The Life Insurance coverage Affiliation, Singapore (LIA Singapore) not too long ago introduced that caps of illustrative funding returns utilized in coverage illustrations for collaborating (par) insurance policies (SGD) might be lowered by the life insurance coverage trade right here, efficient 1 July 2021.

| Caps of illustrative funding returns for par insurance policies — what’s modified | ||

| Earlier than 1 July 2021 | From 1 July 2021 | |

| Higher illustration price | Capped at 4.75% p.a. | Capped at 4.25% p.a. |

| Decrease illustration price* | Capped at 3.25% p.a. | Capped at 3.00% p.a. |

*The decrease illustration price should be at the least 1.25% p.a. under the higher illustration price.

Wait, what?! Whoa, maintain your horses there, buddy. There’s no must panic — these higher and decrease illustration charges are for illustrative functions solely and won’t have an effect on the precise returns of present and future par insurance policies. It’s only a gauge.

Right here’s a few the explanation why LIA Singapore determined to revise these caps downwards:

- The sustained low rate of interest surroundings (sigh, Covid-19)

- Singapore Authorities Securities and US Treasures yields skilled a pointy drop final yr (the Singapore Authorities 10-year bond’s rates of interest fell 0.99% to 1.48% as of 31 Could 2021, from 2.47% in end-2016)

Some insurers, comparable to Prudential and AXA, have additionally minimize bonuses forward of the announcement. Nonetheless, it’s really a prudent transfer for the life insurance coverage trade at a time like this — we’ll clarify additional on this article.

What are par insurance policies?

Earlier than we dive deeper, let’s discuss par insurance policies, particularly for the good thing about those that are completely new to this idea.

A collaborating (par) coverage is termed as such as a result of it means along with receiving safety, you’ll even be collaborating within the revenue of the insurance coverage firm’s collaborating fund. The premiums you pay might be put along with different par policyholders, and also you’ll have the ability to reap the earnings of the par fund.

Therefore, your insurance coverage profit illustration will comprise each assured and non-guaranteed advantages (i.e. bonuses and money dividends), of which the latter is tied to the efficiency of the par fund. Different elements that would additionally influence your non-guaranteed advantages embrace claims by fellow policyholders and the fund’s expense ratio (prices incurred to handle the par fund).

Insurers often declare these non-guaranteed bonuses yearly and policyholders might be notified. Needless to say you most likely received’t have the ability to get pleasure from these bonuses instantly. They’re often added to your sum assured or could possibly be used to offset premiums. It actually depends upon the kind of coverage your insurer gives.

How in regards to the par fund?

Now, you don’t must do something in regards to the par fund as will probably be dealt with by the insurer. Nonetheless, you’re capable of finding out extra about your insurer’s par fund such because the funding technique, what it invests in and so forth, in your coverage’s product abstract. Sometimes, the par fund invests in a spread of belongings comparable to bonds, shares, REITs and so forth. Like all funding fund on the market, the funding combine could also be tweaked or rebalanced every now and then, with the intention to maximise returns inside acceptable volatility.

TL;DRWhen studying the Par Fund Efficiency Replace, you simply must confer with the next key indicators:

|

What about smoothing?

Smoothing, too, performs a task in figuring out policyholders’ non-guaranteed bonuses. Give it some thought as balancing out the years of fine efficiency and the years of not-so-good efficiency. For instance, within the years the place the par fund funding efficiency exceeds expectations, the excess could possibly be saved in a reserve to pad up the declared bonuses in a yr the place the par fund didn’t accomplish that properly. Through the use of this measured method, the coverage’s non-guaranteed returns might stay secure even throughout an financial downturn.

Do be aware that par insurance policies are not the identical as investment-linked insurance coverage insurance policies (ILPs). With ILPs, the returns are usually not smoothed and the money worth of the ILP relies upon closely on the efficiency of the chosen funds (policyholders can select sub funds).

How has the insurance coverage trade carried out within the final 10 years?

Let’s check out the historic funding returns of the foremost life insurers during the last 10 years, from 2011 to 2020. Let’s first check out the yearly funding returns, after which see the way it appears to be like when the geometric common is used.

Why use the geometric common?It’s most fitted for funding portfolios because it takes under consideration compounding (important over a time period) and correlation (returns/losses have an effect on how a lot you’ll be able to reinvest the next yr), and therefore is extra correct. Not like the arithmetic imply, the place the sum of every part is split by the variety of years, the geometric imply multiplies these numbers collectively, to the facility of the inverse of the full variety of years. It sounds cheem, however the calculations have all been carried out within the tables under! |

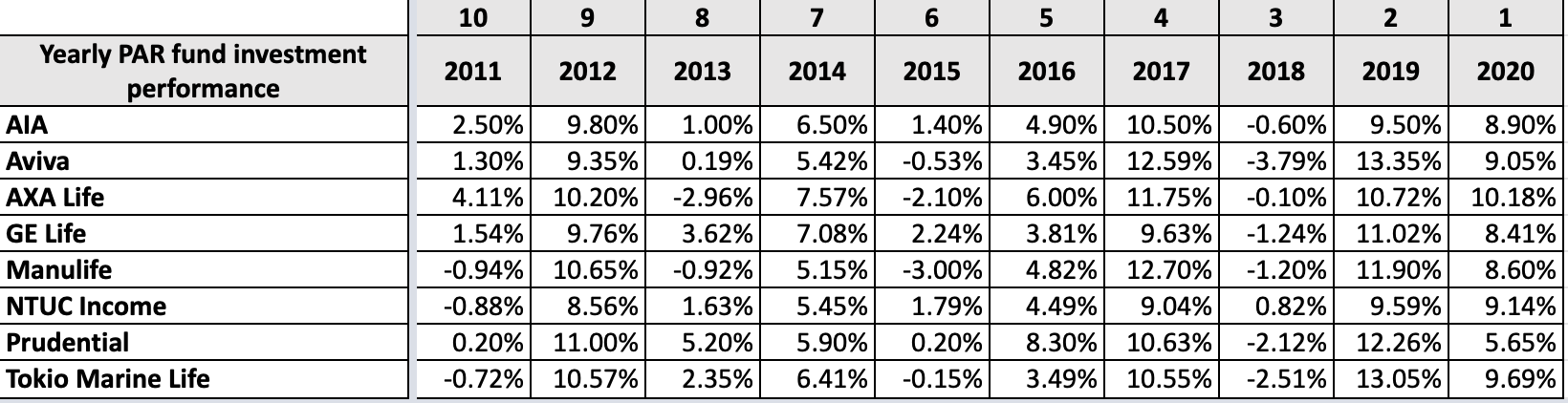

Yearly par fund funding efficiency (2011 to 2020)

Primarily based on insurers’ printed studies

From the desk above, right here’s how the varied insurers carried out:

| Insurer | Variety of instances in Prime 3 over 10-year interval |

| AXA | 6 |

| AIA | 5 |

| Tokio Marine Life | 4 |

| GE Life | 4 |

| Prudential | 4 |

| NTUC Earnings | 3 |

| Aviva | 2 |

| Manulife | 2 |

As you’ll be able to see, primarily based on the pure yearly par fund funding efficiency alone, AXA Life appeared 6 instances within the “prime three” over the last decade. AIA has 5 “prime three” spots, adopted by the insurers that clinched 4 “prime three” spots every: Nice Jap Life, Prudential and Tokio Marine Life Insurance coverage Singapore. Nonetheless, the funds’ funding efficiency tends to fluctuate fairly a bit.

Let’s now have a look at the extra correct illustration, through which the geometric common is used.

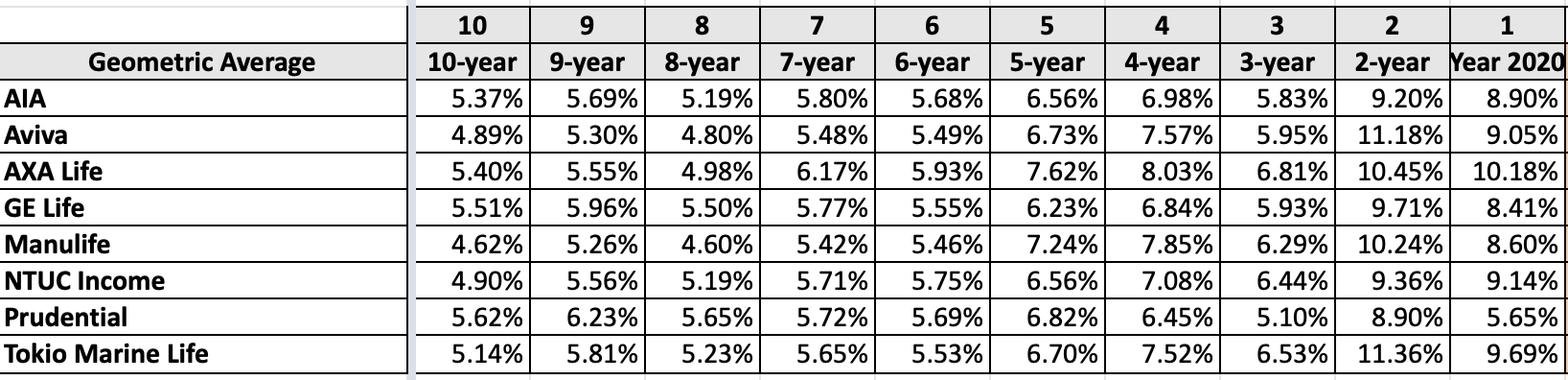

Yearly par fund funding efficiency – geometric imply (2011 to 2020)

Primarily based on the info of insurers’ printed studies

From the desk above, right here’s how the varied insurers carried out:

| Insurer | Variety of instances in Prime 3 over 10-year interval |

| AXA | 8 |

| Tokio Marine Life | 5 |

| Prudential | 5 |

| GE Life | 4 |

| NTUC Earnings | 3 |

| Aviva | 2 |

| Manulife | 2 |

| AIA | 1 |

Phew, there’s way more consistency within the numbers after smoothing with the geometric imply. At first look, many of the figures now simply meet or exceed the projected illustrative returns we often see on our coverage doc. Simply to jog your reminiscence, the illustrative cap earlier than 1 July 2021 was a cushty 4.75% p.a. (higher illustration price) and three.25% p.a. (decrease illustration price).

So in actuality, primarily based on these geometric common returns on the par fund, the precise funding returns are larger than the illustrated price of return (keep in mind, LIA Singapore mentioned “These charges won’t have an effect on the precise returns of present and future par insurance policies”).

This time as properly, AXA Life emerges on prime, with 8 instances within the “prime three”. Tokio Marine Life Insurance coverage Singapore and Prudential do properly too, showing within the “prime three” 5 instances previously decade, adopted by GE Life (4 instances).

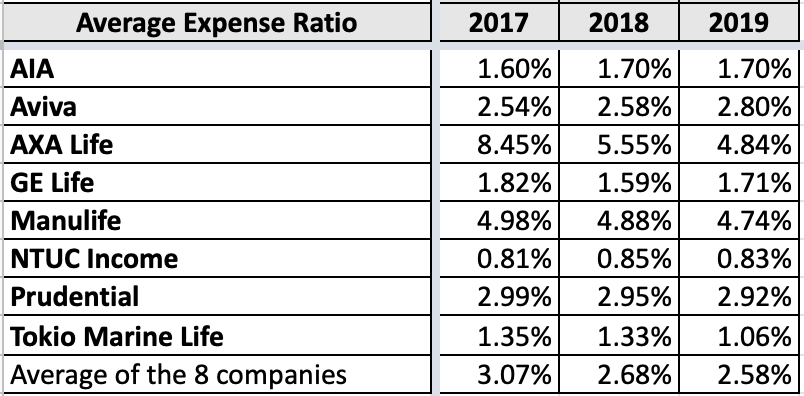

Let’s not neglect about expense ratio

We additionally touched on expense ratio, the amount of cash that goes in the direction of managing the par fund and is taken from the returns of the par fund. The decrease the expense ratio, the much less is spent to handle the par funds, and there’ll be extra earnings to share between the policyholders who’re all collaborating within the par fund.

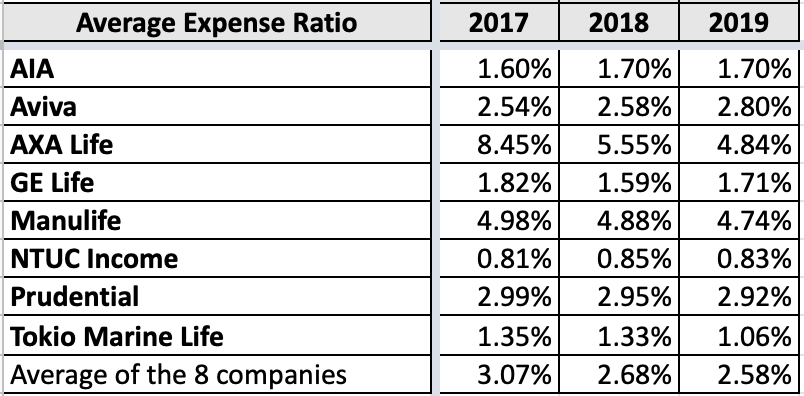

Primarily based on insurers’ printed studies

Let’s check out how these main life insurers managed the prices of managing their par funds from 2017 to 2019.

NTUC Earnings did rather well, with an expense ratio of under 1% p.a.; in the meantime AIA, Nice Jap Life and Tokio Marine Life Insurance coverage Singapore had expense ratios that had been under 2%. Quite the opposite, keep in mind our “winner” of the par fund funding efficiency tables earlier? AXA Life has sadly spent probably the most on managing its par funds, with the very best expense ratios.

To sum up the above:

| Insurer | Prime 3 for Geometric Imply? | In Prime 3 for Par Fund Funding Efficiency? | Greatest 3 for Expense Ratio? |

| Tokio Marine Life | Sure (5 out of 10) | Sure (4 out of 10) | Sure (3 out of three) |

| GE Life | Sure (4 out of 10) | Sure (4 out of 10) | Sure (1 out of three) |

| AXA | Sure (8 out of 10) | Sure (6 out of 10) | No (0 out of three) |

| Prudential | Sure (5 out of 10) | Sure (4 out of 10) | No (0 out of three) |

| AIA | No (1 out of 10) | Sure (5 out of 10) | Sure (2 out of three) |

| NTUC Earnings | No (3 out of 10) | No (3 out of 10) | Sure (3 out of three) |

| Aviva | No (2 out of 10) | No (2 out of 10) | No (0 out of three) |

| Manulife | No (2 out of 10) | No (2 out of 10) | No (0 out of three) |

Primarily based on these outcomes, Tokio Marine Life Insurance coverage Singapore is probably the most constant, and the one insurer to ship optimistic leads to all 3 classes.

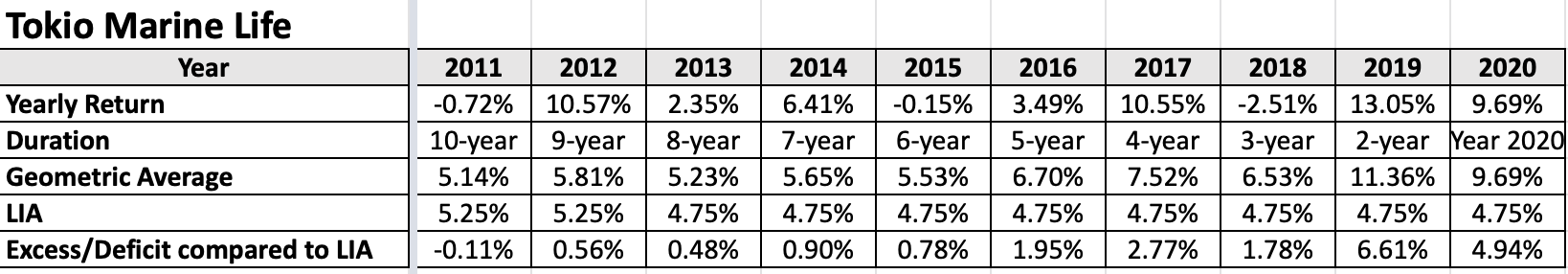

Case examine: Tokio Marine Life Insurance coverage Singapore

We’ve picked Tokio Marine Life Insurance coverage Singapore (TMLS) to do a case examine on, seeing as the way it’s carried out constantly properly in historic par fund funding efficiency, geometric common and expense ratio classes.

Supply: Tokio Marine Life Insurance coverage Singapore

Singling out TMLS and pitting it in opposition to LIA Singapore’s higher illustration price cap over the previous 10 years, the insurer has constantly exceeded expectations with solely a slight “deficit” in 2011 (however this “deficit” is the truth is, nonetheless a optimistic return of 5.14% p.a.). As you’ll be able to see, in 2019 and 2020, TMLS not solely exceeded the higher illustration price cap dictated by LIA Singapore, however comfortably sailed over it by over 100%.

Primarily based on the 10-year historic funding efficiency of TMLS, it’s fairly apparent that the illustrative price cap as set out by LIA Singapore has no bearing on the precise returns and declared bonuses to policyholders — it merely serves as a information, or a benchmark, for policyholders to visualise how a lot they could possibly be getting sooner or later.

Primarily based on insurers’ printed studies

Going again to expense ratio, TMLS’ is basically low, displaying prudence in managing the prices of its par fund. Actually, its expense ratio is lower than the trade common, and simply places it within the Prime 3 of main life insurers in Singapore.

All in all, TMLS has maintained a robust observe report, even displaying steadfastness in managing the funding returns of its par fund — contemplating how 2020 bore the brunt of Covid-19’s monetary influence — to realize optimistic returns yearly.

So why the necessity to revise the illustrative funding return caps down?

You’re most likely now questioning why LIA Singapore has to revise the illustrative price caps down. Primarily based on the figures above, it appears greater than achievable for the foremost life insurers to satisfy and even exceed these illustrative price caps.

Let’s think about you’re employed in gross sales. Each month, you could have gross sales targets to satisfy. You’re good at your job, and also you constantly meet or exceed these gross sales targets every month.

In case your boss retains revising the gross sales targets upwards, you must work more durable and more durable every month, and through months the place you took lengthy depart or fell sick, it might seem like you’re performing under expectations (however you’re nonetheless bringing in loads of gross sales income). Nonetheless, in case your boss is knowing, he would possibly revise the gross sales targets down when he is aware of that the market isn’t doing properly.

Much like this situation, the one setting the expectation is LIA Singapore, however the actual “bosses” who’re doing the value determinations are us, the policyholders.

Thus, in mild of the current low rate of interest surroundings, LIA Singapore has determined to train prudence and revise the illustrative price caps downwards to handle policyholders’ expectations.

Regardless that it’s largely psychological, don’t you’re feeling sian if the insurer initiatives super-high illustrative charges however fails to satisfy them? It’s a basic case of over-promising and under-delivering.

Plus, revising the illustrative funding return caps down additionally serves to guard the curiosity of policyholders and the long-term sustainability of the fund. In spite of everything, with life insurance coverage, you’re in it for the lengthy haul. It’s higher to have reasonable sustained development than risky fluctuations — in the event you benefit from the latter, you’re higher off investing within the inventory market. Bear in mind the saying, excessive threat, excessive return?

As well as, the life insurance coverage trade evaluations and declares the bonuses yearly. That is one other protecting measure for policyholders — in order that bonuses are “locked in” for that specific yr, ought to the next yr present poorer efficiency.

The place will we go from right here?

As a policyholder, whereas the announcement by LIA Singapore initially appeared worrying, I later realised that it’s purely beauty (at the least, to me).

Let’s have a look at it this fashion: The par fund’s precise funding returns sooner or later will depend upon future financial situations, precise asset class returns and asset allocation of the par fund. The truth that LIA Singapore revised the caps downwards is that it anticipates challenges in assembly the earlier caps amidst this low rate of interest surroundings.

The par fund supervisor is doing the most effective they’ll, however there are exterior elements we can not management, like the continued international pandemic. It is going to be what will probably be.

On our finish, we have to cease harping on the illustrative numbers and recalibrate our expectations. To be trustworthy, I all the time have a look at the decrease illustrative returns cap — really I’m comfortable so long as I break even.

After all, if we anticipate decrease returns, the breakeven level (the place the give up worth of the coverage equals the full premiums paid so far) will most likely be even additional sooner or later. However why are you taking a look at surrendering a coverage that’s speculated to final you all through your life (life insurance coverage leh)?! Surrendering your life insurance coverage coverage needs to be a final resort type of scenario.

Finally, the choice to purchase life insurance coverage shouldn’t lie solely on how a lot you’ll be able to probably “earn” (that’s why we’ve got pure funding merchandise), however fairly, how properly you’re protected.