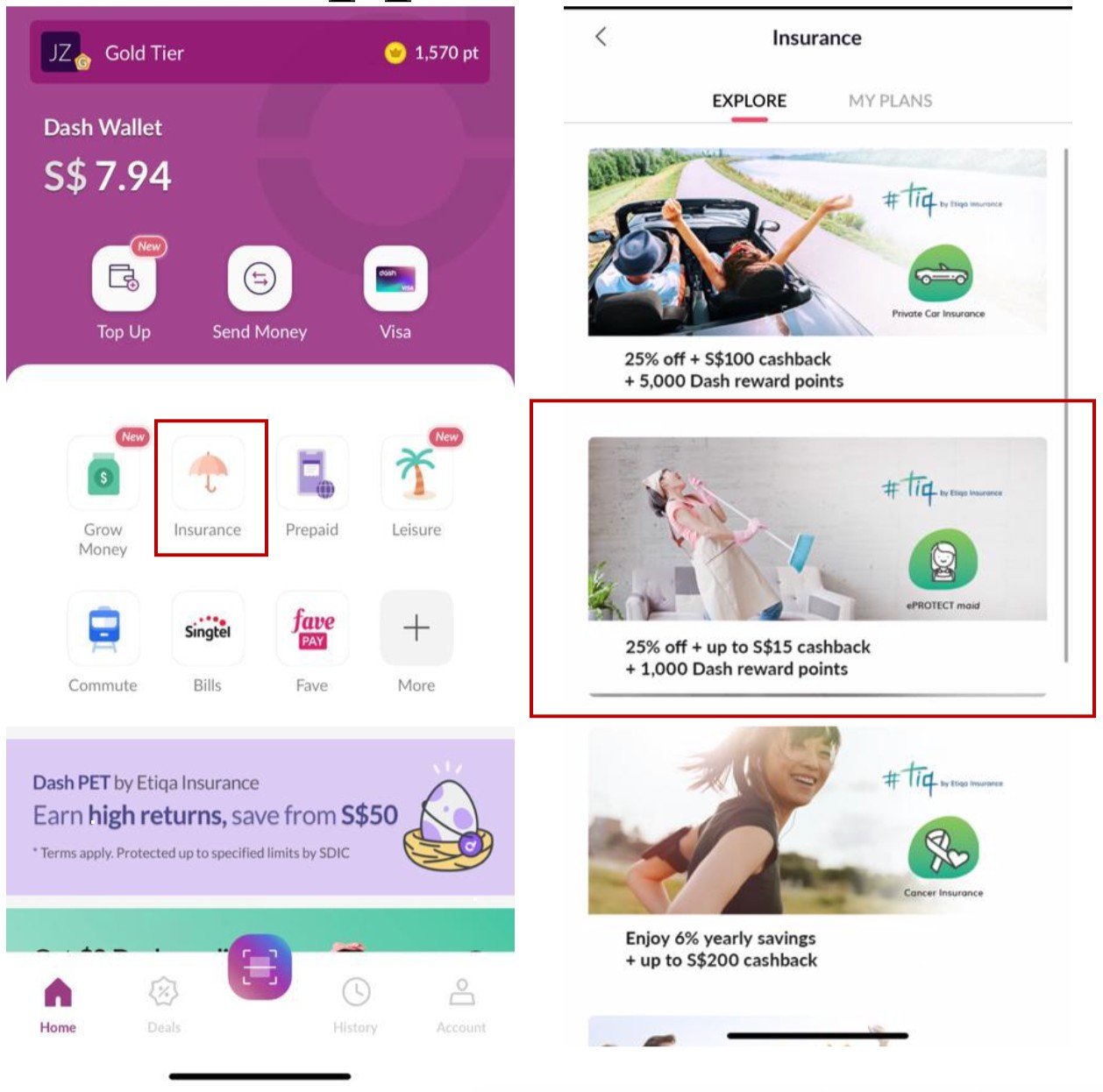

What if there’s a faster (and simpler) means to take action? Yup, as a substitute of asking round for referrals or looking out on-line, you may conveniently view and purchase some insurance policy by a cellular app that you just already use on your day-to-day wants — Singtel’s cellular pockets, Sprint.

A better answer within the palm of our hand

Bear in mind the insurance coverage financial savings plans from Singtel Sprint and digital insurer Etiqa’s Sprint EasyEarn that offered nice returns?

Financial savings insurance coverage plan Sprint EasyEarn was launched in mid-2020, making it the primary insurance coverage financial savings plan obtainable on a cellular pockets in Singapore. Earlier this yr, the second digital insurance coverage financial savings plan Sprint PET (Shield, Earn, Transact) was launched on the app too.

Since end-April 2021, a brand new suite of life and basic insurance policy have been obtainable by the Singtel Sprint app.

What’s Singtel Sprint?Singtel Sprint is a cellular pockets that you need to use to pay for day by day spending on issues similar to public transport and purchasing in-stores or on-line. It really works identical to another contactless cost — simply hyperlink your Sprint Digital Visa card and faucet to pay, or scan a QR code. Apart from permitting you to avoid wasting with Sprint EasyEarn and Sprint PET, Sprint additionally means that you can ship cash to a number of Asian nations, together with China, India, Indonesia, and Malaysia. And it provides rewards too (extra on that later)! |

What important insurance policy can be found by Singtel Sprint?

Singtel Sprint and Etiqa have teamed up as soon as extra to launch a brand new suite of insurance policy. Along with current advantages, reductions and cashbacks, you’ll additionally earn unique Sprint reward factors!

Sometimes, insurance coverage purchases don’t entice different perks (i.e. bank card factors, and many others), however now’s your likelihood to get some additional safety and earn extra Sprint reward factors on the similar time.

Right here’s the 4 plans at present obtainable:

| Sort of insurance coverage | Protection contains.. | Premium | Sprint unique promotion |

| ePROTECT maid Insurance coverage | Private accident, Covid-19 vaccination unintended effects, medical bills reimbursement, and many others | From $138.42/yr (after 25% off) | 1,000 (buy in-app by 31 December 2021) |

| Non-public Automobile Insurance coverage | Restore guarantee, youngster seat, windscreen, and many others | Depending on standards (automobile mannequin, yr, off peak/peak, driver’s profile, and many others.) | 5,000 (buy in-app by 31 December 2021) |

| Tiq Most cancers Insurance coverage | As much as $200,000, contains early stage most cancers | From $0.27/day* | (as much as $200 cashback) |

| Time period Life Insurance coverage | $50,000 – $2 million, lump sum payouts, and many others | From $0.04/day^ | (as much as $100 cashback) |

*Premium based mostly on S$50,000 cowl for a 20-year-old, male non-smoker

^Based mostly on S$50,000 cowl (5-year renewable time period plan) for a 19-year-old non-smoking feminine

Phrases apply. Check with coverage paperwork offered on Singtel Sprint app for particulars.

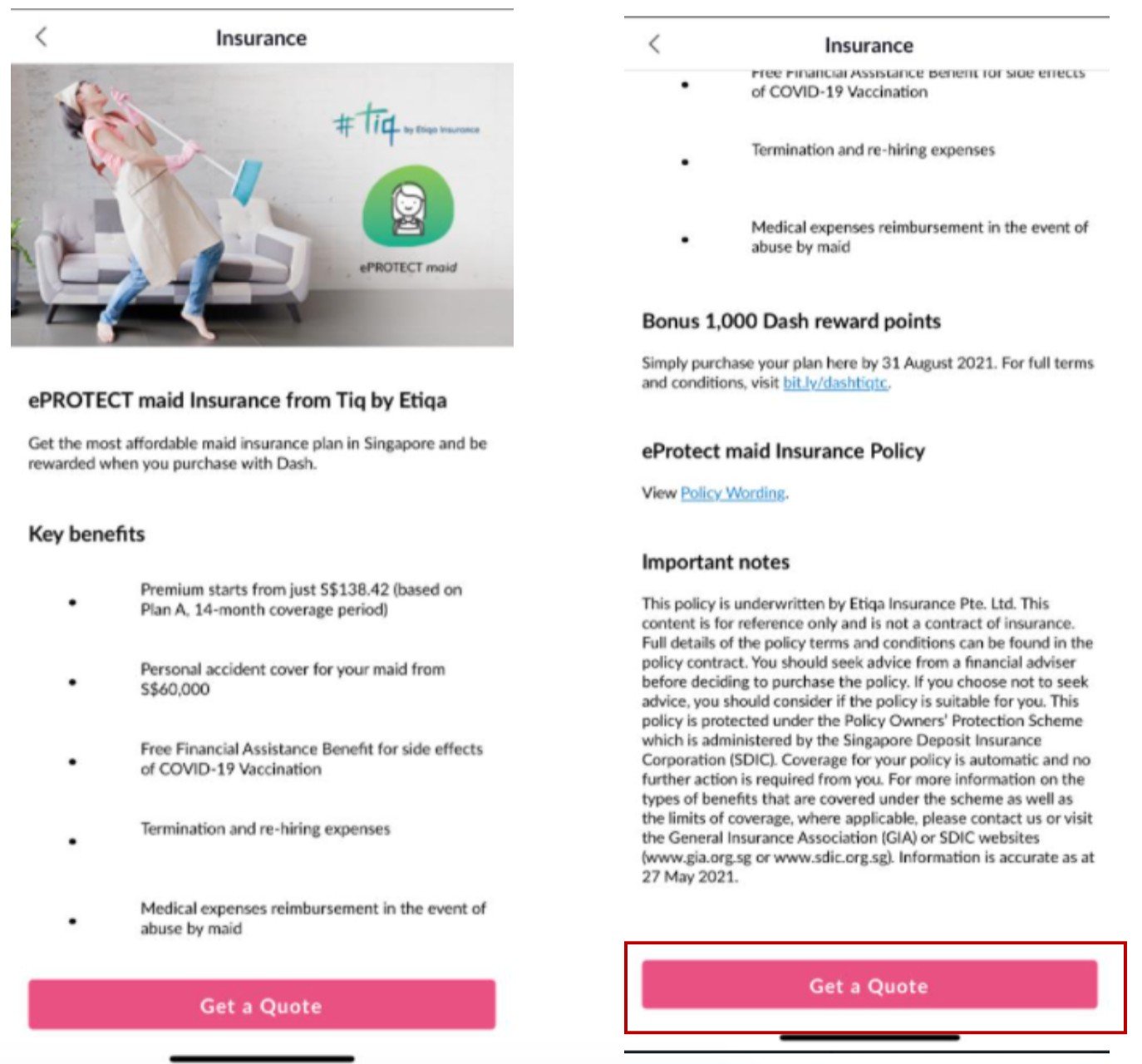

ePROTECT maid Insurance coverage

Your home helper is one who you depend on to maintain your own home so as, deal with your youngsters or dad and mom and prepare dinner for your loved ones. And also you’ll need her to remain protected in case of any unexpected incidents.

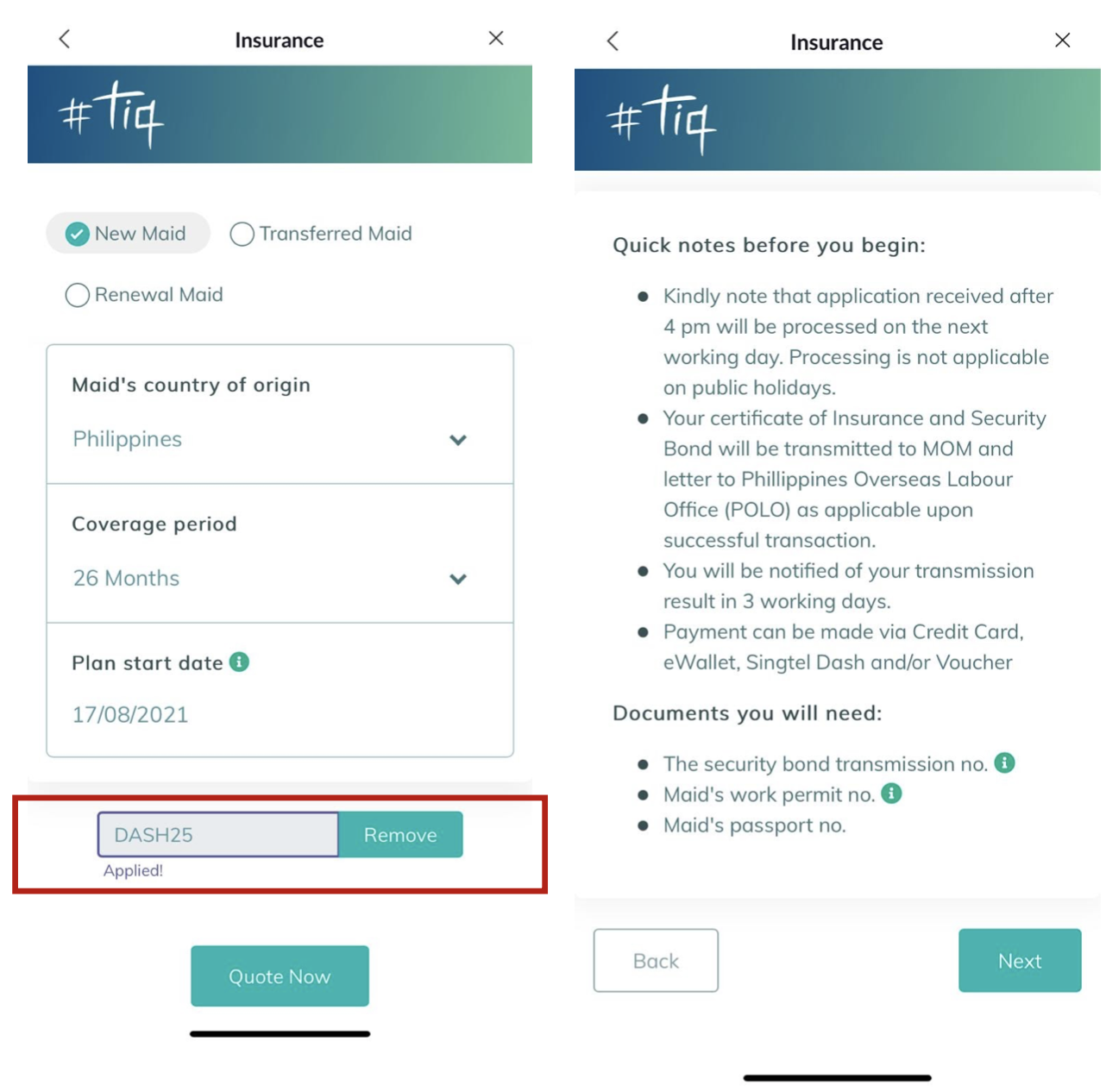

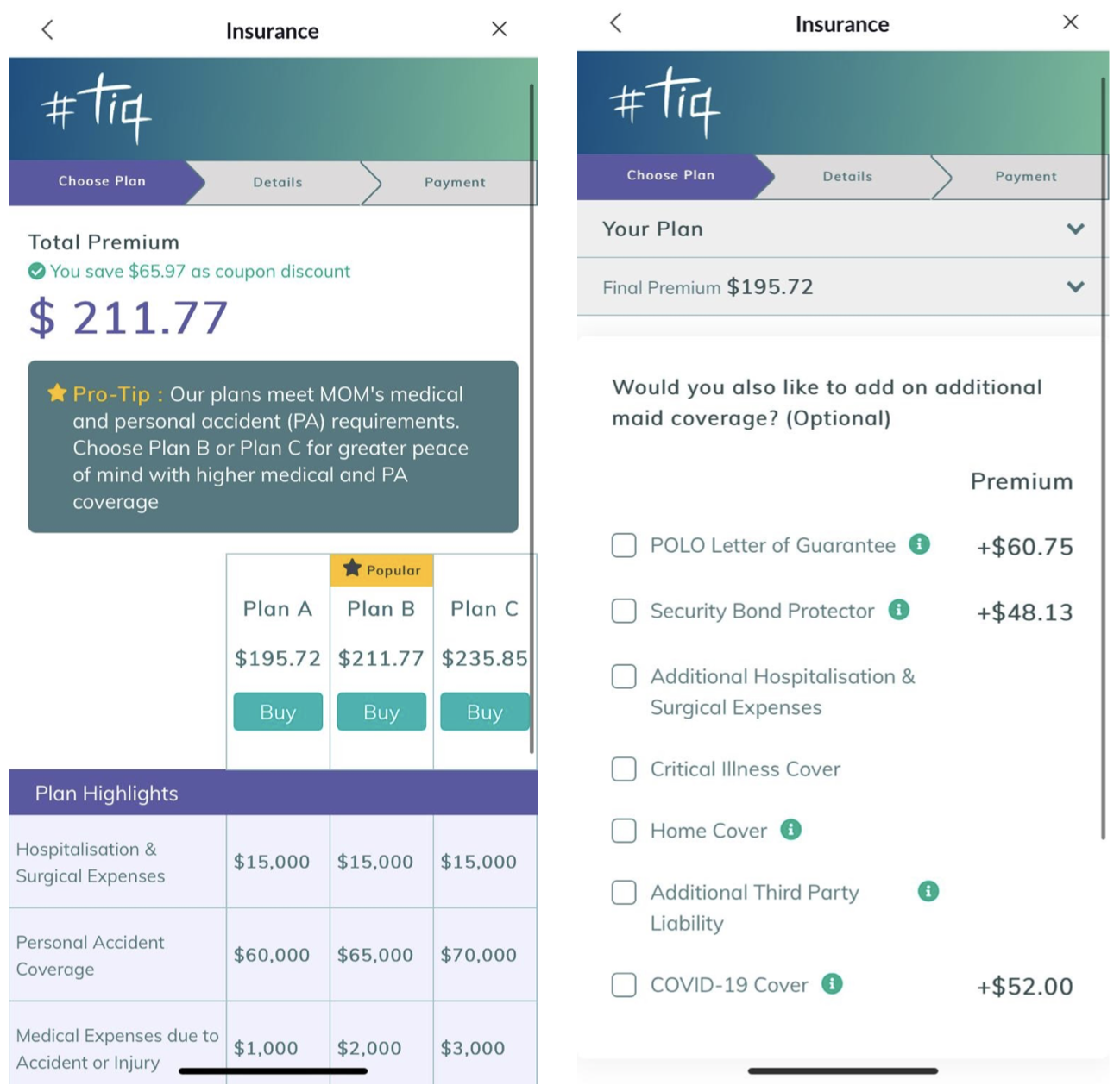

In case you’ve carried out some mild analysis, you’ll know that Etiqa’s maid insurance coverage is among the most reasonably priced choices in Singapore. Take into account getting one by Sprint for the extra factors that you just received’t discover wherever else. Plans are available 14-month and 26-month coverages, with premiums ranging from $138.42 (14-month Plan A, after 25% off).

What’s included:

- Private accident protection from $60,000 on your helper

- Free monetary help profit if any unintended effects arising from Covid-19 vaccination

- Termination and re-hiring bills

- Reimbursement of medical bills (i.e. you and your loved ones) if there’s any abuse by maid

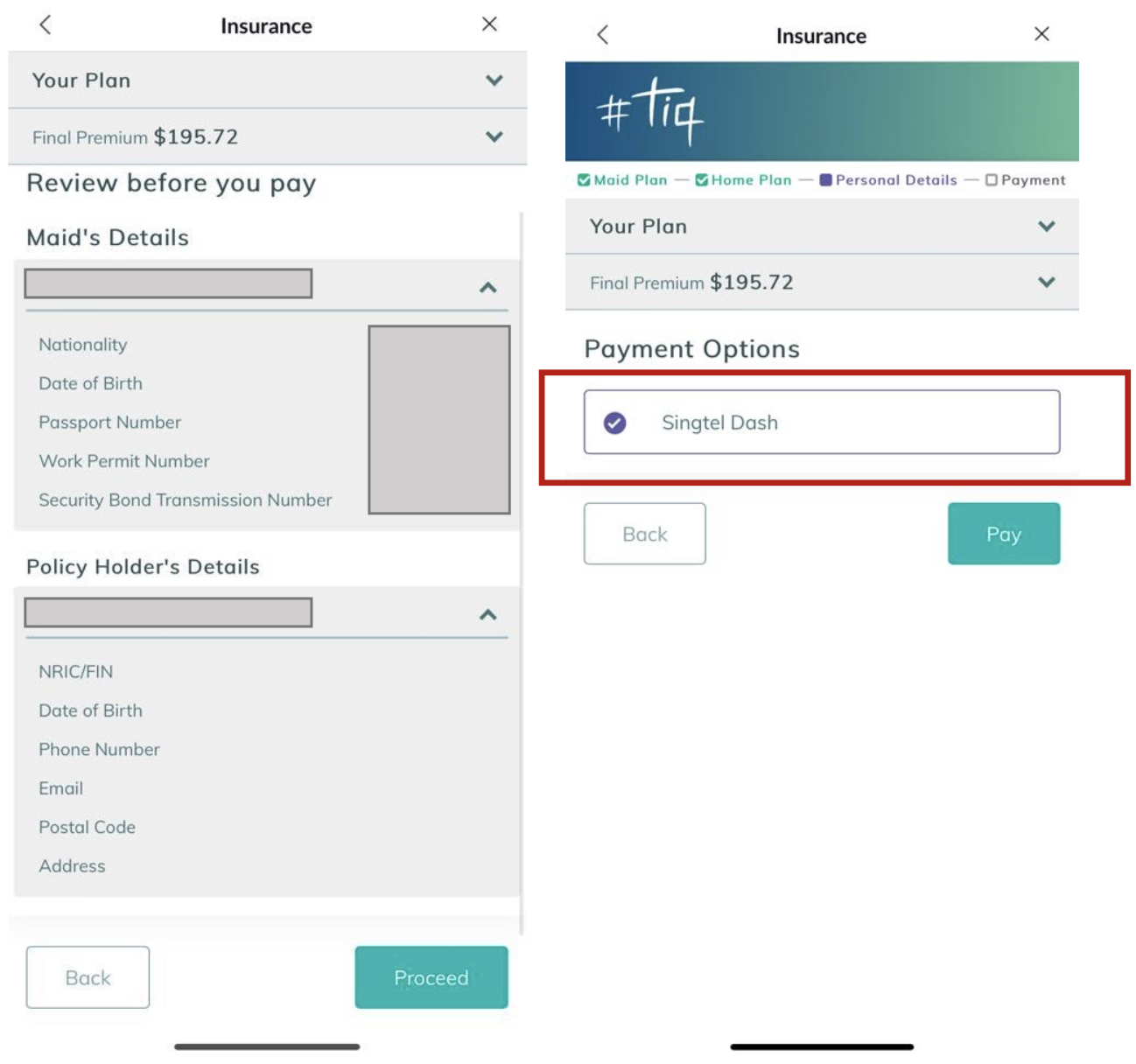

The app will information you thru a step-by-step course of the place you’ll be capable to key in your helper’s private particulars and see the ultimate premium price earlier than you click on pay.

|

Purchase earlier than 31 December 2021 to obtain 1,000 Sprint factors. Stack this with a 25% off promo code (DASH25). |

Non-public Automobile Insurance coverage

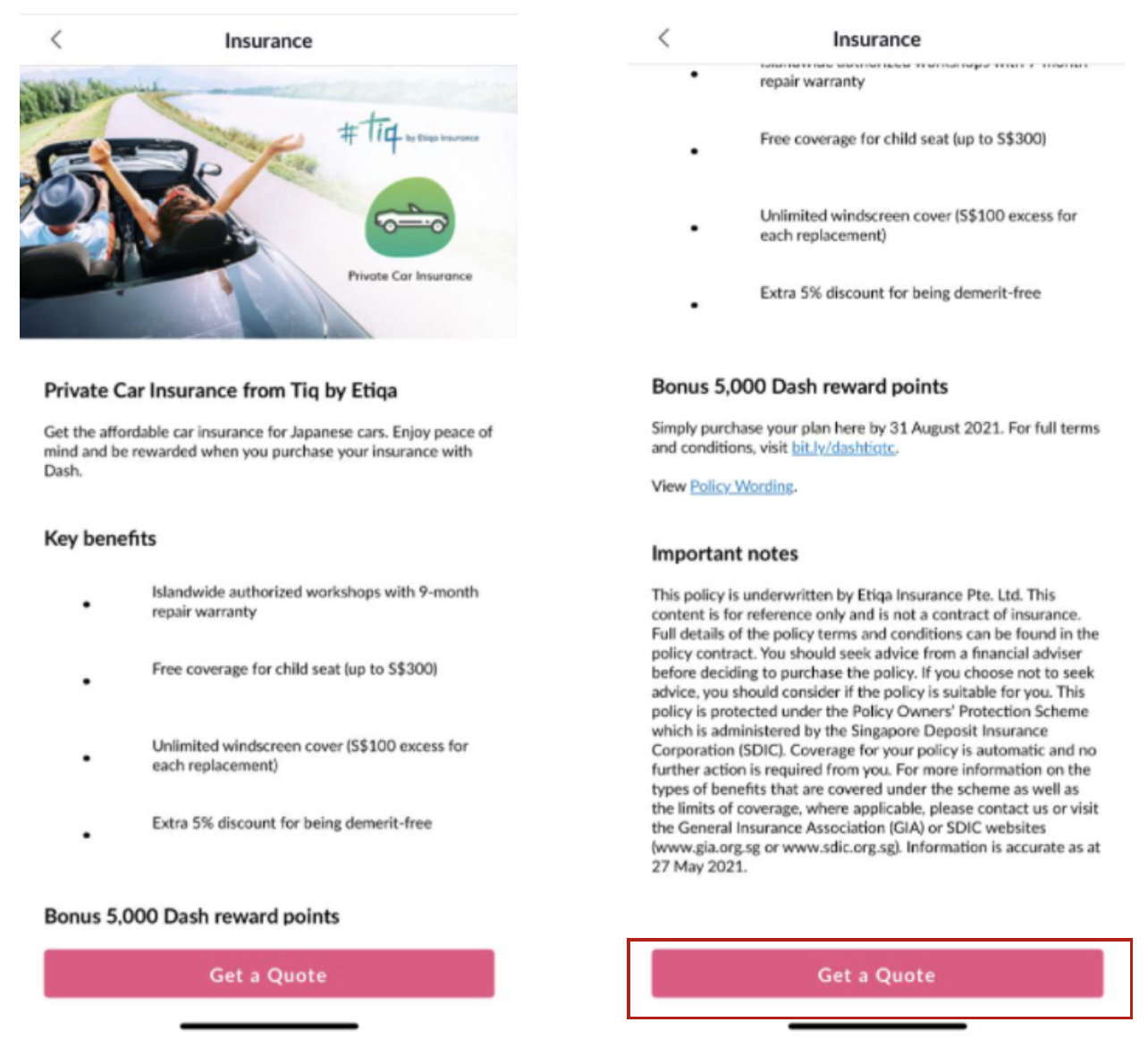

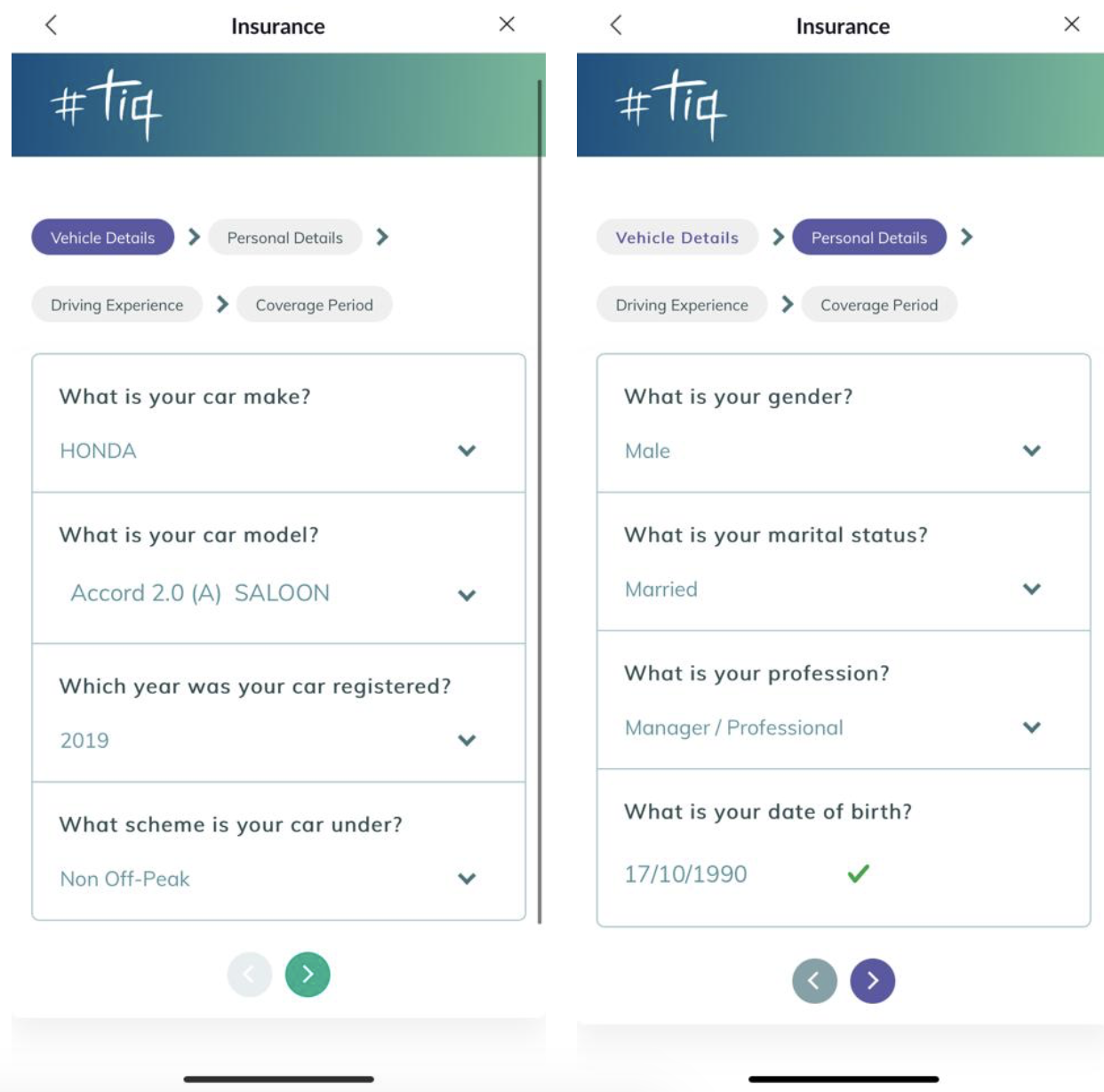

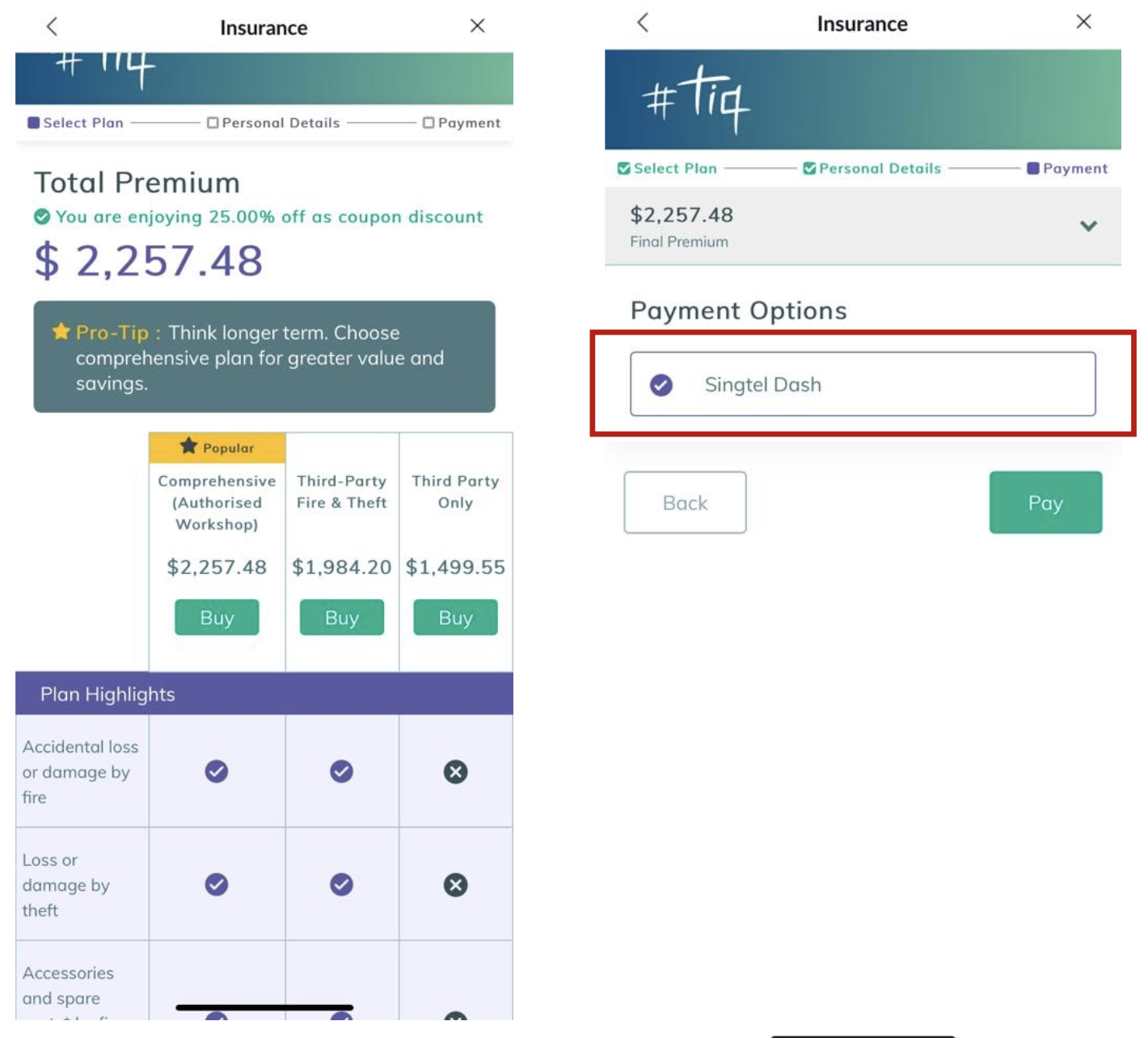

In case your automobile insurance coverage is due for renewal, you may get a brand new plan conveniently through Singtel Sprint with out all of the frills and add-ons that automobile sellers attempt to promote you. And it’s apparently competitively priced for individuals who personal Japanese automobiles, which is most of us.

What’s included:

- 9-month restore guarantee at authorised workshops islandwide

- Free protection of as much as $300 for youngster seat

- Limitless windscreen cowl ($100 extra for every alternative)

- Further 5% low cost for those who’re demerit free

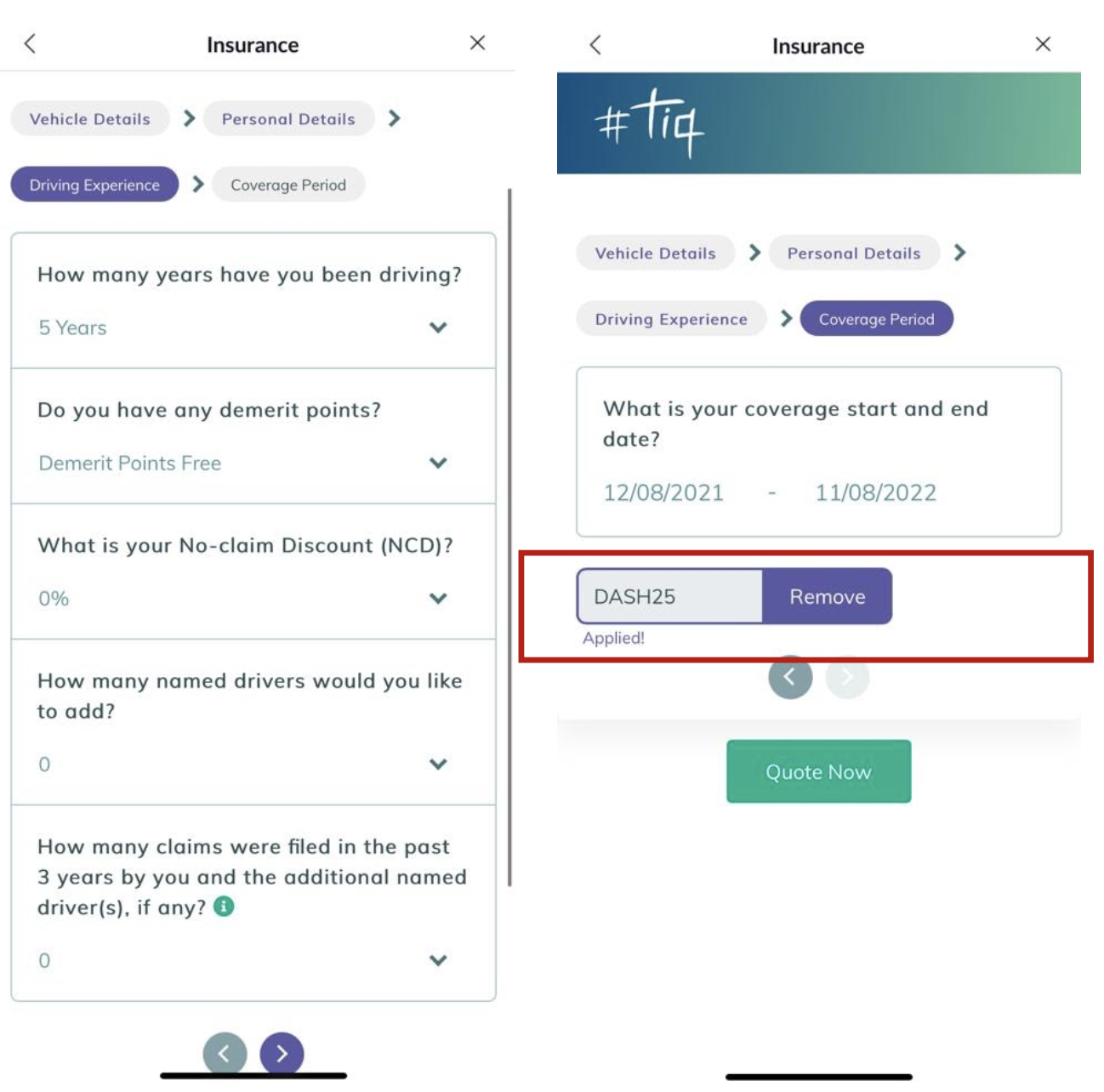

Merely click on by to the right part on the app the place you’ll be requested to fill in your particulars similar to what number of years you’ve been driving, no-claim low cost, variety of claims you’ve filed and for those who’d like so as to add any drivers.

|

Join by 31 December 2021 to get pleasure from 5,000 Sprint reward factors (value S$10). |

Tiq Most cancers Insurance coverage

With regards to most cancers insurance coverage, it’s all the time good to have a plan that covers early stage most cancers, like this one. To not say we’re kiasu, however statistics present that 1 in 4 individuals could develop most cancers of their lifetime. And for those who search remedy early, there’s a excessive likelihood you’ll survive it (about 80% for individuals under age 50).

What’s included:

- Full payout for all levels of most cancers

- Select a advantage of $50,000 or $100,000, or $200,000

- Etiqa particular: Yearly 6% low cost whenever you renew your coverage if no claims made throughout earlier yr

- Dying advantage of $5,000

|

Apply by 30 September 2021 to face to get $50, $100 or $200 cashback, relying in your premium quantity. Use promo code DASH100. |

Time period Life Insurance coverage

Time period life insurance coverage has grow to be extra in style of late because of cheaper premiums for insurance policies that don’t lock you in for all times. This helps tremendously for households who need to guarantee their dependents have sufficient ought to one thing occur to them, or if there’s a big long-term mortgage like mortgage they’re nonetheless paying for.

What’s included:

- Select from time period plans of 5 years (renewable), 20 yr (fastened), or as much as age 65

- Protection of $401,000 – $2 million

- Lump sum payout in occasion of terminal sickness or Complete Everlasting Incapacity ($10,000 – $100,000)

- Protection towards 30 varieties of Important Sickness

- Dying advantage of $2 million

|

Be one of many first 100 to use by 30 September 2021 to get pleasure from reductions and cashback, based mostly on the time period plan you select. Bear in mind to key within the code DASH100. |

| Premium Time period Plan | Sum Assured | Low cost/Cashback quantity entitled to |

| 5 yr renewable time period | Sum Assured from S$401,000 – S$2,000,000 | Perpetual low cost 14% and S$50 Cashback |

| 20 yr fastened time period | Sum Assured from S$401,000 – S$999,000 | Perpetual low cost 18% and S$50 Cashback |

| Sum Assured from S$1,000,00 and above | S$100 Cashback, topic to minimal annual premium of S$500 | |

| As much as age 65 | Sum Insured from S$401,000 and above | S$100 Cashback, topic to minimal annual premium of S$500 |

Supply

About Sprint reward factors

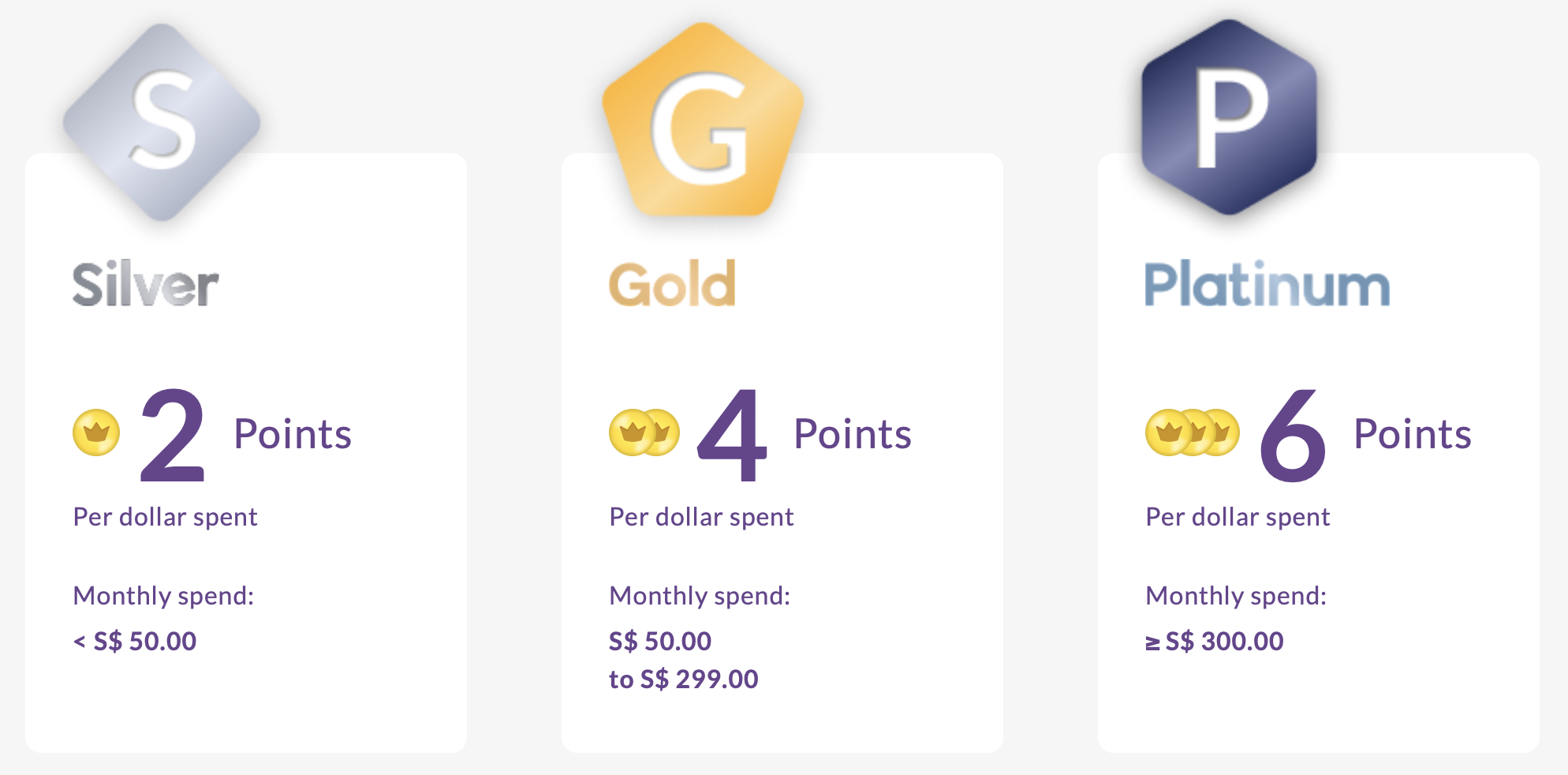

For each greenback you spend through Sprint (i.e. utilizing Sprint to make funds) at any of the over 72,000 retailers, you earn Sprint reward factors. Fairly straightforward to earn huh? Right here’s an outline of the rewards system:

Supply

As you may see, the extra you spend, the extra factors you earn. And the month-to-month spending isn’t even so much in any respect. In case you eat at a restaurant as soon as every week (offered if it’s a collaborating Sprint service provider), you’ll simply be capable to hit at the least Gold tier.

Methods to earn extra Sprint reward factors:

- Make a remittance through the Sprint app (50 factors)

- Save and shield with Sprint PET (until 30 September 2021)

- Buy of chosen insurance policy (new)

Redemption by vouchers through an intensive Rewards catalogue. For instance:

- $2 Seize voucher with 1,000 factors

- $5 Chilly Storage voucher with 2,500 factors

- Different companions embody Subway, Sephora, Zalora, Singtel and extra!

Bear in mind, when shopping for insurance coverage, verify for issues like protection, declare eligibility and price of premiums. Discover out extra particulars on the insurance policy and obtain the Singtel Sprint app to get began.

Disclaimer:

– This text is written in collaboration with Singtel Sprint

– The data is supposed purely for informational functions and shouldn’t be relied upon as monetary recommendation.

– Sprint PET will not be a checking account or a hard and fast deposit. It’s an insurance coverage financial savings plan that earns a crediting rate of interest.

– These insurance policies are underwritten by Etiqa Insurance coverage Pte. Ltd. (Firm Reg. No. 201331905K). This commercial is for basic info solely. Phrases apply. Full particulars of the coverage phrases and situations could be discovered within the coverage contract. Protected as much as specified limits by SDIC. For extra info on the varieties of advantages which are lined underneath the scheme in addition to the bounds of protection, the place relevant, please contact us or go to the Common Insurance coverage Affiliation (GIA), Life Insurance coverage Affiliation (LIA) or SDIC web sites (www.gia.org.sg, www.lia.org.sg or www.sdic.org.sg). As shopping for a life insurance coverage coverage is a long-term dedication, an early termination of the coverage normally includes excessive prices and the give up worth, if any, that’s payable to you could be zero or lower than the overall premiums paid. You must search recommendation from a monetary adviser earlier than deciding to buy the coverage. In case you select to not search recommendation, it’s best to think about if the coverage is appropriate for you. As time period life insurance coverage has no financial savings or funding characteristic, there isn’t a money worth if the coverage ends or if the coverage is terminated prematurely. This commercial has not been reviewed by the Financial Authority of Singapore. Data is correct as at 9 September 2021.