This publish was written in collaboration with Nice Jap. Whereas we’re financially compensated by them, we nonetheless try to take care of our editorial integrity and evaluate merchandise with the identical goal lens. We’re dedicated to offering the perfect data so as so that you can make private monetary choices with confidence. You may view our Editorial Tips right here.

Not all nations have entry to primary healthcare at subsidised charges, however in Singapore we do. Which means that we get pleasure from subsidies on our hospital payments, via authorities plans and insurance policies — even earlier than our personal insurance coverage plan kicks in.

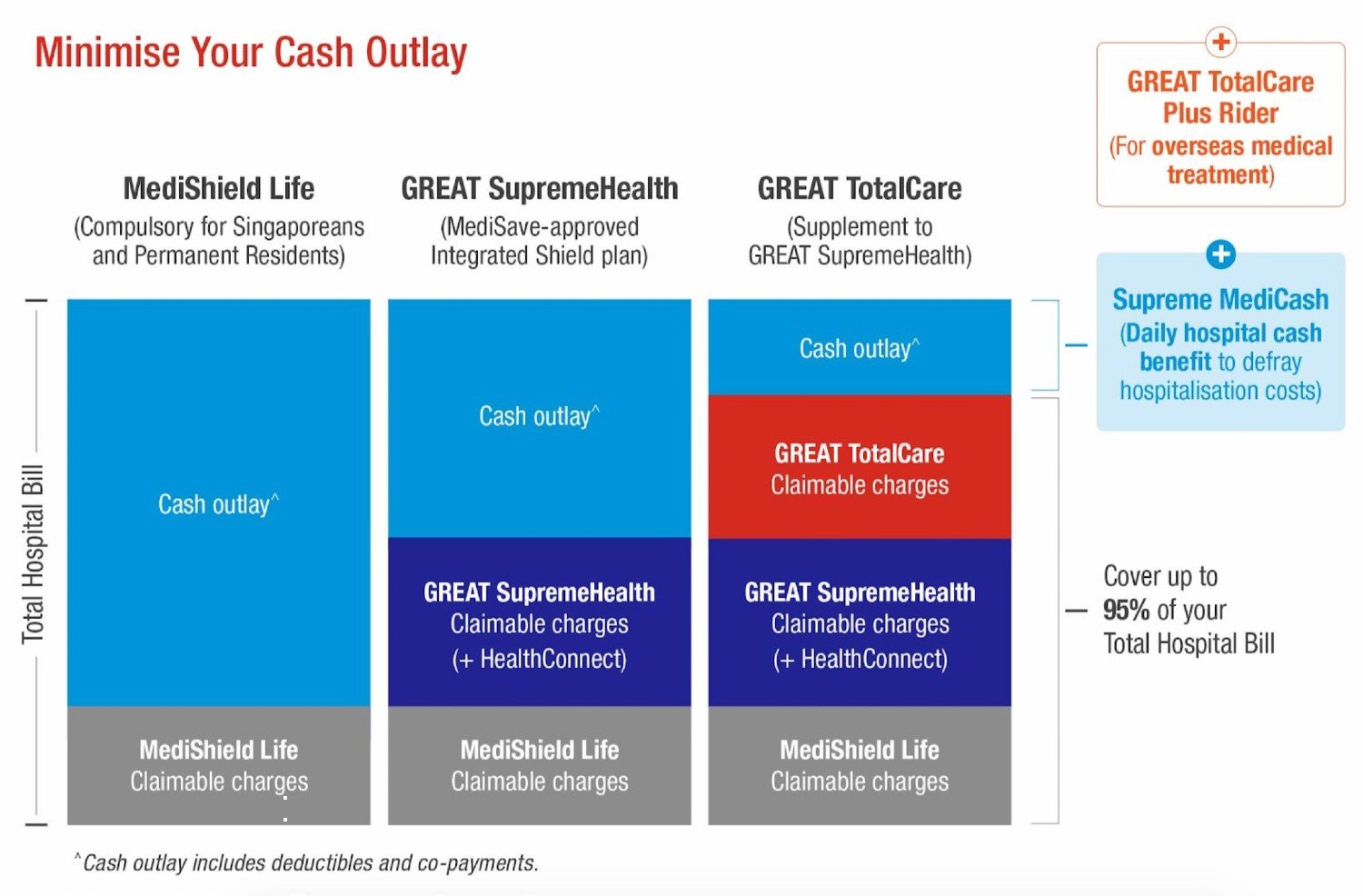

Nonetheless, hospital payments can break the bank. Therefore many people purchase some type of hospital plan — also called an Built-in Defend plan or IP — to cut back out-of-pocket prices aka money outlay or for protection past the essential and even having care in a personal hospital.

However the query on everybody’s thoughts is, do you have to get the highest-tier personal IP out there, a mid-range one, or simply accept the essential? I imply, the usual of healthcare in Singapore is usually excessive; so whether or not you go for a personal hospital or a restructured hospital, you’ll nonetheless be in good palms.

Let’s check out some eventualities to see how insurance coverage can scale back our money outlay, and to assist us decide if we actually want a personal IP:

State of affairs: Personal hospital stick with surgical procedure

Let’s introduce our fictitious character, Jim, who’s in a personal hospital for surgical procedure. Utilizing MediShield Life as probably the most primary protection and basing the IP protection on Nice Jap’s GREAT SupremeHealth (GSH) P Plus with and with out the GREAT TotalCare (GTC) (Elite-P) supplementary plan.

P denotes protection for personal hospitals. With the add-on of Nice Jap’s GTC Elite-P supplementary plan, co-payment is restricted to five% of complete hospital payments†.

Right here’s how Jim’s estimated hospital invoice would seem like underneath the completely different tiers of protection.

| Incurred $10,000 at Personal Hospital | MediShield Life solely | GSH P Plus solely | GSH P Plus and GTC (Elite-P) |

| Eligible Hospital Invoice | $2,500* ($10,000 † pro-ration issue of 25%) |

$10,000 | $10,000 |

| Much less: Deductible | $2,000 | $3,500 | $3,500 |

| Much less: Co-insurance | $50 (1st $5,000 (inclusive of deductible) @ 10%) |

$650 | $650 |

| Policyholder’s out-of-pocket value | Deductible + Co-insurance + Extra of the hospital invoice after making use of the pro-ration issue = $2,000 + $50 + $7,500 = $9,550 |

Deductible + Co-insurance = $3,500 + $650 = $4,150 |

Co-payment (5% of the Eligible Hospital Payments) = 5% x $10,000 = $500 |

| Claimable Quantity | $450 ($10,000 – $9,550) |

$5,850 ($10,000 – $4,150) |

$9,500 ($10,000 – $500) |

* Since Jim stayed in a personal hospital, his MediShield Life declare might be computed based mostly on 25% of the invoice. Jim might want to pay the surplus of the hospital invoice after making use of the pro-ration issue.

State of affairs: Restructured hospital stick with surgical procedure

Let’s say Jim had determined to go along with a restructured hospital as an alternative. Right here’s what his estimated hospital invoice would seem like underneath the completely different tiers of protection.

| Incurred $10,000 at Restructured Hospital — B1 ward | MediShield Life solely | GSH P Plus solely | GSH P Plus and GTC (Elite-P) |

| Eligible Hospital Invoice | $4,300‡ ($10,000 ‡ pro-ration issue of 43%) |

$10,000 | $10,000 |

| Much less: Deductible | $2,000 | $2,500 | $2,500 |

| Much less: Co-insurance | $230 (1st $5,000 (inclusive of deductible) @ 10%) |

$750 | $750 |

| Policyholder’s out-of-pocket value | Deductible + Co-insurance + Extra of the hospital invoice after making use of the pro-ration issue = $2,000 + $230 + $5,700 = $7,930 |

Deductible + Co-insurance = $2,500 + $750 = $3,250 |

Co-payment (5% of the Eligible Hospital Payments) = 5% x $10,000 = $500 |

| Claimable Quantity | $2,070 ($10,000 – $7,930) |

$6,750 ($10,000 – $3,250) |

$9,500 ($10,000 – $500) |

‡ Since Jim stayed in a B1 ward of a restructured hospital, his MediShield Life declare might be computed based mostly on 43% of the invoice. Jim might want to pay the surplus of the hospital invoice after making use of the pro-ration issue.

Abstract: Personal hospital vs restructured hospital

Primarily based on Jim’s eventualities above, his money outlay remains to be manageable at a personal hospital with the fitting insurance coverage plan. Thus, listed here are some the reason why Jim would select a personal hospital over a restructured hospital:

Wait occasions: Typically, individuals ready to be admitted to a restructured hospital may count on longer wait occasions of 1 to six hours, as reported by the Ministry of Well being. In the meantime, for personal hospitals, admission is often inside the first hour itself.

Consolation/privateness: There are numerous ward lessons in a hospital, every providing a distinct stage of consolation and privateness. For instance, a B2 ward has as much as 6 beds within the room, with a shared rest room and there often isn’t air-conditioning, your personal TV or selection of meals. Extra privateness and luxury is accorded to class A wards in restructured hospitals.

Velocity: You will have additionally heard of family and friends ready weeks or months to get an appointment/surgical procedure slot in a restructured hospital, whereas these going to a personal hospital can by some means get therapy inside the week. It is because the restructured hospitals should cater to many extra individuals than personal hospitals at every time, therefore it’s actually on a primary come, first served foundation.

In any other case…

It’s true that insurance coverage premiums for restructured hospitals are decrease, and subsidies for B2 and C class wards are greater. Some might desire the social side of being in a ward with different sufferers, and a few would relatively go for a non-air conditioned ward.

It’s additionally potential to simply stay with MediShield Life alone and never get an IP should you’re content material with primary care. You’ll be restricted to class B2 and C wards, and out-of-pocket medical prices for pre- and post-hospitalisation will not be coated.

In some circumstances, the person may be insured by his/her employer’s hospital plan, nonetheless this can be topic to limits and co-payments decided by the employer, and the plan would stop ought to the person cease working for the corporate sooner or later (or retire).

All in all, it actually is determined by a person’s healthcare preferences and his/her price range out there for insurance coverage.

What Defend plans does Nice Jap have?

As we’ve been utilizing Nice Jap’s GREAT SupremeHealth and its GREAT TotalCare supplementary plan within the eventualities above, let’s now take a look at these plans in additional element.

Evaluate Inexpensive Nice Jap Well being Insurance coverage Plans 2021

GREAT SupremeHealth

GREAT SupremeHealth is an Built-in Defend plan that enhances MediShield Life. It affords various tiers of protection, comparable to ward class and hospital sort. Although largely coated, you’d nonetheless have to pay the deductible and co-insurance.

| Plan | Nice Jap SupremeHealth — B Plus (Class B1 and decrease, restructured hospitals) | Nice Jap SupremeHealth — A Plus (Class A and decrease, restructured hospitals) | Nice Jap SupremeHealth — P Plus (Personal and restructured hospitals) |

| Annual protection restrict | $500,000 | $1 million | $1.5 million |

| Annual premium (Singapore Citizen 35 ANB) | $390 (MediShield Life) + $80 = $470 | $390 (MediShield Life) + $123 = $513 | $390 (MediShield Life) + $322 = $712 |

GREAT TotalCare

That is the supplementary plan for GREAT SupremeHealth, and relying on the plan sort chosen, it can scale back your co-payment to five% of your hospital invoice, capped at $3,000 per coverage 12 months†. This too, has various protection tiers.

| GREAT TotalCare | Annual Profit Restrict | Co-payment to be borne by policyholder† | Annual premium (Singapore Citizen 35 ANB) |

| Traditional-B (Restructured Hospitals, Class B1 Wards & decrease) | $150,000 | 5% of complete Eligible Payments§ or the Deductible incurred underneath GREAT SupremeHealth (the place relevant), whichever is greater | $67 |

| Traditional-A (Restructured Hospitals, Class A Wards & decrease) | $200,000 | $81 | |

| Traditional-P (Personal & Restructured Hospitals) | $400,000 |

|

$335 |

| Elite-B (Restructured Hospitals, Class B1 Wards & decrease) | $150,000 | 5% of complete Eligible Payments§ | $145 |

| Elite-A (Restructured Hospitals, Class A Wards & decrease) | $200,000 | $211 | |

| Elite-P (Personal & Restructured Hospitals) | $400,000 | $712 |

§ Eligible Payments refers back to the Bills incurred, topic to Professional-ration Issue (the place relevant), that are much like these utilized to the GREAT SupremeHealth plan.

As well as, GREAT TotalCare is at the moment the one IP supplementary plan that gives Outpatient Most cancers Therapy protection of as much as $10,000 per coverage 12 months (topic to co-payment ranges) with no hospital keep. It covers the therapy of most cancers supplied by a hospital or a legally registered outpatient most cancers therapy centre for outpatient most cancers therapy, even after 12 months post-hospitalisation.

Extra add-ons:

- GREAT TotalCare Plus rider — for twenty-four/7 specialised assist available throughout abroad emergency conditions.

- Supreme MediCash — to obtain a day by day money advantage of as much as $200 every day for hospitalisation on account of diseases (together with COVID-19) and as much as $400 every day for hospitalisation on account of accidents, even when abroad.

Claims-adjusted pricing

GREAT TotalCare (Elite-P) or (Traditional-P) policyholders also can profit from claims-adjusted pricing, wherein the premiums payable at every renewal is set by one’s claims expertise in the course of the Evaluation Interval. i.e. These on the Commonplace Premium Degree who’ve made no declare in the course of the Evaluation Interval, can benefit from the Most popular Premium Degree which entails a 20% low cost off their normal premium charges.

For a restricted time solely, join and revel in 20% off first-year premiums for GREAT TotalCare (Elite- P) and (Traditional-P) plans. Discover out extra about GREAT Jap’s Built-in Defend plans right here or request a name again from our Monetary Representatives.

#Lifeproof your hospitalisation wants, for all times.

Notes:

† Co-payment varies by Nice TotalCare plan varieties and may be both (i) 5% of the whole eligible invoice; or (ii) 5% of the whole eligible invoice or the deductible, whichever is greater. The quantity of co-payment required by the policyholders might be capped at $3,000 per coverage 12 months, for restructured hospitals claims and/or pre-authorised personal hospital claims.

The data offered is for normal data solely and doesn’t have regard to the precise funding aims, monetary state of affairs or specific wants of any specific particular person. GREAT TotalCare and GREAT TotalCare Plus will not be MediSave-approved Built-in Defend plans and premiums will not be payable utilizing MediSave.

GREAT TotalCare is designed to enhance the advantages supplied underneath GREAT SupremeHealth. GREAT TotalCare Plus is a rider that may solely be hooked up to GREAT TotalCare to increase medical protection worldwide.

Age stipulated refers to age subsequent birthday (ANB).

This commercial has not been reviewed by the Financial Authority of Singapore.

The above is for normal data solely. It’s not a contract of insurance coverage. The exact phrases and circumstances of this insurance coverage plan are specified within the coverage contract.

Protected as much as specified limits by SDIC.

Data right as at 13 December 2021.