In case you’re among the many tens of millions of Individuals who’re uninsured or who purchase their very own medical insurance within the particular person market, the American Rescue Plan (ARP) has simply considerably modified the foundations – and adjusted them in a means that probably enhance your entry to reasonably priced complete medical insurance.

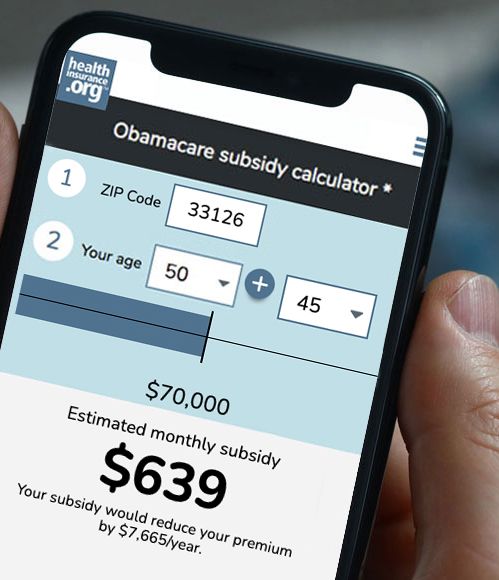

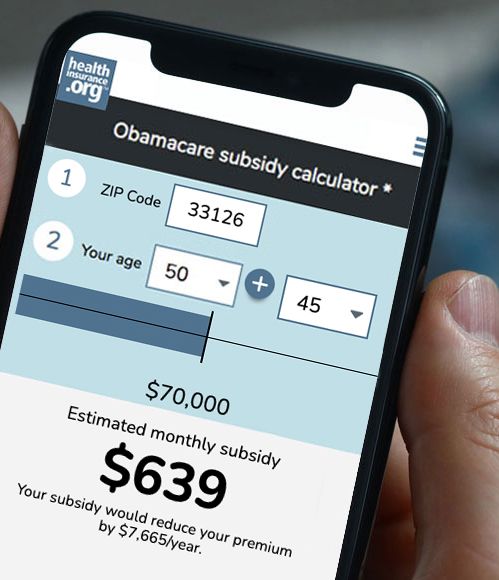

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical insurance premiums.

Because of the laws – signed final week by President Biden – premium subsidies are bigger and accessible to extra individuals in 2021 and 2022.

Many people who find themselves receiving unemployment compensation in 2021 can now qualify for premium-free medical insurance that gives sturdy advantages. And individuals who acquired extra premium subsidies in 2020 shouldn’t have to repay that cash to the IRS after they file their 2020 tax return.

These enhancements – though non permanent and a part of a large invoice designed to assist the nation get well from the COVID pandemic – will make it a lot simpler for individuals to afford high-quality medical insurance. However they’ve additionally generated an excessive amount of questions and confusion, particularly amongst individuals who wonder if they should rethink the plan alternative they already made for 2021.

And the timing of those modifications coincides neatly with a COVID-related enrollment interval accessible nationwide. In most states, it continues via August 15, and in most states it’s a possibility for individuals to newly enroll or swap from one plan to a different, with protection that takes impact the month after you enroll.

Do you have to use this window to enroll or make a plan change now that the ARP has been enacted? It relies upon, though you’ll positively need to not less than take one other have a look at your protection choices. Listed below are among the commonest situations – and questions that individuals ought to be asking about them – proper now:

1. You’re enrolled in an off-exchange ACA-compliant plan

Off-exchange plans are basically the identical as on-exchange plans, however individuals buy them straight from the insurance coverage firm as a substitute of going via the medical insurance market. If you understand for certain that you simply’re not eligible for a premium subsidy, it’s advantageous to be enrolled off-exchange. However in the event you may be subsidy-eligible, the one option to get that subsidy – both upfront or claimed later in your tax return – is to enroll via the alternate.

The Supreme Courtroom simply upheld the ACA. Ought to market insurance coverage patrons breathe a sigh of aid?

Because of the American Rescue Plan, candidates with family incomes above 400% of the federal poverty degree – who had been beforehand ineligible for a subsidy – might discover that they now qualify for a subsidy. And relying on the place they stay and the way previous they’re, the subsidy might be substantial.

In case you’re enrolled off-exchange, it’s positively in your finest curiosity to take a look at the on-exchange choices and see in the event you’d qualify for a subsidy below the brand new guidelines.

In case you’re in a state that makes use of HealthCare.gov, the brand new subsidies and premium quantities can be accessible for shopping as of April 1. (The 15 state-run marketplaces are engaged on this as effectively, and can show the brand new subsidy quantities as quickly as doable.) However CMS has clarified that individuals ought to nonetheless enroll by the tip of March with the intention to have protection April 1, after which come again to {the marketplace} after the start of April to activate the brand new subsidies. (Functions submitted earlier than April 1 will solely have the present, pre-ARP subsidies built-in, though enrollees would then nonetheless have the ability to accumulate the total subsidy quantity after they file their 2021 tax returns).

In case you’re enrolled off-exchange and planning to change to the on-exchange model of your present plan, your insurer is likely to be prepared to transition any collected out-of-pocket bills you might have incurred thus-far this yr. However this isn’t required; you’ll need to attain out to your insurer to see if that is one thing they’d permit.

Relying on the place you reside and the plan you’ve chosen, the identical plan (with the identical medical supplier community) might or will not be accessible on-exchange. And in the event you’re switching to a distinct coverage on-exchange, your out-of-pocket spending will reset to $0 on the brand new plan.

So switching to an on-exchange plan just isn’t essentially the best choice for everybody – it’s going to rely on plan availability, supplier networks, how a lot you’ve spent out-of-pocket already this yr, and the way a lot your premium subsidy can be in the event you enroll in a plan via the alternate.

2. You’re enrolled in a well being plan that’s not ACA-compliant

Proper now, you might have protection via a short-term medical insurance plan, a well being care sharing ministry plan, a set indemnity plan, a direct main care membership, a Farm Bureau plan, or a grandmothered or grandfathered well being plan. Likelihood is, you’ve chosen this selection as a result of the month-to-month premiums match into your price range, and ACA-compliant well being protection didn’t – not less than as of the final time you checked. But it surely’s time to examine once more.

Wholesome individuals with revenue above 400% of the poverty degree have lengthy been drawn to those various forms of protection, as have some individuals with incomes a little bit below 400% of the poverty degree who solely certified for pretty small premium subsidies. However for 2021 and 2022, on account of the ARP, the subsidies are a lot bigger and there’s not a subsidy cliff.

So earlier than the present COVID-related enrollment window ends (August 15 in most states, though this varies in states that run their very own exchanges), you’ll need to try your market choices. You is likely to be pleasantly shocked to see that you could get complete ACA-compliant medical insurance – not less than for this yr and subsequent yr – at a a lot decrease premium than you might need seen the final time you checked. (Once more, word that in the event you’re shopping plan choices earlier than April 1 in most states, you gained’t but have the ability to see the extra sturdy premium subsidies. However you’ll nonetheless have the ability to declare them in your 2021 tax return for any months in 2021 that you simply had been enrolled.)

3. You’re enrolled in a Bronze plan via the alternate

In case you’re presently enrolled in a Bronze plan via the alternate, you might have picked it as a result of the premiums had been decrease than Silver, Gold or Platinum protection choices. Your Bronze plan might have been fully free after your subsidy was utilized.

You’ll nonetheless have a low (or free) premium below the ARP, nevertheless it’s in your finest curiosity to actively examine it to the opposite accessible choices throughout the present COVID-related enrollment interval. It’s possible you’ll discover that you could now qualify for a really low-cost – or possibly free – Silver plan, which might have extra sturdy advantages than your Bronze plan. That is very true in the event you’re eligible for cost-sharing reductions (CSR), as these are basically a free improve in your well being protection advantages. (CSR advantages can be found in 2021 to a single particular person incomes as much as $31,900, and to a household of 4 incomes as much as $65,500. These quantities are larger in Alaska and Hawaii.)

Earlier than you make a plan swap, nevertheless, you’ll need to take note of the utmost out-of-pocket limits for the plans at a better metallic degree. In case you’re not eligible for CSR (ie, your revenue is above 250% of the poverty degree), you may discover that the accessible Silver plans have out-of-pocket limits which can be much like what you have got along with your Bronze plan. Relying on the way you anticipate utilizing your plan throughout the yr, it might or might not make sense to pay a better premium to improve your protection.

In case you anticipate excessive claims prices that can lead to hitting the out-of-pocket most no matter what plan you have got, you won’t come out forward with an upgraded plan, when you account to your complete out-of-pocket prices and premiums. However in the event you hardly ever have medical wants, the upgraded plan may prevent cash by way of a decrease deductible and decrease copays for issues like workplace visits and prescribed drugs.

As at all times, take the entire components into consideration: Whole premiums, out-of-pocket most, and the way the plan may cowl your medical prices in the event you don’t count on to fulfill that out-of-pocket most throughout the yr.

In case you picked a Bronze plan since you wished to contribute to a well being financial savings account (HSA) and wanted to enroll in an HSA-qualified high-deductible well being plan (HDHP), it’s value checking to see if there are any HDHPs accessible in your space at a better metallic degree. Whereas it’s widespread to see Bronze HDHPs, there are additionally Silver and even Gold HDHPs in lots of areas. With the brand new subsidies created by the ARP, you may discover that you could nonetheless preserve your HSA eligibility whereas additionally having a well being plan with decrease out-of-pocket prices that doesn’t price you an excessive amount of extra in month-to-month premiums.

4. You’ve misplaced, or will quickly lose, your job — and your well being protection

In case you just lately misplaced or will quickly lose your job – and your medical insurance – you’ve obtained some selections to make. You might need entry to COBRA or state continuation protection (mini-COBRA), and also you’ll even have entry to a particular enrollment interval throughout which you’ll be able to join a person/household well being plan.

Below ARP Part 9501, the federal government will cowl the total premium prices for COBRA or mini-COBRA from April 1 via September 30, 2021. (Observe that this isn’t accessible in the event you voluntarily left your job.)

In case you had been laid off (or skilled an involuntary discount in hours that resulted in a lack of well being protection) any time within the final 18 months and had been COBRA-eligible however both declined it or later terminated it, you may choose again into COBRA with the intention to reap the benefits of the brand new subsidy. Nonetheless, the subsidy doesn’t prolong your preliminary COBRA termination date, which continues to be, normally, 18 months after your COBRA would have begun in the event you had opted in from the beginning. So in the event you had been first eligible for COBRA on October 1, 2019, your COBRA and your COBRA subsidy will finish on April 30, 2021 (ie, 18 months later). This additionally applies to state continuation plans, which are sometimes shorter in size than COBRA

In case you’re receiving unemployment compensation at any level this yr, you’ll even be eligible for a $0 premium Silver plan within the market, with probably the most sturdy degree of cost-sharing reductions. (CMS has clarified that it’d take some time to get the small print of this programmed into HealthCare.gov, however enrollees will have the ability to log again into their accounts later within the yr to activate the bigger subsidies, and there’s at all times the choice to only declare them in your tax return after the tip of the yr.)

So do you have to take the absolutely sponsored COBRA protection or the absolutely sponsored market plan? It relies upon, however there are a number of components to think about:

- In case you elect COBRA, what’s your plan for the ultimate quarter of the yr? Would you have the ability to pay full worth as soon as the federal government subsidy ends?

- We don’t but have federal steerage on whether or not the tip of the government-funded COBRA subsidies will set off a particular enrollment interval for market plans, though we assume that it’ll. (The tip of employer subsidies for COBRA does set off a particular enrollment interval.) However assuming it does, would you need to swap to a market plan at that time?

- In case you’ve incurred out-of-pocket prices below your employer’s plan up to now in 2021, COBRA is likely to be the higher alternative, as you gained’t have to begin over on the out-of-pocket prices for a brand new plan. However you’ll nonetheless need to think about what you’ll do after September, and whether or not it is going to be less expensive to pay full worth for COBRA for the ultimate months of the yr, or begin over with a brand new plan at that time.

- In case you choose to change to a market plan, pay shut consideration to the supplier networks and coated drug lists. Even when {the marketplace} plan is issued by the identical insurance coverage firm that gives or administers your employer’s plan, the advantages and supplier community is likely to be fairly completely different on the person/household plan.

In case you’re already enrolled in a market plan and also you’re receiving or have acquired unemployment compensation this yr, you’ll need to take an in depth have a look at your protection choices. In case you’re presently enrolled in a Bronze plan, remember to try the $0 premium Silver plan with sturdy cost-sharing reductions that could be accessible to you below the ARP, on account of your unemployment compensation in 2021.

5. You’re already enrolled within the market and completely happy along with your plan

About 15% of present market enrollees pay full worth for his or her protection, normally as a result of they earn greater than 400% of the poverty degree and thus aren’t subsidy-eligible. However in the event you’re on this group, chances are you’ll be eligible for a subsidy below the ARP.

Tens of millions of different market enrollees are receiving premium subsidies, and though their accessible subsidy quantities are prone to be bigger below the ARP, they might not need to make any modifications to their protection.

In case you’re already enrolled in a market plan and sure that your present plan is the best choice to your circumstances, you don’t have to do something in any respect. In case you qualify for an extra premium subsidy quantity, it is going to be retroactive to January 2021 and also you’ll have the ability to declare it if you file your 2021 taxes.

However chances are you’ll need to log again into your market account and declare your new or further subsidy quantity, in order that it may be paid to your insurer in your behalf every month for the remainder of 2021.

In case you’re in a state that makes use of HealthCare.gov, CMS has confirmed that the premium subsidy quantities is not going to mechanically replace (the 15 state-run marketplaces can have their very own protocols for the way that is dealt with). So that you’ll have to return to {the marketplace} to supply proof of your revenue (in the event you’re presently enrolled in a full-price plan and by no means gave your revenue particulars to {the marketplace}) or reselect your present plan and set off the brand new subsidies.

Louise Norris is an particular person medical insurance dealer who has been writing about medical insurance and well being reform since 2006. She has written dozens of opinions and academic items concerning the Inexpensive Care Act for healthinsurance.org. Her state well being alternate updates are commonly cited by media who cowl well being reform and by different medical insurance specialists.

In case you’re among the many tens of millions of Individuals who’re uninsured or who purchase their very own medical insurance within the particular person market, the American Rescue Plan (ARP) has simply considerably modified the foundations – and adjusted them in a means that probably enhance your entry to reasonably priced complete medical insurance.

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical insurance premiums.

Because of the laws – signed final week by President Biden – premium subsidies are bigger and accessible to extra individuals in 2021 and 2022.

Many people who find themselves receiving unemployment compensation in 2021 can now qualify for premium-free medical insurance that gives sturdy advantages. And individuals who acquired extra premium subsidies in 2020 shouldn’t have to repay that cash to the IRS after they file their 2020 tax return.

These enhancements – though non permanent and a part of a large invoice designed to assist the nation get well from the COVID pandemic – will make it a lot simpler for individuals to afford high-quality medical insurance. However they’ve additionally generated an excessive amount of questions and confusion, particularly amongst individuals who wonder if they should rethink the plan alternative they already made for 2021.

And the timing of those modifications coincides neatly with a COVID-related enrollment interval accessible nationwide. In most states, it continues via August 15, and in most states it’s a possibility for individuals to newly enroll or swap from one plan to a different, with protection that takes impact the month after you enroll.

Do you have to use this window to enroll or make a plan change now that the ARP has been enacted? It relies upon, though you’ll positively need to not less than take one other have a look at your protection choices. Listed below are among the commonest situations – and questions that individuals ought to be asking about them – proper now:

1. You’re enrolled in an off-exchange ACA-compliant plan

Off-exchange plans are basically the identical as on-exchange plans, however individuals buy them straight from the insurance coverage firm as a substitute of going via the medical insurance market. If you understand for certain that you simply’re not eligible for a premium subsidy, it’s advantageous to be enrolled off-exchange. However in the event you may be subsidy-eligible, the one option to get that subsidy – both upfront or claimed later in your tax return – is to enroll via the alternate.

The Supreme Courtroom simply upheld the ACA. Ought to market insurance coverage patrons breathe a sigh of aid?

Because of the American Rescue Plan, candidates with family incomes above 400% of the federal poverty degree – who had been beforehand ineligible for a subsidy – might discover that they now qualify for a subsidy. And relying on the place they stay and the way previous they’re, the subsidy might be substantial.

In case you’re enrolled off-exchange, it’s positively in your finest curiosity to take a look at the on-exchange choices and see in the event you’d qualify for a subsidy below the brand new guidelines.

In case you’re in a state that makes use of HealthCare.gov, the brand new subsidies and premium quantities can be accessible for shopping as of April 1. (The 15 state-run marketplaces are engaged on this as effectively, and can show the brand new subsidy quantities as quickly as doable.) However CMS has clarified that individuals ought to nonetheless enroll by the tip of March with the intention to have protection April 1, after which come again to {the marketplace} after the start of April to activate the brand new subsidies. (Functions submitted earlier than April 1 will solely have the present, pre-ARP subsidies built-in, though enrollees would then nonetheless have the ability to accumulate the total subsidy quantity after they file their 2021 tax returns).

In case you’re enrolled off-exchange and planning to change to the on-exchange model of your present plan, your insurer is likely to be prepared to transition any collected out-of-pocket bills you might have incurred thus-far this yr. However this isn’t required; you’ll need to attain out to your insurer to see if that is one thing they’d permit.

Relying on the place you reside and the plan you’ve chosen, the identical plan (with the identical medical supplier community) might or will not be accessible on-exchange. And in the event you’re switching to a distinct coverage on-exchange, your out-of-pocket spending will reset to $0 on the brand new plan.

So switching to an on-exchange plan just isn’t essentially the best choice for everybody – it’s going to rely on plan availability, supplier networks, how a lot you’ve spent out-of-pocket already this yr, and the way a lot your premium subsidy can be in the event you enroll in a plan via the alternate.

2. You’re enrolled in a well being plan that’s not ACA-compliant

Proper now, you might have protection via a short-term medical insurance plan, a well being care sharing ministry plan, a set indemnity plan, a direct main care membership, a Farm Bureau plan, or a grandmothered or grandfathered well being plan. Likelihood is, you’ve chosen this selection as a result of the month-to-month premiums match into your price range, and ACA-compliant well being protection didn’t – not less than as of the final time you checked. But it surely’s time to examine once more.

Wholesome individuals with revenue above 400% of the poverty degree have lengthy been drawn to those various forms of protection, as have some individuals with incomes a little bit below 400% of the poverty degree who solely certified for pretty small premium subsidies. However for 2021 and 2022, on account of the ARP, the subsidies are a lot bigger and there’s not a subsidy cliff.

So earlier than the present COVID-related enrollment window ends (August 15 in most states, though this varies in states that run their very own exchanges), you’ll need to try your market choices. You is likely to be pleasantly shocked to see that you could get complete ACA-compliant medical insurance – not less than for this yr and subsequent yr – at a a lot decrease premium than you might need seen the final time you checked. (Once more, word that in the event you’re shopping plan choices earlier than April 1 in most states, you gained’t but have the ability to see the extra sturdy premium subsidies. However you’ll nonetheless have the ability to declare them in your 2021 tax return for any months in 2021 that you simply had been enrolled.)

3. You’re enrolled in a Bronze plan via the alternate

In case you’re presently enrolled in a Bronze plan via the alternate, you might have picked it as a result of the premiums had been decrease than Silver, Gold or Platinum protection choices. Your Bronze plan might have been fully free after your subsidy was utilized.

You’ll nonetheless have a low (or free) premium below the ARP, nevertheless it’s in your finest curiosity to actively examine it to the opposite accessible choices throughout the present COVID-related enrollment interval. It’s possible you’ll discover that you could now qualify for a really low-cost – or possibly free – Silver plan, which might have extra sturdy advantages than your Bronze plan. That is very true in the event you’re eligible for cost-sharing reductions (CSR), as these are basically a free improve in your well being protection advantages. (CSR advantages can be found in 2021 to a single particular person incomes as much as $31,900, and to a household of 4 incomes as much as $65,500. These quantities are larger in Alaska and Hawaii.)

Earlier than you make a plan swap, nevertheless, you’ll need to take note of the utmost out-of-pocket limits for the plans at a better metallic degree. In case you’re not eligible for CSR (ie, your revenue is above 250% of the poverty degree), you may discover that the accessible Silver plans have out-of-pocket limits which can be much like what you have got along with your Bronze plan. Relying on the way you anticipate utilizing your plan throughout the yr, it might or might not make sense to pay a better premium to improve your protection.

In case you anticipate excessive claims prices that can lead to hitting the out-of-pocket most no matter what plan you have got, you won’t come out forward with an upgraded plan, when you account to your complete out-of-pocket prices and premiums. However in the event you hardly ever have medical wants, the upgraded plan may prevent cash by way of a decrease deductible and decrease copays for issues like workplace visits and prescribed drugs.

As at all times, take the entire components into consideration: Whole premiums, out-of-pocket most, and the way the plan may cowl your medical prices in the event you don’t count on to fulfill that out-of-pocket most throughout the yr.

In case you picked a Bronze plan since you wished to contribute to a well being financial savings account (HSA) and wanted to enroll in an HSA-qualified high-deductible well being plan (HDHP), it’s value checking to see if there are any HDHPs accessible in your space at a better metallic degree. Whereas it’s widespread to see Bronze HDHPs, there are additionally Silver and even Gold HDHPs in lots of areas. With the brand new subsidies created by the ARP, you may discover that you could nonetheless preserve your HSA eligibility whereas additionally having a well being plan with decrease out-of-pocket prices that doesn’t price you an excessive amount of extra in month-to-month premiums.

4. You’ve misplaced, or will quickly lose, your job — and your well being protection

In case you just lately misplaced or will quickly lose your job – and your medical insurance – you’ve obtained some selections to make. You might need entry to COBRA or state continuation protection (mini-COBRA), and also you’ll even have entry to a particular enrollment interval throughout which you’ll be able to join a person/household well being plan.

Below ARP Part 9501, the federal government will cowl the total premium prices for COBRA or mini-COBRA from April 1 via September 30, 2021. (Observe that this isn’t accessible in the event you voluntarily left your job.)

In case you had been laid off (or skilled an involuntary discount in hours that resulted in a lack of well being protection) any time within the final 18 months and had been COBRA-eligible however both declined it or later terminated it, you may choose again into COBRA with the intention to reap the benefits of the brand new subsidy. Nonetheless, the subsidy doesn’t prolong your preliminary COBRA termination date, which continues to be, normally, 18 months after your COBRA would have begun in the event you had opted in from the beginning. So in the event you had been first eligible for COBRA on October 1, 2019, your COBRA and your COBRA subsidy will finish on April 30, 2021 (ie, 18 months later). This additionally applies to state continuation plans, which are sometimes shorter in size than COBRA

In case you’re receiving unemployment compensation at any level this yr, you’ll even be eligible for a $0 premium Silver plan within the market, with probably the most sturdy degree of cost-sharing reductions. (CMS has clarified that it’d take some time to get the small print of this programmed into HealthCare.gov, however enrollees will have the ability to log again into their accounts later within the yr to activate the bigger subsidies, and there’s at all times the choice to only declare them in your tax return after the tip of the yr.)

So do you have to take the absolutely sponsored COBRA protection or the absolutely sponsored market plan? It relies upon, however there are a number of components to think about:

- In case you elect COBRA, what’s your plan for the ultimate quarter of the yr? Would you have the ability to pay full worth as soon as the federal government subsidy ends?

- We don’t but have federal steerage on whether or not the tip of the government-funded COBRA subsidies will set off a particular enrollment interval for market plans, though we assume that it’ll. (The tip of employer subsidies for COBRA does set off a particular enrollment interval.) However assuming it does, would you need to swap to a market plan at that time?

- In case you’ve incurred out-of-pocket prices below your employer’s plan up to now in 2021, COBRA is likely to be the higher alternative, as you gained’t have to begin over on the out-of-pocket prices for a brand new plan. However you’ll nonetheless need to think about what you’ll do after September, and whether or not it is going to be less expensive to pay full worth for COBRA for the ultimate months of the yr, or begin over with a brand new plan at that time.

- In case you choose to change to a market plan, pay shut consideration to the supplier networks and coated drug lists. Even when {the marketplace} plan is issued by the identical insurance coverage firm that gives or administers your employer’s plan, the advantages and supplier community is likely to be fairly completely different on the person/household plan.

In case you’re already enrolled in a market plan and also you’re receiving or have acquired unemployment compensation this yr, you’ll need to take an in depth have a look at your protection choices. In case you’re presently enrolled in a Bronze plan, remember to try the $0 premium Silver plan with sturdy cost-sharing reductions that could be accessible to you below the ARP, on account of your unemployment compensation in 2021.

5. You’re already enrolled within the market and completely happy along with your plan

About 15% of present market enrollees pay full worth for his or her protection, normally as a result of they earn greater than 400% of the poverty degree and thus aren’t subsidy-eligible. However in the event you’re on this group, chances are you’ll be eligible for a subsidy below the ARP.

Tens of millions of different market enrollees are receiving premium subsidies, and though their accessible subsidy quantities are prone to be bigger below the ARP, they might not need to make any modifications to their protection.

In case you’re already enrolled in a market plan and sure that your present plan is the best choice to your circumstances, you don’t have to do something in any respect. In case you qualify for an extra premium subsidy quantity, it is going to be retroactive to January 2021 and also you’ll have the ability to declare it if you file your 2021 taxes.

However chances are you’ll need to log again into your market account and declare your new or further subsidy quantity, in order that it may be paid to your insurer in your behalf every month for the remainder of 2021.

In case you’re in a state that makes use of HealthCare.gov, CMS has confirmed that the premium subsidy quantities is not going to mechanically replace (the 15 state-run marketplaces can have their very own protocols for the way that is dealt with). So that you’ll have to return to {the marketplace} to supply proof of your revenue (in the event you’re presently enrolled in a full-price plan and by no means gave your revenue particulars to {the marketplace}) or reselect your present plan and set off the brand new subsidies.

Louise Norris is an particular person medical insurance dealer who has been writing about medical insurance and well being reform since 2006. She has written dozens of opinions and academic items concerning the Inexpensive Care Act for healthinsurance.org. Her state well being alternate updates are commonly cited by media who cowl well being reform and by different medical insurance specialists.