This publish was written in collaboration with NTUC Earnings. Whereas we’re financially compensated by them, we nonetheless try to keep up our editorial integrity and overview merchandise with the identical goal lens. We’re dedicated to offering the perfect suggestions and recommendation so as so that you can make private monetary selections with confidence. You’ll be able to view our Editorial Tips right here.

CareShield Life, our authorities’s new nationwide long-term care insurance coverage scheme, was launched on 1 October 2020.

This isn’t to be confused with ElderShield, by the way in which.

Some variations between CareShield Life and ElderShield:

| CareShield Life | ElderShield | |

| Age eligible | From 30 years previous | From 40 years previous |

| Payout quantity | From $612/month in 2021 (will increase yearly till age 67 or when a declare is made) | As much as $400/month |

| Payout length | Lifetime | As much as 72 months per lifetime |

| Standards | Unable to carry out 3 out of 6 Actions of Each day Residing (ADLs) | |

*Be aware: These on ElderShield could have the choice to change to CareShield Life from 2021, however might want to pay larger premiums

Most significantly, CareShield Life supplies common long-term care protection for all Singapore Residents (Singaporean Residents and Everlasting Residents) born in 1980 or later, together with these with pre-existing medical circumstances and incapacity.

In response to the Ministry of Well being: “1 in 2 wholesome Singaporeans aged 65 may change into severely disabled of their lifetime, and might have long-term care. Extreme incapacity could come up attributable to a sudden disabling occasion (e.g. stroke and spinal twine accidents), the worsening of power circumstances and illnesses (e.g. diabetes), or the development of diseases as we age (e.g. dementia).” (Supply)

The price of long-term care is not any joke additionally. In response to the Company for Built-in Care, the fundamental value of staying in a nursing residence varies between $2,000 and $3,600 a month (earlier than MOH subsidy), relying on the extent of care required. (Supply)

Even for those who’re single and rich, being severely disabled (unable to carry out 3 out of 6 ADLs) would possible imply that you just’re unable to earn a wage and might want to enroll in a nursing residence or make use of a live-in caregiver. We’re not even counting the medical provides, gear (mattress, wheelchair, walker, and many others) and every day bills. The payout of $612/month (as of 2021) offered by CareShield Life alone might not be sufficient to totally cowl all these bills.

Associated article: How Does CareShield Life Assist Singaporeans?

And what occurs if attributable to an accident or an sickness (sudden or power — the latter possible led to attributable to way of life danger elements reminiscent of stress, weight problems, an unhealthy food regimen, sedentary way of life, smoking, and many others — which can not at all times occur attributable to previous age), an individual is briefly disabled and unable to work however to not the extent of being unable to carry out 3 ADLs? Jialat liao…

How CareShield Life dietary supplements assist

However that’s the place CareShield Life dietary supplements come into play — at present, there are solely 3 personal insurers in Singapore providing this, considered one of which is NTUC Earnings. These CareShield Life dietary supplements assist to shut the hole by offering protection from 2 ADLs and above, providing month-to-month payouts (sure, additionally for all times) and different funds that may assist your caregivers and even your dependants.

Let’s take a better take a look at what further advantages CareShield Life dietary supplements could provide.

Protection for two ADLs or extra

Recap: The federal government’s primary CareShield Life will solely kick in when an individual is assessed by a MOH-accredited extreme incapacity assessor to be unable to independently carry out a minimum of 3 out of 6 ADLs.

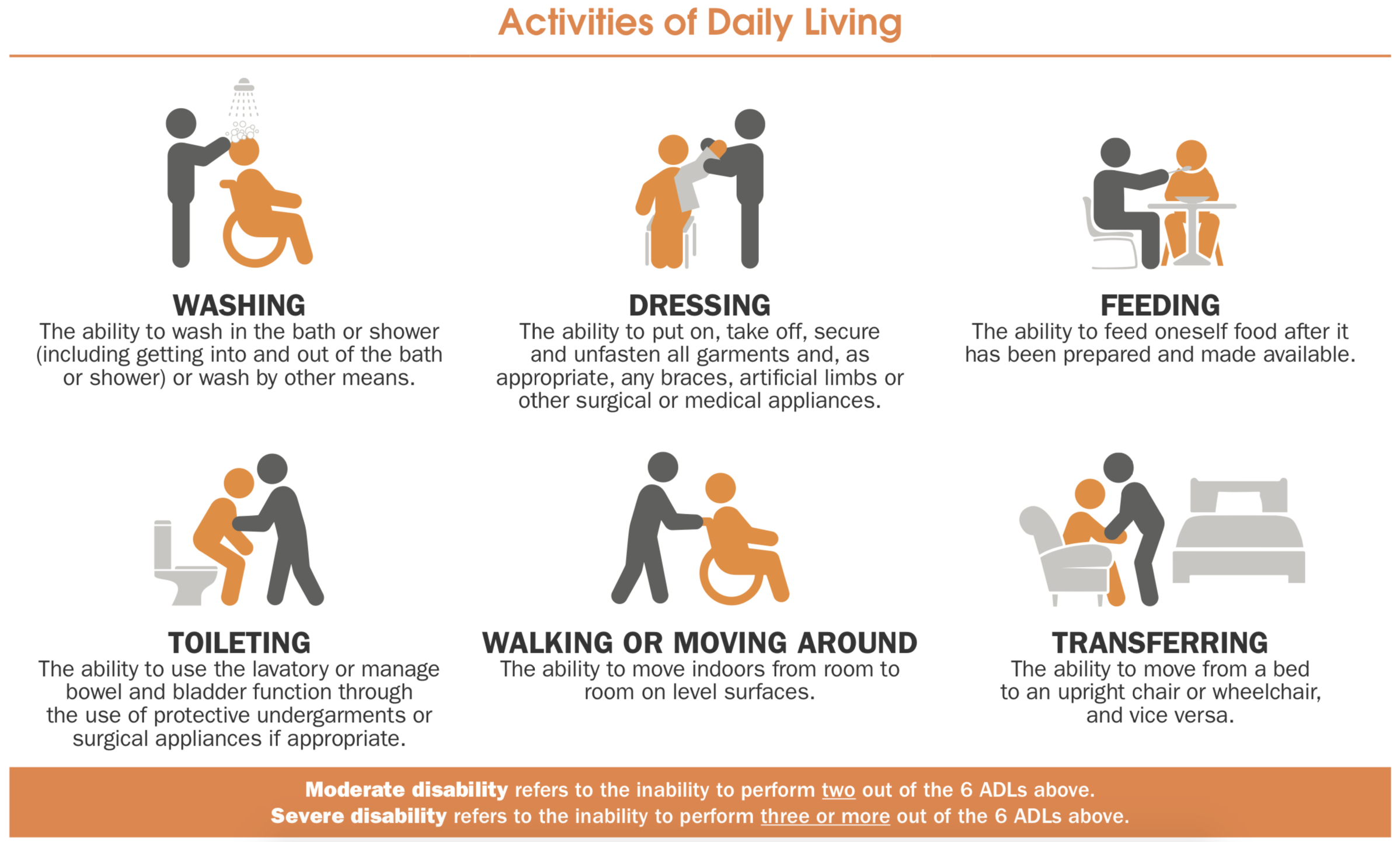

Listed here are the 6 ADLs for straightforward reference:

(Picture supply: Earnings)

Earnings’s Care Safe (a CareShield Life complement) closes the hole because it supplies protection for two ADLs or extra. This implies a person can be coated from an earlier stage of incapacity (and we all know each little bit of additional monetary assist helps, proper?).

And who says this incapacity have to be everlasting? It might be non permanent, and the extra assist/much less stress one has, the faster the restoration may be, proper?

Relying on the extent of your CareShield Life complement plan, the month-to-month incapacity payout might be as excessive as $5,000 (for Earnings’s Care Safe).

Help profit

Search for a CareShield Life complement that has a assist profit, generally termed a lump sum profit.

This might vastly support the insured individual, who would possibly want monetary assist dealing with their new state of affairs, getting medical provides/gear, rehabilitation, and many others.

Earnings’s Care Safe supplies assist profit that pays as much as 600% of the incapacity profit in a lump sum.

- Unable to carry out 2 ADLs: 300% of incapacity profit

- Unable to carry out 3 ADLs: 600% of incapacity profit

If somebody is roofed by Care Safe, they may obtain as much as $30,000 because the assist profit payout in the event that they went for the utmost quantity of protection and had been unable to carry out 3 or extra ADLs (as much as $5,000 incapacity profit/month). Even when they opted for the minimal of $1,200/month incapacity profit, that’s nonetheless a excessive quantity of $7,200.

Dependant profit

And what if the insured has younger youngsters, a partner or aged dad and mom who’re relying on him/her? It’s much more troublesome if the insured is the only breadwinner.

Earnings’s Care Safe pays 25% of the incapacity profit because the dependant profit each month for as much as 36 months within the insured’s lifetime.

This extra cash of as much as $1,250/month (if the insured received the utmost of $5,000 incapacity profit/month) may vastly assist with a child’s college charges, family upkeep charges, groceries and so forth.

That’s useful, as a result of incapacity and caregiving not solely impacts the affected person, however these round him/her as properly.

Premium charges

In an ideal world, it could be good to pay nothing and be assured the $5,000/month payout for all times ought to one thing occur to us. However there’s no free lunch, so we have to weigh our choices, do our sums, work out our price range and select the perfect plan for our wants.

The excellent news — you should use as much as $600/12 months from our MediSave to pay for the CareShield Life complement.

For a 35-year-old, non-smoker, paying as much as 67 Age Final Birthday:

|

Earnings’s Care Safe

|

*The premium fee relies on the insured’s entry age ultimately birthday and is non-guaranteed.

Because the annual pattern premium is lower than $600/12 months, the total quantity can be coated by MediSave (you’ll in fact must have enough funds in your MediSave).

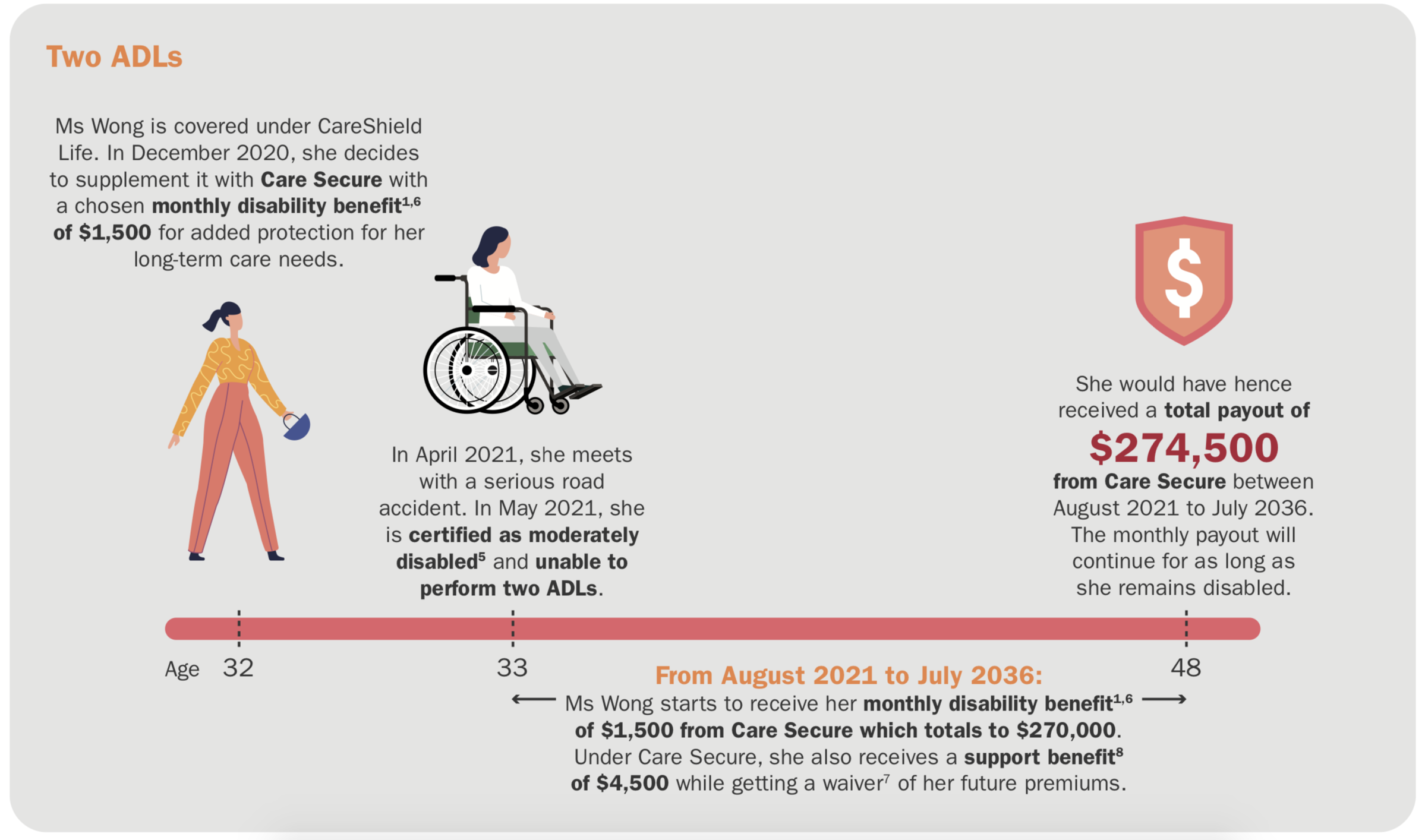

Right here’s how Earnings’s Care Safe can present early assist in your long-term care wants in case you are not in a position to carry out 2 ADLs (p.s. CareShield Life covers you ranging from 3 ADLs).

(Supply)

*The figures used are for illustrative functions solely and assumes that the payout will not be restricted or excluded by coverage phrases and circumstances; please additionally confer with footnotes 1, 5, 6, 7, 8 in Care Safe’s brochure right here.

Different advantages to look out for

Do test all the opposite advantages/protection of your CareShield Life complement, reminiscent of:

Premium waiver

What are the phrases and circumstances, when does it kick in, and many others? For instance, the premium waiver for Earnings’s Care Safe kicks in when the insured is unable to carry out 2 ADLs and above.

Loss of life profit

There may be additionally a loss of life profit accessible. Within the occasion of the insured’s loss of life, 300% of the incapacity profit is paid out on the situation that the insured was already receiving the incapacity profit.

Get the monetary assist for early therapy to keep away from/decelerate incapacity deterioration and risk of creating a full restoration. Keep in mind, the federal government means that you can use as much as $600/12 months of your MediSave for CareShield Life dietary supplements, so why not use it?