Most U.S. drivers have automotive insurance coverage. Whether or not it’s as a result of their state requires it, or they simply need to be on the secure aspect in case of an accident, about 87.4% of drivers select to hold automotive insurance coverage. However what concerning the uninsured 12.6% left over? And what occurs if you happen to get right into a wreck with an uninsured driver?

That’s the place uninsured/underinsured motorist protection is available in. One of these protection is necessary to think about when taking out a automotive insurance coverage coverage, realizing that there are many drivers on the market with out insurance coverage. At us Insurance coverage, we don’t need to fearmonger, however we do need to be sure you’re as knowledgeable as attainable to maintain you secure from any on-the-road eventualities. On this article, we’ll break down uninsured/underinsured motorist protection, the way it works, and why you would possibly want it.

What’s uninsured/underinsured motorist protection?

Uninsured/underinsured motorist protection is a kind of insurance coverage that protects you if you happen to get into an accident with a driver who doesn’t have legal responsibility insurance coverage, or who doesn’t have sufficient legal responsibility protection to pay for all your damages. Your uninsured/underinsured motorist protection choices differ extensively by state; some states have made one of these protection obligatory, whereas others don’t require it in any respect.

What does it cowl?

Relying in your state, your insurance coverage firm, and the precise coverage you’ve gotten, uninsured/underinsured motorist protection may help pay for automobile restore prices, medical bills, lack of revenue, ache and struggling, and funeral bills. For those who opted out of one of these further protection and get into an accident with an uninsured driver, you could find yourself having to pay for every thing by yourself.

Are hit-and-run accidents coated?

As is the case with many insurance coverage questions, the reply is: it relies upon. At us’s headquarters in Virginia, uninsured/underinsured motorist protection is elective…however if in case you have it, it will assist cowl the prices of a hit-and-run accident.

Uninsured vs beneathinsured: what’s the distinction?

These two phrases are almost similar and are sometimes used interchangeably. Nevertheless, there are a couple of key variations between the 2.

Underinsured motorist protection

Underinsured motorist protection helps defend you financially if you happen to get into an accident the place the opposite driver is at-fault and has some auto insurance coverage, however not sufficient to cowl your full bills. On this scenario, the underinsured, at-fault drivers’ insurance coverage can pay on your accidents and bills as much as their coverage restrict, after which your underinsured motorist protection will kick in to cowl the remainder. For those who choose out of this protection, you could possibly as an alternative find yourself having to pay out of pocket for every thing the opposite drivers’ insurance coverage couldn’t cowl, despite the fact that the accident wasn’t your fault.

Uninsured motorist protection

Uninsured motorist protection offers you very comparable safety as underinsured motorist protection, however is supposed to guard you from drivers who haven’t any insurance coverage in any respect, as an alternative of only a low quantity. Whereas there are specific circumstances wherein a driver can legally drive with out insurance coverage (Virginia permits drivers to pay a $500 Uninsured Motorist Payment as a way to choose out of protection), automotive insurance coverage is legally required in virtually all U.S. states. For those who get into an accident with somebody who doesn’t have any insurance coverage protection in any respect, they may very nicely be driving illegally. Even when they aren’t, odds are they gained’t have the ability to afford to cowl your bills stemming from the accident. Uninsured motorist protection protects you from having to shell out your hard-earned cash on this scenario.

Two forms of uninsured/underinsured motorist protection

Now that we’ve defined the distinction between uninsured and underinsured motorist protection, we’ll undergo the 2 completely different protection choices supplied beneath every of these two insurance coverage sorts.

Uninsured/underinsured motorist bodily damage protection

Uninsured/underinsured motorist bodily damage protection, or UMBI, may help pay on your medical therapies, ache and struggling, misplaced wages, and funeral bills in case you are in an accident brought on by an uninsured or underinsured driver. One of these protection may apply in case you are hit by an uninsured/underinsured driver as a pedestrian or whereas using your bike.

Uninsured/underinsured motorist property harm protection

Uninsured/underinsured motorist property harm protection, or UMPD, takes care of prices for harm to your automotive or private property after an accident with an at-fault driver with too little insurance coverage, or no insurance coverage in any respect.

How do I resolve how a lot protection I want?

First, you’ll need to actually take into consideration the knowledge above concerning every thing that uninsured/underinsured motorist protection may help pay for. For those who choose out of this protection, or select decrease protection limits, would you have the ability to afford all of your bills after an accident with an uninsured or underinsured driver? Medical payments and automobile restore bills can actually pile up, so hold this in thoughts when selecting your protection quantities.

On your UMPD protection, it’s a good suggestion to decide on a restrict as shut as attainable to the worth of your automobile, particularly if you happen to don’t have collision protection. So, in case your automotive is value about $30,000, it’s best to choose in for a minimum of that very same quantity in UMPD protection. This fashion, even when your automotive is totaled, you gained’t find yourself having to pay out of pocket.

On your UMBI protection, issues are just a little extra sophisticated, because the protection quantity you select ought to rely in your legal responsibility protection limits. Legal responsibility protection typically has two limits, and is written as follows: restrict per individual / restrict per accident. So, in case your legal responsibility protection limits are written as $50,000/$100,000, then, within the occasion of an accident, your insurance coverage firm could pay out as much as $50,000 per individual concerned, as much as a complete of $100,000. So, in case you are in an accident the place you and a passenger are each injured, and every of you receives $50,000 on your medical bills, you’ve reached the full legal responsibility insurance coverage payout on your accident. Nevertheless, if you happen to select UMBI protection with similar limits, you’ll have much more monetary wiggle room in case of a extra extreme accident.

How does the payout from a declare work?

Relying in your state, your UMBI or UMPD protection could include a deductible. So, in case your UMPD protection has a restrict of $15,000 and you’ve got a $300 deductible, in an accident the place the at-fault driver induced $5,000 in harm, your insurer would cowl $4,700 value of your restore bills, leaving you to pay the $300 deductible.

Which states require uninsured and/or underinsured motorist protection?

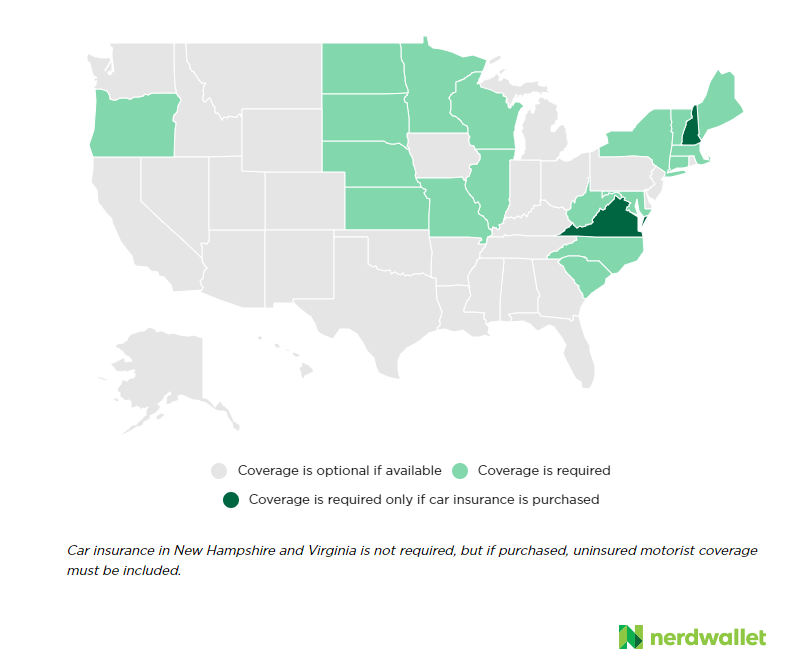

Drivers in 18 states (Oregon, North Dakota, South Dakota, Nebraska, Kansas, Minnesota, Missouri, Wisconsin, Illinois, West Virginia, Maryland, North Carolina, South Carolina, New York, Vermont, Massachusetts, Connecticut, and Maine) and D.C. are legally required to hold uninsured/underinsured motorist protection. In New Hampshire and Virginia, automotive insurance coverage isn’t legally mandated; nonetheless, if a driver does select to take out a coverage, it should embrace each UMBI and UMPD insurance coverage.

Is uninsured/underinsured motorist protection value it?

In case your state is among the many 32 that don’t legally require uninsured/underinsured motorist protection, you is likely to be tempted to attempt to squeak by with out it. Whereas the query of whether or not this protection is value it or not is as much as you, we are saying that every one indicators level to sure. It might be a cliché, however we imagine it’s at all times higher to be secure than sorry. For those who choose out of uninsured/underinsured motorist protection and also you get into an accident with any one of many 12.6% of US drivers on the street with out insurance coverage, your bills can rack up quickly. Store round to discover a coverage worth you’re comfy with, and know that the expense is cash nicely spent. Contact us to study extra, or get a quote right now.

Was this text useful?