This submit was written in collaboration with MoneyOwl. Whereas we’re financially compensated by them, we nonetheless try to keep up our editorial integrity and evaluation merchandise with the identical goal lens. We’re dedicated to offering the very best data so as so that you can make private monetary selections with confidence. You possibly can view our Editorial Tips right here.

As the tip of the yr approaches with festivities and feasting, many people could also be splurging a bit extra as we meet up with family and friends.

Whereas we get pleasure from a little bit of indulgence this era, it’s additionally time to take inventory of our funds for the yr and channel some funds to cowl our insurance coverage gaps.

A method to do this is thru MoneyOwl, a monetary adviser and fund administration firm licensed by the Financial Authority of Singapore.

Aside from offering monetary recommendation, the corporate can also be dedicated to doing good — it’s a social enterprise and a three way partnership between NTUC Enterprise Co-operative Restricted and Providend Holding, with a mission to assist on a regular basis bizarre Singaporeans make wiser monetary selections.

The truth is, MoneyOwl has lately been awarded on the Singapore FinTech Pageant’s World FinTech Awards within the Social Impression class, in recognition of the optimistic contributions that it has made to our society.

If that sounds good to you, learn on to seek out out extra about the advantages of shopping for insurance coverage with MoneyOwl, and why you must do it at present.

1. Simply entry & evaluate greater than 500,000 insurance coverage quotes immediately

When you haven’t purchased insurance coverage as a result of there’s simply too many several types of plans for various functions and phrases and situations to undergo, don’t fear, we utterly perceive.

Or you may simply be too busy to check quotes from totally different insurance coverage suppliers to make sure that you get the most affordable, most value-for-money quote that matches your wants.

We completely get that too with busy schedules and a endless to-do listing as we do business from home.

Right here’s the place MoneyOwl’s insurance coverage comparability device turns out to be useful. Evaluate greater than 500,000 insurance coverage quotes immediately once you seek for an insurance coverage plan on MoneyOwl. Its search perform is categorised into differing kinds — life safety, important sickness, occupational incapacity, hospital plan, long-term care, training fund, retirement earnings plans and SRS plans.

Simply choose the kind of insurance coverage you need, fill within the required fields and also you’ll be capable of see the plans which might be appropriate to satisfy your monetary wants.

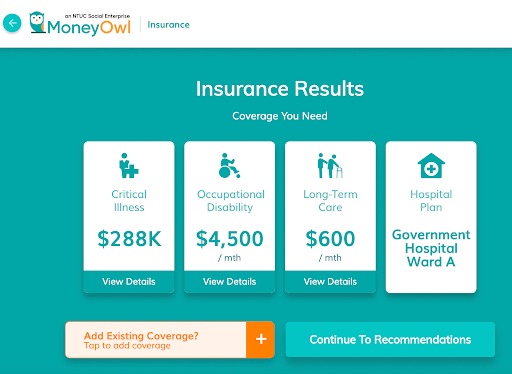

When you don’t know what to get, it’s also possible to take a questionnaire, also called the “Discover wants” device, the place you key in particulars about your private profile (eg. single, married with or with out youngsters, or planning for retirement). The questionnaire will go on to evaluate your monetary profile and insurance coverage wants earlier than exhibiting you the sort and quantity of insurance coverage protection you want.

Supply: MoneyOwl

The personalisation options assist make sure the coverage you get is totally tailor-made to your wants, and you’ve got the choice to select from any supplier you want.

And you are able to do it on-line, by your self, at any time. When you’ve got chosen a couple of plans however are spoilt for alternative, you could contact MoneyOwl’s pleasant consumer advisers who may assist to advise one which most accurately fits your wants.

It’s no marvel MoneyOwl prides itself as “Singapore’s 1st Bionic Monetary Advisor”, combining the facility of know-how and human insights. Expertise to combine advanced monetary fashions into your monetary plan; devoted consumer advisers to information you thru your life targets.

Moreover, it’s all within the firm’s title and emblem — consider a clever owl giving sage recommendation, and powered by tech!

2. MoneyOwl’s consumer advisers don’t earn fee out of your buy

How usually have you ever felt pressured to join a coverage from an insurance coverage agent? Worse nonetheless if the individual is your buddy or former classmate who has instantly resurfaced: Hey bro, once you free? Let’s go seize some kopi leh.

We’ve usually heard horror tales of how pushy some brokers might be, recommending all types of plans for any potential conditions simply to earn their fee.

What units MoneyOwl aside is that its Consumer Advisers are all totally salaried and don’t earn any fee.

This implies there received’t be any laborious promoting to shoppers merchandise that you just don’t want or are overly costly. You possibly can thus be reassured that recommendation and proposals offered are in your finest pursuits and tailor-made to your wants.

Due to this fact, even should you have been beforehand cautious of pushy insurance coverage brokers, you’ll be able to relaxation assured that you’ll not face that strain from MoneyOwl. It’s possible you’ll safely get in contact with a MoneyOwl Consumer Adviser to get unbiased recommendation and make clear any questions you could have.

There was this time an agent was asking me to pay fairly a hefty sum for a plan and after I stated I had no cash for it, the worth for it dramatically lowered. Hmm… positively may have completed with participating somebody who wasn’t so pushed by fee.

3. You’ll obtain as much as 50% of the insurance coverage commissions

Extra financial savings? Rely us in. MoneyOwl rebates its clients as much as 50% of the fundamental commissions they obtain from the insurer proper again to your checking account once you buy insurance coverage.

How does this work? While you purchase an insurance coverage coverage, a portion of the premium you pay goes to the insurance coverage agent as fee. Since MoneyOwl doesn’t have brokers who receives a commission by fee, they’ll go again a portion of the commissions to the shopper, serving to to cut back the price of insurance coverage.

Thus, you’ll obtain as much as 50% of the insurance coverage commissions, after deducting an admin cost of $26.75.

Each greenback it can save you is a greenback extra for you.

This is applicable to insurance policies which might be eligible for fee. And so long as you get an eligible coverage, it doesn’t matter whether or not you pay your premiums yearly or month-to-month, as you’ll nonetheless get the fee rebate.

All insurance coverage insurance policies are eligible for fee rebates besides:

- Non-public Built-in Defend plans

- Native Hospitalisation plans

- CareShield Life/ElderShield Dietary supplements

- Plans utilizing CPF monies

- Private Accident Plans

When you pay yearly, you’ll get the fee in about 3 to 4 months after the coverage comes into impact — on to your checking account! For month-to-month, quarterly or half-yearly funds, you’ll get the fee each December.

4. Shopping for insurance coverage by way of MoneyOwl is actually music to your ears

Up your type with some brand-new Apple AirPods should you make a purchase order by way of MoneyOwl. Those that have been seeking to get a pair for the longest time can stand to snag the third gen AirPods value $269 in the event that they’re the primary 500 clients, from now until 31 Dec 2021.

The coverage has to return in pressure on or earlier than 31 Jan 2022 so that you can be eligible to get the AirPods. Be aware that non-public built-in protect plans, native hospitalisation plans, private accident plans and plans utilizing CPF funds are usually not eligible for the promo.

Now that you just’ve come to the tip of this text, why wait until 2022 to plug your safety gaps? Discover out extra about MoneyOwl’s insurance coverage at present.