This submit was written in collaboration with Nice Japanese. Whereas we’re financially compensated by them, we nonetheless try to keep up our editorial integrity and evaluation merchandise with the identical goal lens. We’re dedicated to offering the perfect suggestions and recommendation so as so that you can make private monetary selections with confidence. You’ll be able to view our Editorial Tips right here.

When our dad and mom had been our age, issues had been less expensive and so they might survive on much less. Right this moment, we see many seniors proceed to work previous the retirement age, and the price of dwelling continues to extend with inflation.

For instance, a bowl of noodles which will have price simply $2 a decade in the past is now priced at $3.50. Within the Nineteen Nineties, $120,000 might get you a 5-room HDB BTO flat in mature estates akin to Toa Payoh, however now that very same quantity can barely purchase a 3-room BTO unit in a non-mature property.

What is going to retirement appear to be when it’s our flip? Would we be capable of afford our each day necessities and luxuriate in our silver years comfortably?

In a current survey from insurer Nice Japanese on the state of retirement in Singapore, those that didn’t plan for retirement usually tend to be dissatisfied with their retirement way of life (35%). That is 7 occasions extra as in comparison with these retirees who deliberate with skilled assist and twice those that deliberate with out skilled assist.

Retirees’ primary remorse? Not beginning sooner (45%), stated those that had truly deliberate for retirement.

This underscores the necessity to not solely plan for our retirement, however to take action early, to make sure that we are able to obtain a cushty retirement way of life sooner or later.

Simply how quickly is quickly sufficient? Or is it higher late than by no means? How do we start, and what does our present retirement progress bar appear to be? Let’s take a look at 3 frequent monetary situations skilled by Singaporeans and the way planning early and getting skilled recommendation will help.

What does your ‘retire-meter’, AKA your retirement progress bar appear to be?

Have you ever ever used a retirement calculator to suss out how a lot it’s worthwhile to obtain your required retirement way of life and whenever you’re financially capable of retire? Along with your present monetary scenario, what retirement way of life are you able to realistically work in the direction of?

To get you began, listed here are 3 monetary situations generally skilled by us (you in all probability can relate to a few of them) and the way their retirement progress bar appears like, in accordance with Ms Riley Koh, a Nice Japanese Monetary Consultant.

Situation 1 – STARTING OUT & SAVING FOR THE FUTUREYou’re in your 20s, simply graduated from faculty and began working. You’re seemingly nonetheless reliant in your dad and mom for a lot of issues, together with family bills and lodging, however you hope to change into unbiased quickly. A few of chances are you’ll be paying off your schooling loans, whereas others could also be saving as much as marry your sweetheart and on your BTO. Riley says that individuals on this age group generally really feel that “retirement remains to be an extended option to go and I can’t see that far forward but.” It’s comprehensible — with so many issues to cater for, akin to paying off their schooling mortgage, making an attempt to avoid wasting, and even planning for main milestones, planning for retirement might not but be a precedence. Nevertheless, it’s necessary to not overlook long-term targets whereas engaged on short- to mid-term plans. Younger adults are inspired to domesticate good saving habits, construct their safety protection and begin accumulating their wealth as early as potential. With compounding curiosity — assuming curiosity is similar — you’ll be able to have a bigger sum of financial savings regardless of saving much less in comparison with somebody who began at a later age with a much bigger financial savings quantity. For those who delay, there will likely be much less time on your cash to develop and the more durable you must work to succeed in your retirement targets. |

Situation 2 – ENTERING A NEW LIFE STAGE, GAINING NEW COMMITMENTSYou’re in your 30s, incomes wherever from $3,500 to $5,000 a month. You will have some extra income streams from dividend investing and/or a facet hustle, and have amassed about $50,000 in financial savings. Nevertheless, you’ll have a mortgage to pay, presumably youngsters and/or dad and mom (in the event that they’ve retired) to help as effectively. Riley says that as one goes by means of the completely different milestones in life, it’s frequent to expertise “way of life inflation” (spending extra as your revenue goes up). If there’s no correct cash administration, one might find yourself overspending and derailing from their monetary targets. By training good cash habits, you’ll be able to higher obtain your required targets. Inflation is a silent killer that erodes our spending energy. In case your financial savings quantity will not be retaining tempo with inflation price, you’re not incomes any curiosity returns. That’s why investing is without doubt one of the key instruments for our retirement planning. Some might shun investments due to sure misconceptions akin to:

Nevertheless, there are various sorts of funding and wealth accumulation plans with completely different threat ranges and beginning capital that will help you attain your monetary targets and construct your retirement kitty. One instance is GREAT Wealth Benefit, a common premium complete life investment-linked plan which allows you to make investments from as little as $200/month and with the choice to put money into funds that are well-diversified and managed by professionals. You’ll get pleasure from welcome and loyalty bonuses which will help to speed up the expansion of your cash. It additionally supplies protection towards Demise, Complete and Everlasting Incapacity and Terminal Sickness with no medical underwriting required. |

Situation 3 – SANDWICHED BUT STILL GOING STRONGYou’re in your 40s. Prefer it or not, you’re beginning to really feel kanchiong (anxious) about retirement and also you’ve began, however you’re unsure if it’s sufficient to put aside $200 a month. You’re fearful in case your CPF funds are ample for retirement as you have got worn out all the quantity to pay for your own home in your late 20s/early 30s. You’ve additionally been utilizing most of your financial savings on your children’ schooling, college charges, mortgage and likewise supporting your aged dad and mom. Riley weighs in: “As the price of dwelling continues to rise in Singapore and with a rising ageing inhabitants, we have to plan early in order to not stick with it the pattern of the ‘sandwich era’.” At this stage, it is very important diversify and to not put all of your eggs into one basket to keep away from the situations under:

In case you are seeking to construct a flexible retirement nest egg with assured common payouts, you’ll be able to contemplate taking part insurance policy akin to GREAT Lifetime Payout and GREAT Retire Revenue as a part of your retirement planning. These options present some capital preservation, flexibility and a steady stream of revenue to cater on your wants akin to youngsters’s schooling, your individual retirement and many others. GREAT Lifetime Payout has a singular proposition which supplies you with a lifetime month-to-month payout with capital preservation. So as to use it whenever you want additional monetary sources or select to go away a legacy on your family members. It’s by no means too early/late to plan for retirement. It’s extra necessary to be clear about your monetary targets and maximise your sources in getting there. |

These monetary situations are on no account intensive, and are solely meant to spotlight frequent conditions. For a personalised and holistic retirement plan, it’s greatest to seek the advice of an expert monetary consultant who will help you evaluation your retirement planning wants.

Much like how we have now common medical check-ups to make sure we keep within the pink of well being, getting skilled recommendation from an skilled monetary consultant will assist you to to construct and preserve good monetary well being.

Learn how to begin planning on your retirement

The primary order of enterprise when planning for retirement is to attract up your monetary storyboard. This helps you see previous any blind spots akin to optimism bias (i.e. that voice in your head telling you that the worst gained’t occur and that your present safety is enough, although that will not be the case) and stress-tests your monetary plans by simulating completely different life occasions.

Nice Japanese’s Monetary Storyboard makes it easy to plan on your monetary targets early with the assistance {of professional} recommendation — and never just for retirement.

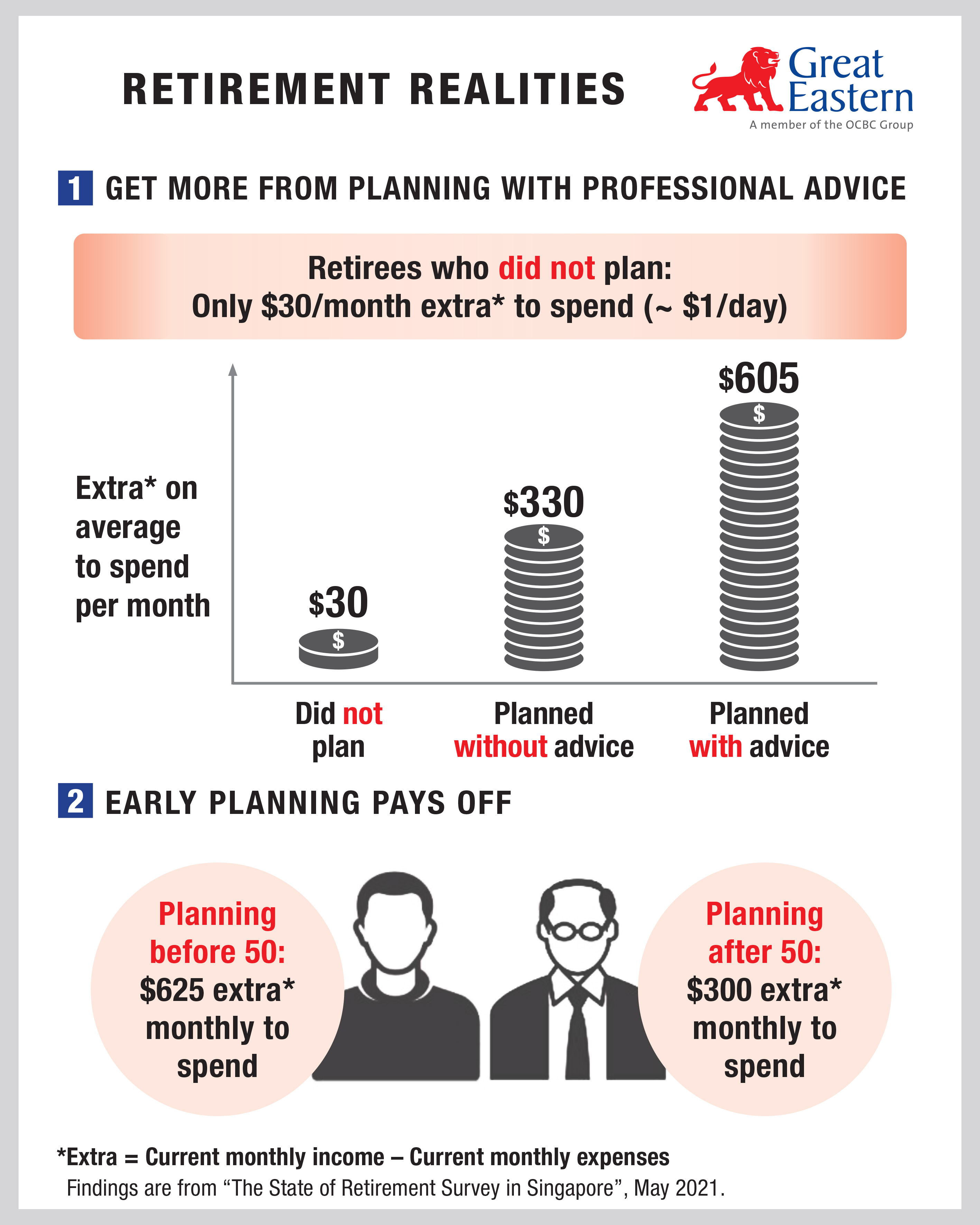

Going again to Nice Japanese’s state of retirement in Singapore survey, the distinction between those that deliberate for his or her retirement with and with out skilled assist is sort of vital.

The survey findings confirmed that those that deliberate their retirement with skilled assist had $605 extra on common to spend as they need. That is virtually twice the quantity than those that deliberate for retirement with out skilled recommendation (a mean of $330 additional to spend per 30 days).

Those that deliberate for retirement earlier than they reached age 50 (52%) are considerably higher off with $625 additional to spend every month. Sadly, retirees who didn’t plan in any respect had solely about $30 additional per 30 days to spend — that’s about $1 a day (month-to-month revenue minus month-to-month bills).

In reality, most retirees didn’t contemplate if they might have sufficient to spend for the following 10 to twenty years of their lives. For a lot of within the survey, their high 3 revenue sources had been their financial savings (56%), allowances from household (41%) and CPF LIFE (43%). And 11% of the retirees surveyed stated they nonetheless wanted to work as they nonetheless had ongoing commitments and money owed akin to housing and automotive loans.

Survey takeaways? Begin early, and search skilled recommendation. The earlier you start, the better it’s to amass the quantity wanted on your retirement.

That can assist you get began, contemplate Nice Japanese’s retirement-focused taking part insurance policy, GREAT Lifetime Payout and GREAT Retire Revenue. Right here’s a fast take a look at their key options:

| GREAT Lifetime Payout | GREAT Retire Revenue |

|

|

Plan your Monetary Storyboard with Nice Japanese by 31 December 2021 and obtain $20 price of GREAT {Dollars} to redeem unique offers on the Nice Japanese Rewards app! Click on right here for extra particulars.

Footnotes:

1 Month-to-month payout contains of assured survival profit and non-guaranteed money bonus. 3.00% p.a. of complete annual premiums paid is predicated on an Illustrated Funding Price of Return (IIRR) of the Collaborating Fund at 4.25% p.a.. At an IIRR of three.00% p.a., the month-to-month payout is 1.94% p.a. of the full annual premiums paid. The precise advantages payable might fluctuate accordingly to the long run expertise of the Collaborating Fund.

2 Capital assure is on the situation that premiums are paid by annual mode and no coverage alterations are made.

3 For a 35-year-old male with a 20-year premium time period, chosen retirement of age 71 and revenue interval of 20 years on accumulation choice, at an Illustrated Funding Price of Return (IIRR) of the Collaborating Fund at 4.25% p.a.. At an IIRR of three% p.a., the full retirement revenue advantages obtained is as much as 2.7X of complete premiums paid at coverage maturity.

4 Capital assure is on the situation that no coverage alterations are made.

5 Lack of Independence (LOI) revenue profit is payable if the Life Assured, as licensed by a medical practitioner, is unable with out the continuous bodily help of one other particular person to carry out 2 or extra Actions of Each day Dwelling (ADLs). ADLs embrace washing, dressing, feeding, strolling or shifting round and transferring.

6 Safety towards complete and everlasting incapacity is from the beginning of the coverage until earlier than the coverage anniversary on which the Life Assured reaches the chosen retirement age.

7 Primarily based on a 20-year premium time period, premium illustrated is rounded all the way down to the closest 10 greenback. Please seek advice from coverage illustration for precise premium quantity.

This commercial has not been reviewed by the Financial Authority of Singapore.

Phrases and Circumstances apply. Protected as much as specified limits by SDIC.

As shopping for a life insurance coverage coverage is a long-term dedication, early termination of the coverage normally includes excessive prices and the give up worth, if any, that’s payable to chances are you’ll be zero or lower than the full premiums paid.

Investments in GREAT Wealth Benefit are topic to funding dangers together with the potential lack of the principal quantity invested. The worth of the models within the Fund(s) and the revenue accruing to the models, if any, might fall or rise. Please seek advice from Fund Particulars and Product Highlights Sheet for the particular dangers of the Fund(s). Previous efficiency will not be essentially indicative of future efficiency.