For hundreds of thousands of Individuals who don’t have entry to employer-sponsored or government-run medical insurance, the American Rescue Plan (ARP) does so much to make well being protection extra inexpensive this 12 months. Premium subsidies are bigger, and extra individuals will qualify for premium-free plans, together with anybody receiving unemployment compensation at any level in 2021.

The Supreme Court docket upholds the Inexpensive Care Act. What it means for policyholders.

If you happen to’re at present uninsured or enrolled in one thing like a short-term plan or well being care sharing ministry plan and also you’ve turn out to be eligible for premium subsidies because of the ARP, it’s possible an apparent option to enroll in a plan by means of {the marketplace} in your state as quickly as attainable. And there’s a COVID/ARP enrollment window that continues by means of August 15 in most states, making it simple to enroll in a brand new plan and benefit from the brand new subsidies.

However if you happen to’re already enrolled in an ACA-compliant plan, or perhaps a grandmothered or grandfathered main medical plan, you’ll need to determine whether or not you need to make a plan change through the COVID/ARP enrollment window. And relying on the circumstances, it won’t be a simple resolution.

Are out-of-pocket prices you’ve paid making you assume twice?

Not like plan adjustments made throughout open enrollment, plan adjustments made through the COVID/ARP enrollment window will take impact mid-year. And for individuals who have already paid some or all of their deductible and out-of-pocket prices this 12 months, that provides an additional layer of complication to the switch-or-not resolution.

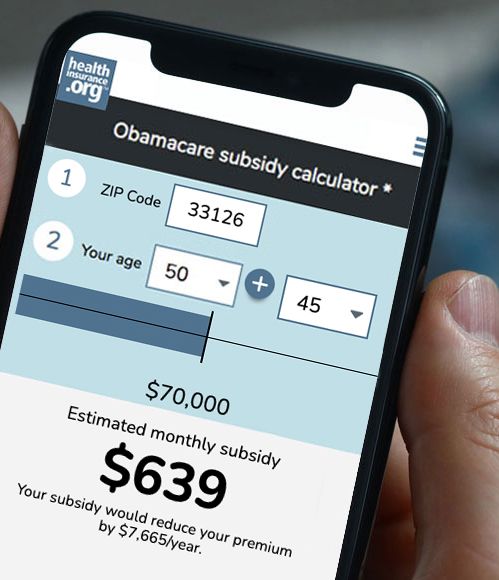

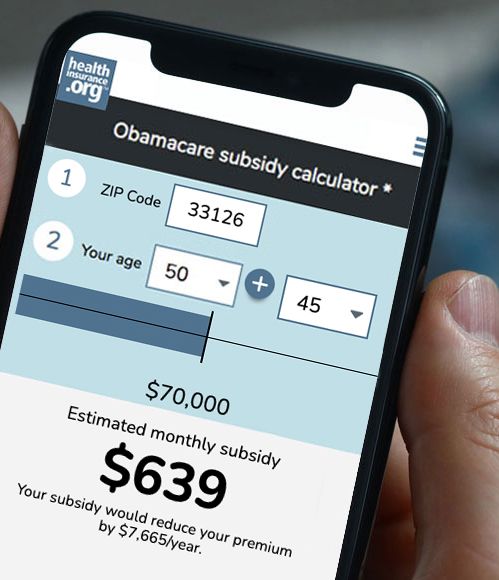

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical insurance premiums.

Usually, the final rule of thumb is that if you happen to change to a brand new plan mid-year, you’re going to be beginning over at $0 on the brand new plan’s deductible and out-of-pocket bills. (These are known as accumulators, because it’s a operating whole of the bills you’ve amassed towards your out-of-pocket most). For somebody whose accumulators have already amounted to a large sum of cash this 12 months, having to start out over at $0 in the course of the 12 months may very well be a deal-breaker.

Are ARP’s increased subsidies value it?

However 2021 just isn’t a standard 12 months. The ARP has made important adjustments to subsidy quantities and eligibility, and lots of people will discover that switching plans allows them to greatest benefit from the improved subsidies. For instance:

- An individual who beforehand enrolled off-exchange with the intention to benefit from the “Silver change” strategy to cost-sharing discount funding, and who’s now eligible for a premium subsidy within the change.

- An individual who enrolled in a Bronze plan throughout open enrollment however is now eligible for a $0 premium or low-premium Silver or Gold plan (relying on location) resulting from earnings or unemployment compensation.

- An individual who was eligible for cost-sharing reductions however chosen a Bronze or Gold plan throughout open enrollment as a result of the Silver plans have been too costly, however who can now afford the Silver plan because of the additional subsidies (cost-sharing reductions are solely accessible on Silver plans)

If you happen to change plans, will it’s important to begin over at zero?

The excellent news is that many states, state-run marketplaces, and insurers have taken motion to make sure that accumulators will switch to a brand new plan. (In just about all circumstances, this does need to be a brand new plan with the identical insurer — if you happen to change to a unique insurance coverage firm, you’ll nearly actually have to start out over at $0 in your accumulators.)

HealthCare.gov is the change/market that’s utilized in 36 states. Its official place is that “any client who selects a brand new plan could have their accumulators, equivalent to deductibles, reset to zero.” However insurance coverage commissioners in a few of these states have stepped in to require insurers to switch accumulators, and in different states, all the insurers have voluntarily agreed to take action. Washington, DC, and 14 states have state-run marketplaces, and several other of them have introduced that insurers will switch accumulators.

Which states are serving to with accumulators?

We’ve combed by means of communications from state-run marketplaces and state insurance coverage commissioners to see which of them have issued steering on this. However no matter the place you reside, your greatest wager is to succeed in out to your insurance coverage firm earlier than you make a plan change. Discover out precisely how they’re dealing with accumulators throughout this enrollment window, and if they’re transferring accumulators to new plans, just be sure you adhere to no matter necessities they could have in place.

That mentioned, right here’s what we discovered when it comes to how states and state-run marketplaces are addressing accumulators and mid-year plan adjustments in 2021.

States the place all accumulators will switch so long as your previous and new plans are provided by the identical insurance coverage firm

In some circumstances, these accumulator switch guidelines solely apply when switching from off-exchange to on-exchange; in different circumstances, they apply to any plan adjustments, together with from one change plan to a different:

- Colorado

- District of Columbia – {The marketplace} has confirmed that each one accumulators will switch.

- Idaho – Idaho solely allowed individuals to change to a plan provided by their present insurer, until that they had a qualifying occasion. Be aware that Idaho’s COVID/ARP enrollment window ended April 30, which is way sooner than the remainder of the nation.

- Maine

- Maryland – Plan adjustments are restricted to upgrades, however the market confirmed that accumulators will switch.

- Massachusetts — All insurers have agreed to switch accumulators for individuals switching from off-exchange to on-exchange plans

- Michigan – Deductibles will switch, though some insurers will solely enable this if you happen to’re upgrading your plan. (Two insurers are permitting deductible transfers even if you happen to’re switching from a unique insurer’s plan.)

- Minnesota – Minnesota is at present not permitting market enrollees to change plans through the COVID/ARP enrollment window, though this will likely change throughout the subsequent a number of weeks. So for now, the accumulator transfers solely apply to individuals switching from an off-exchange plan to an on-exchange plan. All 4 of the insurers that provide each on-exchange and off-exchange plans have agreed to switch accumulators to the on-exchange plans.

- New Hampshire

- New Mexico

- New York

- Tennessee

- Vermont – Like Minnesota, Vermont is at present solely permitting individuals to change from off-exchange (full-cost particular person direct enrollment) to on-exchange plans. Accumulators will switch for these plan adjustments.

- West Virginia — The WV Workplace of the Insurance coverage Commissioner confirmed that each insurers are transferring accumulators, aside from a switch between an HSA-qualified plan and a non-HSA-qualified plan (primarily resulting from IRS rules for the way HSA-qualified plans should deal with out-of-pocket prices).

- Wisconsin – Protecting Wisconsin, a nonprofit enrollment help group, notes that accumulators is not going to switch if individuals choose a plan from a unique insurer, which is to be anticipated.

In some states, guidelines are barely extra sophisticated

- Alaska – Deductibles will reset to $0 if a policyholder is switching from off-exchange to on-exchange (or vice-versa), however is not going to reset if the transfer is from one change plan to a different, with the identical insurer.

- California – {The marketplace} has confirmed that insurers will switch accumulators for plan holders switching from an off-exchange plan to an on-exchange plan or from one change plan to a different, so long as they stick with the identical insurance coverage firm and the identical kind of managed care plan (ie, HMO to HMO, or PPO to PPO).

- New Jersey – Deductibles will switch, probably even to a brand new insurer (which is pretty distinctive; we aren’t conscious of this elsewhere, apart from the 2 Michigan insurers which might be providing it). However extra out-of-pocket spending is not going to switch to the brand new plan.

States the place the official phrase is that ‘it relies upon’

A number of states have addressed accumulator transfers so that buyers know to pay attention to them, however are leaving the choice as much as the insurers. In these states (listed beneath), some or all the insurers could also be providing accumulator transfers, however shoppers ought to positively ask their insurer how it will work earlier than making the choice to change plans.

- Connecticut

- Nevada

- Ohio

- Montana

- North Dakota — the ND Insurance coverage Division is recommending that buyers attain out to their insurance coverage firm to see how that is being dealt with.

- Oregon — As of April, the state was nonetheless working with insurers to kind out an strategy for individuals switching from off-exchange to on-exchange, however in line with OregonHealthCare.gov, accumulators is not going to switch when an individual switches from one market plan to a different

- Pennsylvania

- Rhode Island – There are two insurers that provide plans in Rhode Island’s market; one has agreed to switch accumulators and one has not, however the market remains to be working to deal with this and it’s attainable each insurers may find yourself permitting accumulators to switch.

- Washington

States the place the official phrase is that accumulators is not going to switch

Some states have pretty clearly indicated that insurers is not going to switch accumulators if policyholders make a plan change. However even in these states, it’s nonetheless value checking with a selected insurer to see what strategy they’re taking, as some are nonetheless growing their strategy throughout this distinctive time.

What if my state’s not listed?

Insurance coverage departments in the remainder of the states haven’t put out any official steering or bulletins concerning accumulator transfers, though these should still be forthcoming because the COVID/ARP window progresses. Understand that will probably be July in most states earlier than the ARP’s advantages can be found for individuals receiving unemployment compensation in 2021, so that is nonetheless very a lot a piece in progress and prone to evolve over time.

States that haven’t but issued particular steering or clarified insurers positions on accumulator transfers embrace:

- Alabama

- Arizona

- Arkansas

- Delaware

- Florida

- Georgia

- Hawaii

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Mississippi

- Missouri

- Nebraska

- North Carolina

- Oklahoma

- South Carolina

- South Dakota

- Texas

- Utah

- Wyoming

If you happen to’re in considered one of these states, your insurer could or is probably not transferring accumulators when enrollees change to a brand new plan in 2021. If you happen to’ve had important out-of-pocket medical spending up to now this 12 months, you’ll want to attain out to your insurer to see how they’re dealing with this. And if a consultant tells you that accumulators will switch, it’s a good suggestion to get affirmation in writing.

And in case your insurer initially says no, maintain asking over the approaching days and weeks. We’ve seen some insurers begin to supply accumulator transfers after initially stating that they didn’t plan to take action, and it’s attainable that different insurers would possibly comply with swimsuit.

To change or to not change?

So what must you do if you happen to’ve already spent some cash out-of-pocket this 12 months, and also you’re going to have to start out over at $0 on a brand new plan?

Possibly you’re enrolled in a grandmothered or grandfathered plan and your insurer merely doesn’t supply plans on the market within the market. Relying on the place you reside, this may also be the case when you have an ACA-compliant off-exchange plan, as not all off-exchange insurers promote plans within the change. And as famous above, it may also be the case even if you wish to switch from one ACA-compliant plan to a different. (However examine with each the insurer and the insurance coverage division in your state earlier than giving up on accumulator transfers in that scenario.)

Actually, it simply comes right down to the maths: Will the quantity you’re going to save lots of resulting from premium tax credit score (and probably cost-sharing reductions, if you happen to’re eligible for them and switching to a Silver plan) offset the loss you’ll take by having to start out over at $0 in your deductible and out-of-pocket publicity? If you happen to haven’t spent a lot this 12 months, the reply might be Sure. If you happen to’ve already met your most out-of-pocket for the 12 months, it’s most likely going to be a more durable resolution.

However don’t assume that it’s not value your whereas. Relying on the circumstances (particularly if you happen to have been beforehand impacted by the “subsidy cliff” and are newly eligible for subsidies), your new subsidies is likely to be value greater than you’d be giving up by having to start out over with new out-of-pocket prices.

And if you happen to’re a part of the best way towards assembly your deductible on a Bronze plan and are newly eligible for a free or very low-cost Silver plan that features cost-sharing reductions, you would possibly discover that the brand new plan finally saves you cash in out-of-pocket prices for the remainder of the 12 months, even when your accumulators don’t switch.

Louise Norris is an particular person medical insurance dealer who has been writing about medical insurance and well being reform since 2006. She has written dozens of opinions and academic items concerning the Inexpensive Care Act for healthinsurance.org. Her state medical insurance market updates are repeatedly cited by media who cowl well being reform and by different medical insurance specialists.

For hundreds of thousands of Individuals who don’t have entry to employer-sponsored or government-run medical insurance, the American Rescue Plan (ARP) does so much to make well being protection extra inexpensive this 12 months. Premium subsidies are bigger, and extra individuals will qualify for premium-free plans, together with anybody receiving unemployment compensation at any level in 2021.

The Supreme Court docket upholds the Inexpensive Care Act. What it means for policyholders.

If you happen to’re at present uninsured or enrolled in one thing like a short-term plan or well being care sharing ministry plan and also you’ve turn out to be eligible for premium subsidies because of the ARP, it’s possible an apparent option to enroll in a plan by means of {the marketplace} in your state as quickly as attainable. And there’s a COVID/ARP enrollment window that continues by means of August 15 in most states, making it simple to enroll in a brand new plan and benefit from the brand new subsidies.

However if you happen to’re already enrolled in an ACA-compliant plan, or perhaps a grandmothered or grandfathered main medical plan, you’ll need to determine whether or not you need to make a plan change through the COVID/ARP enrollment window. And relying on the circumstances, it won’t be a simple resolution.

Are out-of-pocket prices you’ve paid making you assume twice?

Not like plan adjustments made throughout open enrollment, plan adjustments made through the COVID/ARP enrollment window will take impact mid-year. And for individuals who have already paid some or all of their deductible and out-of-pocket prices this 12 months, that provides an additional layer of complication to the switch-or-not resolution.

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical insurance premiums.

Usually, the final rule of thumb is that if you happen to change to a brand new plan mid-year, you’re going to be beginning over at $0 on the brand new plan’s deductible and out-of-pocket bills. (These are known as accumulators, because it’s a operating whole of the bills you’ve amassed towards your out-of-pocket most). For somebody whose accumulators have already amounted to a large sum of cash this 12 months, having to start out over at $0 in the course of the 12 months may very well be a deal-breaker.

Are ARP’s increased subsidies value it?

However 2021 just isn’t a standard 12 months. The ARP has made important adjustments to subsidy quantities and eligibility, and lots of people will discover that switching plans allows them to greatest benefit from the improved subsidies. For instance:

- An individual who beforehand enrolled off-exchange with the intention to benefit from the “Silver change” strategy to cost-sharing discount funding, and who’s now eligible for a premium subsidy within the change.

- An individual who enrolled in a Bronze plan throughout open enrollment however is now eligible for a $0 premium or low-premium Silver or Gold plan (relying on location) resulting from earnings or unemployment compensation.

- An individual who was eligible for cost-sharing reductions however chosen a Bronze or Gold plan throughout open enrollment as a result of the Silver plans have been too costly, however who can now afford the Silver plan because of the additional subsidies (cost-sharing reductions are solely accessible on Silver plans)

If you happen to change plans, will it’s important to begin over at zero?

The excellent news is that many states, state-run marketplaces, and insurers have taken motion to make sure that accumulators will switch to a brand new plan. (In just about all circumstances, this does need to be a brand new plan with the identical insurer — if you happen to change to a unique insurance coverage firm, you’ll nearly actually have to start out over at $0 in your accumulators.)

HealthCare.gov is the change/market that’s utilized in 36 states. Its official place is that “any client who selects a brand new plan could have their accumulators, equivalent to deductibles, reset to zero.” However insurance coverage commissioners in a few of these states have stepped in to require insurers to switch accumulators, and in different states, all the insurers have voluntarily agreed to take action. Washington, DC, and 14 states have state-run marketplaces, and several other of them have introduced that insurers will switch accumulators.

Which states are serving to with accumulators?

We’ve combed by means of communications from state-run marketplaces and state insurance coverage commissioners to see which of them have issued steering on this. However no matter the place you reside, your greatest wager is to succeed in out to your insurance coverage firm earlier than you make a plan change. Discover out precisely how they’re dealing with accumulators throughout this enrollment window, and if they’re transferring accumulators to new plans, just be sure you adhere to no matter necessities they could have in place.

That mentioned, right here’s what we discovered when it comes to how states and state-run marketplaces are addressing accumulators and mid-year plan adjustments in 2021.

States the place all accumulators will switch so long as your previous and new plans are provided by the identical insurance coverage firm

In some circumstances, these accumulator switch guidelines solely apply when switching from off-exchange to on-exchange; in different circumstances, they apply to any plan adjustments, together with from one change plan to a different:

- Colorado

- District of Columbia – {The marketplace} has confirmed that each one accumulators will switch.

- Idaho – Idaho solely allowed individuals to change to a plan provided by their present insurer, until that they had a qualifying occasion. Be aware that Idaho’s COVID/ARP enrollment window ended April 30, which is way sooner than the remainder of the nation.

- Maine

- Maryland – Plan adjustments are restricted to upgrades, however the market confirmed that accumulators will switch.

- Massachusetts — All insurers have agreed to switch accumulators for individuals switching from off-exchange to on-exchange plans

- Michigan – Deductibles will switch, though some insurers will solely enable this if you happen to’re upgrading your plan. (Two insurers are permitting deductible transfers even if you happen to’re switching from a unique insurer’s plan.)

- Minnesota – Minnesota is at present not permitting market enrollees to change plans through the COVID/ARP enrollment window, though this will likely change throughout the subsequent a number of weeks. So for now, the accumulator transfers solely apply to individuals switching from an off-exchange plan to an on-exchange plan. All 4 of the insurers that provide each on-exchange and off-exchange plans have agreed to switch accumulators to the on-exchange plans.

- New Hampshire

- New Mexico

- New York

- Tennessee

- Vermont – Like Minnesota, Vermont is at present solely permitting individuals to change from off-exchange (full-cost particular person direct enrollment) to on-exchange plans. Accumulators will switch for these plan adjustments.

- West Virginia — The WV Workplace of the Insurance coverage Commissioner confirmed that each insurers are transferring accumulators, aside from a switch between an HSA-qualified plan and a non-HSA-qualified plan (primarily resulting from IRS rules for the way HSA-qualified plans should deal with out-of-pocket prices).

- Wisconsin – Protecting Wisconsin, a nonprofit enrollment help group, notes that accumulators is not going to switch if individuals choose a plan from a unique insurer, which is to be anticipated.

In some states, guidelines are barely extra sophisticated

- Alaska – Deductibles will reset to $0 if a policyholder is switching from off-exchange to on-exchange (or vice-versa), however is not going to reset if the transfer is from one change plan to a different, with the identical insurer.

- California – {The marketplace} has confirmed that insurers will switch accumulators for plan holders switching from an off-exchange plan to an on-exchange plan or from one change plan to a different, so long as they stick with the identical insurance coverage firm and the identical kind of managed care plan (ie, HMO to HMO, or PPO to PPO).

- New Jersey – Deductibles will switch, probably even to a brand new insurer (which is pretty distinctive; we aren’t conscious of this elsewhere, apart from the 2 Michigan insurers which might be providing it). However extra out-of-pocket spending is not going to switch to the brand new plan.

States the place the official phrase is that ‘it relies upon’

A number of states have addressed accumulator transfers so that buyers know to pay attention to them, however are leaving the choice as much as the insurers. In these states (listed beneath), some or all the insurers could also be providing accumulator transfers, however shoppers ought to positively ask their insurer how it will work earlier than making the choice to change plans.

- Connecticut

- Nevada

- Ohio

- Montana

- North Dakota — the ND Insurance coverage Division is recommending that buyers attain out to their insurance coverage firm to see how that is being dealt with.

- Oregon — As of April, the state was nonetheless working with insurers to kind out an strategy for individuals switching from off-exchange to on-exchange, however in line with OregonHealthCare.gov, accumulators is not going to switch when an individual switches from one market plan to a different

- Pennsylvania

- Rhode Island – There are two insurers that provide plans in Rhode Island’s market; one has agreed to switch accumulators and one has not, however the market remains to be working to deal with this and it’s attainable each insurers may find yourself permitting accumulators to switch.

- Washington

States the place the official phrase is that accumulators is not going to switch

Some states have pretty clearly indicated that insurers is not going to switch accumulators if policyholders make a plan change. However even in these states, it’s nonetheless value checking with a selected insurer to see what strategy they’re taking, as some are nonetheless growing their strategy throughout this distinctive time.

What if my state’s not listed?

Insurance coverage departments in the remainder of the states haven’t put out any official steering or bulletins concerning accumulator transfers, though these should still be forthcoming because the COVID/ARP window progresses. Understand that will probably be July in most states earlier than the ARP’s advantages can be found for individuals receiving unemployment compensation in 2021, so that is nonetheless very a lot a piece in progress and prone to evolve over time.

States that haven’t but issued particular steering or clarified insurers positions on accumulator transfers embrace:

- Alabama

- Arizona

- Arkansas

- Delaware

- Florida

- Georgia

- Hawaii

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Mississippi

- Missouri

- Nebraska

- North Carolina

- Oklahoma

- South Carolina

- South Dakota

- Texas

- Utah

- Wyoming

If you happen to’re in considered one of these states, your insurer could or is probably not transferring accumulators when enrollees change to a brand new plan in 2021. If you happen to’ve had important out-of-pocket medical spending up to now this 12 months, you’ll want to attain out to your insurer to see how they’re dealing with this. And if a consultant tells you that accumulators will switch, it’s a good suggestion to get affirmation in writing.

And in case your insurer initially says no, maintain asking over the approaching days and weeks. We’ve seen some insurers begin to supply accumulator transfers after initially stating that they didn’t plan to take action, and it’s attainable that different insurers would possibly comply with swimsuit.

To change or to not change?

So what must you do if you happen to’ve already spent some cash out-of-pocket this 12 months, and also you’re going to have to start out over at $0 on a brand new plan?

Possibly you’re enrolled in a grandmothered or grandfathered plan and your insurer merely doesn’t supply plans on the market within the market. Relying on the place you reside, this may also be the case when you have an ACA-compliant off-exchange plan, as not all off-exchange insurers promote plans within the change. And as famous above, it may also be the case even if you wish to switch from one ACA-compliant plan to a different. (However examine with each the insurer and the insurance coverage division in your state earlier than giving up on accumulator transfers in that scenario.)

Actually, it simply comes right down to the maths: Will the quantity you’re going to save lots of resulting from premium tax credit score (and probably cost-sharing reductions, if you happen to’re eligible for them and switching to a Silver plan) offset the loss you’ll take by having to start out over at $0 in your deductible and out-of-pocket publicity? If you happen to haven’t spent a lot this 12 months, the reply might be Sure. If you happen to’ve already met your most out-of-pocket for the 12 months, it’s most likely going to be a more durable resolution.

However don’t assume that it’s not value your whereas. Relying on the circumstances (particularly if you happen to have been beforehand impacted by the “subsidy cliff” and are newly eligible for subsidies), your new subsidies is likely to be value greater than you’d be giving up by having to start out over with new out-of-pocket prices.

And if you happen to’re a part of the best way towards assembly your deductible on a Bronze plan and are newly eligible for a free or very low-cost Silver plan that features cost-sharing reductions, you would possibly discover that the brand new plan finally saves you cash in out-of-pocket prices for the remainder of the 12 months, even when your accumulators don’t switch.

Louise Norris is an particular person medical insurance dealer who has been writing about medical insurance and well being reform since 2006. She has written dozens of opinions and academic items concerning the Inexpensive Care Act for healthinsurance.org. Her state medical insurance market updates are repeatedly cited by media who cowl well being reform and by different medical insurance specialists.