For generations, one of many transition factors for younger adults has been the method of leaving their dad and mom’ medical health insurance and enrolling in their very own protection (assuming they had been lucky sufficient to be lined beneath a mum or dad’s well being plan within the first place).

The Reasonably priced Care Act (ACA) ushered in some vital adjustments that made protection way more accessible for younger adults, together with the supply that permits them to stay on a mum or dad’s well being plan till age 26. Now, the American Rescue Plan (ARP) is making protection much more inexpensive, albeit quickly.

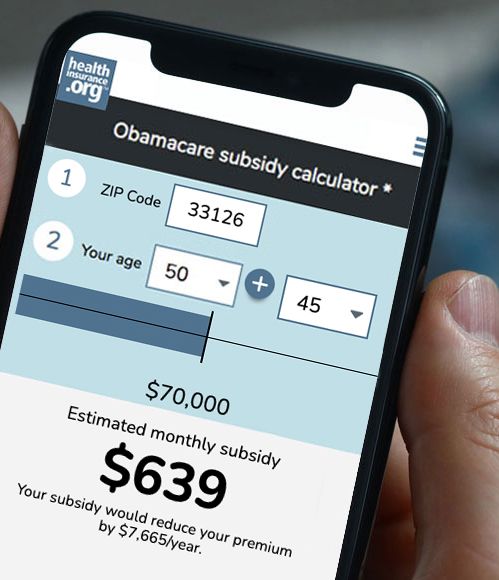

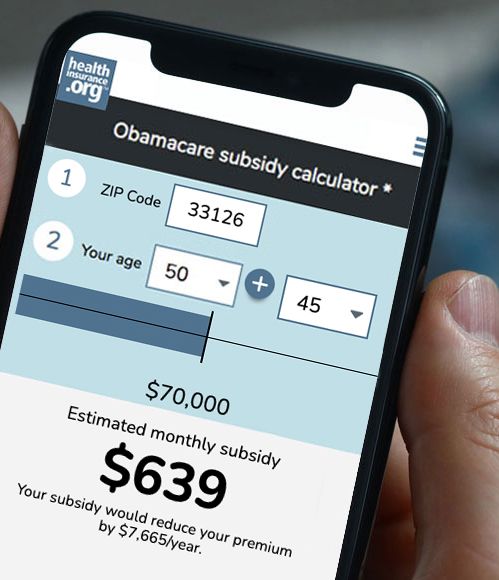

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical health insurance premiums.

For 2021 and 2022, the ARP supplies enhanced premium subsidies (aka premium tax credit). And generally, those that are receiving unemployment compensation at any level in 2021 are eligible for premium-free protection that features sturdy cost-sharing reductions.

By the point they should safe their very own protection, some younger adults have already got entry to their very own employer’s well being plan. However what should you don’t? Possibly you’re working for a small enterprise that doesn’t supply protection, or striving to satisfy your entrepreneurial goals, or working a number of part-time jobs. Let’s check out your choices for acquiring your individual well being protection, and the factors it is best to think about once you’re working via this course of:

Particular person-market plans extra inexpensive than ever

Buying a person plan within the market has at all times been an possibility for younger adults, and the ACA ensures that protection is guaranteed-issue, no matter an individual’s medical historical past (that’s, you possibly can’t be denied protection or charged a better premium attributable to a pre-existing medical situation). The ACA additionally created premium subsidies that make protection extra inexpensive than it might in any other case be. However the ARP has elevated the dimensions of these subsidies for 2021 and 2022.

The Supreme Courtroom simply upheld the ACA. Ought to market insurance coverage consumers breathe a sigh of aid?

Beforehand, wholesome younger folks with restricted revenue typically discovered themselves having to make a troublesome selection between a plan with a really low (or free) premium and really excessive out-of-pocket prices, versus a plan with extra manageable out-of-pocket prices however a not-insignificant month-to-month premium.

In some circumstances, the brand new subsidy construction beneath the ARP helps to eradicate this powerful determination by decreasing premiums for the extra sturdy protection.

How a lot can ‘younger invincibles’ save on protection?

The precise quantity of a purchaser’s subsidy will rely on how previous they’re and the place they stay. However some examples will assist for instance how the ARP’s subsidy enhancements make protection extra inexpensive and permit younger folks to enroll in additional sturdy well being plans:

Let’s say you’re about to show 26, you reside in Chicago, and also you anticipate to earn $18,000 this yr working at two part-time jobs – neither of which supply medical health insurance advantages. You’re dropping protection beneath your dad and mom’ well being plan on the finish of June, and have to get your individual plan in place for July.

- In response to HealthCare.gov’s plan comparability instrument, the benchmark plan in that space has a full-price price of about $277/month for a 26-year-old.

- Below the traditional guidelines (ie, earlier than the American Rescue Plan), the after-subsidy quantity for the benchmark plan could be about $54/month. (That’s 3.59% of the particular person’s $18,000 revenue. Right here’s the mathematics on how that’s all decided.)

- Below the American Rescue Plan, that coverage is free at this revenue degree. Zero premium. It’s received a $200 deductible, $5 copays for major care visits and generic medicine, and an $800 out-of-pocket most. These sturdy advantages are because of the built-in cost-sharing reductions. (Word that this selection –a $0 premium plan with sturdy cost-sharing reductions – can also be accessible should you’re receiving unemployment compensation in 2021, no matter your whole revenue.)

These cost-sharing reductions are at all times accessible. However with out the American Rescue Plan, a wholesome 26-year-old might need been tempted to get one of many less-expensive Bronze plans. (On this specific case, one plan was accessible for beneath $2/month, and others had been accessible for beneath $30/month.) However these include deductibles of at the least $7,400, and out-of-pocket maximums of $8,550. (Price-sharing reductions are solely accessible on Silver plans. The benchmark plan is at all times a Silver plan, and its worth is used to find out the quantity of an individual’s subsidy.)

A younger, wholesome particular person with a restricted revenue might need enrolled in that $2/month plan as a result of the premiums match their price range. However they might seemingly have struggled to pay the out-of-pocket prices in the event that they skilled a major medical occasion in the course of the yr. Because of the expanded premium subsidies created by the ARP, there’s now not a troublesome determination to make, because the benchmark plan, with sturdy cost-sharing reductions, has a $0 premium for folks with revenue as much as 150% of the federal poverty degree (for a single particular person, that’s $19,140 in 2021).

Though the greenback quantities of the ARP’s subsidy will increase are bigger for older folks (as a result of their pre-subsidy premiums are a lot greater), it’s actually vital that the brand new regulation helps to make it simpler for “younger invincibles” with restricted incomes to enroll in plans with cost-sharing reductions. The Bronze plans that include a lot greater out-of-pocket prices gained’t be such an interesting different when Silver plans are made way more inexpensive – or free, as within the case we simply checked out.

What about younger folks with greater incomes?

However what should you’re a teenager with an revenue that’s too excessive for cost-sharing reductions? The American Rescue Plan nonetheless makes protection extra inexpensive, and makes it simpler to afford a better-quality plan. Let’s say our 26-year-old in Chicago is incomes $40,000 in 2021 – about 313% of the federal poverty degree.

- The benchmark plan remains to be $277/month with none premium subsidies.

- With out the American Rescue Plan, no subsidies can be found for this particular person at this revenue degree (even though their revenue is beneath 400% of the poverty degree). The benchmark plan is $277/month and the most affordable accessible plan is $215/month (it’s a Bronze plan with a $7,400 deductible, $60 major care copays, and an out-of-pocket cap of $8,550).

- Below the American Rescue Plan, this particular person could be eligible for a premium subsidy that would scale back the price of the benchmark (Silver) plan to $211/month (as a result of the proportion of revenue that individuals are anticipated to spend on the benchmark plan has been diminished). The bottom-cost plan would drop to about $149/month.

The take-away right here? Shopping for your individual medical health insurance is way more inexpensive in 2021 and 2022 than it might usually be. Relying in your revenue, you could be eligible for sturdy well being protection with $0 premiums, otherwise you could be eligible for premium subsidies even should you weren’t previous to the American Rescue Plan.

Switching to your individual plan: Issues to bear in mind

When you’re switching to your individual self-purchased medical health insurance plan after having protection beneath a mum or dad’s well being plan, there are a number of issues to concentrate on as you make this variation, significantly in case your earlier well being protection was supplied by an employer:

- You’ll have way more plan choices than you and your loved ones are used to having. In case your dad and mom’ plan is obtainable by an employer, it’s seemingly certainly one of only some choices from which they’ll select every year. However once you’re buying to your personal protection within the particular person market, you may see dozens of obtainable plans. If the plan choice course of feels overwhelming, listed below are some concerns to bear in mind as you go about selecting a plan.

- There may not be any PPO choices. PPOs, which offer some protection for out-of-network providers and likewise are likely to have broader supplier networks, are extensively accessible within the employer-sponsored market. However they are typically a lot much less accessible within the particular person market. If you’re buying to your personal protection, you’re extra prone to encounter plans that solely cowl care obtained in-network. This makes it significantly vital to grasp what medical doctors and amenities are in-network earlier than you enroll.

- The supplier community could be very completely different, even when the medical health insurance firm is identical one you had earlier than. For instance, your dad and mom’ plan could be supplied or administered by Anthem Blue Cross Blue Defend, and also you may resolve to enroll in a market plan supplied by the identical insurer. However most insurers have completely different supplier networks for his or her particular person and group well being plans, so that you’ll wish to double-check to see in case your medical suppliers are in-network with the plans you’re contemplating.

Low revenue? Medicaid could also be an possibility

When you’re in Washington, DC or one of many 36 states (quickly to be 38) the place Medicaid eligibility was expanded on account of the ACA, you may discover that you just’re eligible for Medicaid. For a single particular person within the continental U.S., Medicaid eligibility extends to an annual revenue of $17,774 in 2021. (It’s greater in Alaska and Hawaii, and DC additionally has a better eligibility restrict, permitting folks to enroll in Medicaid with an revenue as excessive as $25,760.)

Medicaid eligibility can also be based mostly on present month-to-month revenue, which means you gained’t have to mission your whole annual revenue the best way you do for premium subsidy eligibility. In a state that has expanded Medicaid eligibility beneath the ACA, a single particular person can qualify for Medicaid with a month-to-month revenue of as much as $1,482 in 2021. So should you’re going via a time interval when your revenue is decrease than regular, Medicaid could be a nice security internet.

Normally, Medicaid has no month-to-month premiums, and out-of-pocket prices are typically a lot decrease than they might be with a non-public insurance coverage plan.

In Minnesota and New York, Primary Well being Program protection can also be accessible. These plans have modest premiums and supply sturdy well being protection. They’re accessible to individuals who earn an excessive amount of for Medicaid however not more than 200% of the poverty degree (which quantities to $25,520 for a single particular person in 2021).

COBRA: Entry stays unchanged, however could be costly

When you’re getting old off your dad and mom’ well being plan, COBRA or mini-COBRA (state continuation protection) could be accessible. This could be a good possibility should you’re capable of afford it, because it lets you maintain the identical protection you have already got for as much as 18 further months. You gained’t have to begin over with a brand new plan’s deductible and out-of-pocket most, nor will you’ll want to fear about switching to a unique supplier community or deciding on a plan with a unique lined drug record.

The American Rescue Plan supplies a one-time six-month federal subsidy that pays 100% of COBRA premiums, however that is solely accessible to people who find themselves eligible for COBRA attributable to an involuntary job lack of involuntary discount in hours, and it’s solely accessible via September 2020.

Getting older off a mum or dad’s well being plan is a qualifying occasion that can can help you proceed your protection by way of COBRA (assuming it’s accessible), nevertheless it’s not an occasion that can set off the COBRA subsidy. (The small print for in ARP Part 9501(a)(1)(B)(i), which references different present statutes, all of which pertain to individuals who lose their jobs or have their hours diminished; the laws notes that this should be involuntary so as to set off the subsidies).

So relying on the circumstances, it might make extra sense to change to a person plan within the market.

Pupil well being plans: Most are compliant with the ACA

When you’re at school and eligible for a pupil well being plan, this could be an inexpensive and handy possibility. Because of the ACA, practically all pupil well being plans are way more sturdy than they was once, and supply protection that follows all the similar guidelines that apply to particular person market plans.

Test together with your faculty to see if protection is obtainable, and if that’s the case, whether or not it’s compliant with the ACA (some self-insured pupil well being plans have opted to keep away from ACA-compliance; in case your faculty presents certainly one of these plans, be sure you perceive what sorts of medical care may not be lined beneath the plan).

When you do have an choice to enroll in a high-quality pupil well being plan, you’ll wish to examine that with the opposite accessible choices, together with self-purchased particular person market protection, or remaining on a mum or dad’s plan should you’re beneath 26 and that possibility is obtainable to you.

Louise Norris is an particular person medical health insurance dealer who has been writing about medical health insurance and well being reform since 2006. She has written dozens of opinions and academic items concerning the Reasonably priced Care Act for healthinsurance.org. Her state well being trade updates are often cited by media who cowl well being reform and by different medical health insurance consultants.

For generations, one of many transition factors for younger adults has been the method of leaving their dad and mom’ medical health insurance and enrolling in their very own protection (assuming they had been lucky sufficient to be lined beneath a mum or dad’s well being plan within the first place).

The Reasonably priced Care Act (ACA) ushered in some vital adjustments that made protection way more accessible for younger adults, together with the supply that permits them to stay on a mum or dad’s well being plan till age 26. Now, the American Rescue Plan (ARP) is making protection much more inexpensive, albeit quickly.

Use our up to date subsidy calculator to estimate how a lot it can save you in your 2021 medical health insurance premiums.

For 2021 and 2022, the ARP supplies enhanced premium subsidies (aka premium tax credit). And generally, those that are receiving unemployment compensation at any level in 2021 are eligible for premium-free protection that features sturdy cost-sharing reductions.

By the point they should safe their very own protection, some younger adults have already got entry to their very own employer’s well being plan. However what should you don’t? Possibly you’re working for a small enterprise that doesn’t supply protection, or striving to satisfy your entrepreneurial goals, or working a number of part-time jobs. Let’s check out your choices for acquiring your individual well being protection, and the factors it is best to think about once you’re working via this course of:

Particular person-market plans extra inexpensive than ever

Buying a person plan within the market has at all times been an possibility for younger adults, and the ACA ensures that protection is guaranteed-issue, no matter an individual’s medical historical past (that’s, you possibly can’t be denied protection or charged a better premium attributable to a pre-existing medical situation). The ACA additionally created premium subsidies that make protection extra inexpensive than it might in any other case be. However the ARP has elevated the dimensions of these subsidies for 2021 and 2022.

The Supreme Courtroom simply upheld the ACA. Ought to market insurance coverage consumers breathe a sigh of aid?

Beforehand, wholesome younger folks with restricted revenue typically discovered themselves having to make a troublesome selection between a plan with a really low (or free) premium and really excessive out-of-pocket prices, versus a plan with extra manageable out-of-pocket prices however a not-insignificant month-to-month premium.

In some circumstances, the brand new subsidy construction beneath the ARP helps to eradicate this powerful determination by decreasing premiums for the extra sturdy protection.

How a lot can ‘younger invincibles’ save on protection?

The precise quantity of a purchaser’s subsidy will rely on how previous they’re and the place they stay. However some examples will assist for instance how the ARP’s subsidy enhancements make protection extra inexpensive and permit younger folks to enroll in additional sturdy well being plans:

Let’s say you’re about to show 26, you reside in Chicago, and also you anticipate to earn $18,000 this yr working at two part-time jobs – neither of which supply medical health insurance advantages. You’re dropping protection beneath your dad and mom’ well being plan on the finish of June, and have to get your individual plan in place for July.

- In response to HealthCare.gov’s plan comparability instrument, the benchmark plan in that space has a full-price price of about $277/month for a 26-year-old.

- Below the traditional guidelines (ie, earlier than the American Rescue Plan), the after-subsidy quantity for the benchmark plan could be about $54/month. (That’s 3.59% of the particular person’s $18,000 revenue. Right here’s the mathematics on how that’s all decided.)

- Below the American Rescue Plan, that coverage is free at this revenue degree. Zero premium. It’s received a $200 deductible, $5 copays for major care visits and generic medicine, and an $800 out-of-pocket most. These sturdy advantages are because of the built-in cost-sharing reductions. (Word that this selection –a $0 premium plan with sturdy cost-sharing reductions – can also be accessible should you’re receiving unemployment compensation in 2021, no matter your whole revenue.)

These cost-sharing reductions are at all times accessible. However with out the American Rescue Plan, a wholesome 26-year-old might need been tempted to get one of many less-expensive Bronze plans. (On this specific case, one plan was accessible for beneath $2/month, and others had been accessible for beneath $30/month.) However these include deductibles of at the least $7,400, and out-of-pocket maximums of $8,550. (Price-sharing reductions are solely accessible on Silver plans. The benchmark plan is at all times a Silver plan, and its worth is used to find out the quantity of an individual’s subsidy.)

A younger, wholesome particular person with a restricted revenue might need enrolled in that $2/month plan as a result of the premiums match their price range. However they might seemingly have struggled to pay the out-of-pocket prices in the event that they skilled a major medical occasion in the course of the yr. Because of the expanded premium subsidies created by the ARP, there’s now not a troublesome determination to make, because the benchmark plan, with sturdy cost-sharing reductions, has a $0 premium for folks with revenue as much as 150% of the federal poverty degree (for a single particular person, that’s $19,140 in 2021).

Though the greenback quantities of the ARP’s subsidy will increase are bigger for older folks (as a result of their pre-subsidy premiums are a lot greater), it’s actually vital that the brand new regulation helps to make it simpler for “younger invincibles” with restricted incomes to enroll in plans with cost-sharing reductions. The Bronze plans that include a lot greater out-of-pocket prices gained’t be such an interesting different when Silver plans are made way more inexpensive – or free, as within the case we simply checked out.

What about younger folks with greater incomes?

However what should you’re a teenager with an revenue that’s too excessive for cost-sharing reductions? The American Rescue Plan nonetheless makes protection extra inexpensive, and makes it simpler to afford a better-quality plan. Let’s say our 26-year-old in Chicago is incomes $40,000 in 2021 – about 313% of the federal poverty degree.

- The benchmark plan remains to be $277/month with none premium subsidies.

- With out the American Rescue Plan, no subsidies can be found for this particular person at this revenue degree (even though their revenue is beneath 400% of the poverty degree). The benchmark plan is $277/month and the most affordable accessible plan is $215/month (it’s a Bronze plan with a $7,400 deductible, $60 major care copays, and an out-of-pocket cap of $8,550).

- Below the American Rescue Plan, this particular person could be eligible for a premium subsidy that would scale back the price of the benchmark (Silver) plan to $211/month (as a result of the proportion of revenue that individuals are anticipated to spend on the benchmark plan has been diminished). The bottom-cost plan would drop to about $149/month.

The take-away right here? Shopping for your individual medical health insurance is way more inexpensive in 2021 and 2022 than it might usually be. Relying in your revenue, you could be eligible for sturdy well being protection with $0 premiums, otherwise you could be eligible for premium subsidies even should you weren’t previous to the American Rescue Plan.

Switching to your individual plan: Issues to bear in mind

When you’re switching to your individual self-purchased medical health insurance plan after having protection beneath a mum or dad’s well being plan, there are a number of issues to concentrate on as you make this variation, significantly in case your earlier well being protection was supplied by an employer:

- You’ll have way more plan choices than you and your loved ones are used to having. In case your dad and mom’ plan is obtainable by an employer, it’s seemingly certainly one of only some choices from which they’ll select every year. However once you’re buying to your personal protection within the particular person market, you may see dozens of obtainable plans. If the plan choice course of feels overwhelming, listed below are some concerns to bear in mind as you go about selecting a plan.

- There may not be any PPO choices. PPOs, which offer some protection for out-of-network providers and likewise are likely to have broader supplier networks, are extensively accessible within the employer-sponsored market. However they are typically a lot much less accessible within the particular person market. If you’re buying to your personal protection, you’re extra prone to encounter plans that solely cowl care obtained in-network. This makes it significantly vital to grasp what medical doctors and amenities are in-network earlier than you enroll.

- The supplier community could be very completely different, even when the medical health insurance firm is identical one you had earlier than. For instance, your dad and mom’ plan could be supplied or administered by Anthem Blue Cross Blue Defend, and also you may resolve to enroll in a market plan supplied by the identical insurer. However most insurers have completely different supplier networks for his or her particular person and group well being plans, so that you’ll wish to double-check to see in case your medical suppliers are in-network with the plans you’re contemplating.

Low revenue? Medicaid could also be an possibility

When you’re in Washington, DC or one of many 36 states (quickly to be 38) the place Medicaid eligibility was expanded on account of the ACA, you may discover that you just’re eligible for Medicaid. For a single particular person within the continental U.S., Medicaid eligibility extends to an annual revenue of $17,774 in 2021. (It’s greater in Alaska and Hawaii, and DC additionally has a better eligibility restrict, permitting folks to enroll in Medicaid with an revenue as excessive as $25,760.)

Medicaid eligibility can also be based mostly on present month-to-month revenue, which means you gained’t have to mission your whole annual revenue the best way you do for premium subsidy eligibility. In a state that has expanded Medicaid eligibility beneath the ACA, a single particular person can qualify for Medicaid with a month-to-month revenue of as much as $1,482 in 2021. So should you’re going via a time interval when your revenue is decrease than regular, Medicaid could be a nice security internet.

Normally, Medicaid has no month-to-month premiums, and out-of-pocket prices are typically a lot decrease than they might be with a non-public insurance coverage plan.

In Minnesota and New York, Primary Well being Program protection can also be accessible. These plans have modest premiums and supply sturdy well being protection. They’re accessible to individuals who earn an excessive amount of for Medicaid however not more than 200% of the poverty degree (which quantities to $25,520 for a single particular person in 2021).

COBRA: Entry stays unchanged, however could be costly

When you’re getting old off your dad and mom’ well being plan, COBRA or mini-COBRA (state continuation protection) could be accessible. This could be a good possibility should you’re capable of afford it, because it lets you maintain the identical protection you have already got for as much as 18 further months. You gained’t have to begin over with a brand new plan’s deductible and out-of-pocket most, nor will you’ll want to fear about switching to a unique supplier community or deciding on a plan with a unique lined drug record.

The American Rescue Plan supplies a one-time six-month federal subsidy that pays 100% of COBRA premiums, however that is solely accessible to people who find themselves eligible for COBRA attributable to an involuntary job lack of involuntary discount in hours, and it’s solely accessible via September 2020.

Getting older off a mum or dad’s well being plan is a qualifying occasion that can can help you proceed your protection by way of COBRA (assuming it’s accessible), nevertheless it’s not an occasion that can set off the COBRA subsidy. (The small print for in ARP Part 9501(a)(1)(B)(i), which references different present statutes, all of which pertain to individuals who lose their jobs or have their hours diminished; the laws notes that this should be involuntary so as to set off the subsidies).

So relying on the circumstances, it might make extra sense to change to a person plan within the market.

Pupil well being plans: Most are compliant with the ACA

When you’re at school and eligible for a pupil well being plan, this could be an inexpensive and handy possibility. Because of the ACA, practically all pupil well being plans are way more sturdy than they was once, and supply protection that follows all the similar guidelines that apply to particular person market plans.

Test together with your faculty to see if protection is obtainable, and if that’s the case, whether or not it’s compliant with the ACA (some self-insured pupil well being plans have opted to keep away from ACA-compliance; in case your faculty presents certainly one of these plans, be sure you perceive what sorts of medical care may not be lined beneath the plan).

When you do have an choice to enroll in a high-quality pupil well being plan, you’ll wish to examine that with the opposite accessible choices, together with self-purchased particular person market protection, or remaining on a mum or dad’s plan should you’re beneath 26 and that possibility is obtainable to you.

Louise Norris is an particular person medical health insurance dealer who has been writing about medical health insurance and well being reform since 2006. She has written dozens of opinions and academic items concerning the Reasonably priced Care Act for healthinsurance.org. Her state well being trade updates are often cited by media who cowl well being reform and by different medical health insurance consultants.